How Investors May Respond To Takeda Pharmaceutical (TSE:4502) Ending Cell Therapy Research and Refocusing R&D

Reviewed by Sasha Jovanovic

- Earlier this week, Takeda Pharmaceutical announced it will discontinue all cell therapy research, resulting in 137 job losses at its Massachusetts R&D facility and an upcoming impairment charge related to its cell therapy technology.

- This move signals a major refocusing of Takeda’s innovation efforts, with increased priority given to antibody-drug conjugates, biologics, and small molecules in six targeted therapeutic areas.

- We’ll examine how Takeda’s complete withdrawal from cell therapy could reshape its portfolio priorities and long-term growth narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Takeda Pharmaceutical Investment Narrative Recap

To be a shareholder in Takeda Pharmaceutical, you generally need to believe that its choice to refocus on core therapeutic innovations, at the expense of discontinuing cell therapy, will support new product launches and stabilize revenue as current key drugs like VYVANSE face generic pressures. The withdrawal from cell therapy is not expected to significantly affect the near-term catalyst, which remains positive clinical data and approvals in the rare disease and neuroscience pipeline, though pipeline underperformance remains a core risk.

The recent FDA approval of VONVENDI for both adult and pediatric von Willebrand Disease adds fresh momentum to Takeda’s rare disease franchise, reinforcing one of its core revenue pillars. While this aligns with Takeda’s renewed portfolio focus, it remains crucial for the company to continually launch successful products to mitigate the impact of generic competition on legacy brands.

However, investors should be especially mindful that while pipeline setbacks are always possible, intensified biosimilar and generic competition for Takeda’s mature blockbusters could still...

Read the full narrative on Takeda Pharmaceutical (it's free!)

Takeda Pharmaceutical's narrative projects ¥4,696.5 billion revenue and ¥339.5 billion earnings by 2028. This requires 1.6% yearly revenue growth and a ¥202.6 billion earnings increase from ¥136.9 billion today.

Uncover how Takeda Pharmaceutical's forecasts yield a ¥5056 fair value, a 16% upside to its current price.

Exploring Other Perspectives

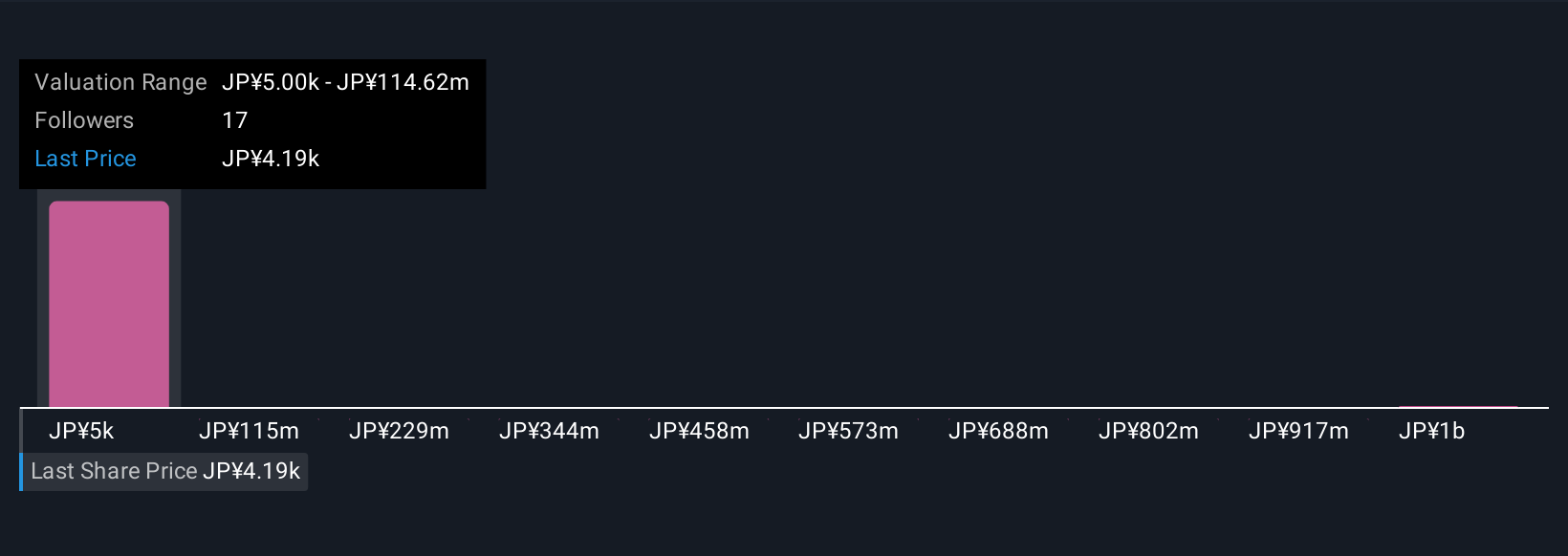

Three distinct fair value opinions from the Simply Wall St Community span from ¥5,056 to over ¥1.1 billion, signaling outsized valuation contrasts. Consider how ongoing generic and biosimilar competition could weigh on Takeda’s future earnings as you explore these perspectives.

Explore 3 other fair value estimates on Takeda Pharmaceutical - why the stock might be worth just ¥5056!

Build Your Own Takeda Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takeda Pharmaceutical research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Takeda Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takeda Pharmaceutical's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeda Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4502

Takeda Pharmaceutical

Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives