- Japan

- /

- Entertainment

- /

- TSE:9766

Assessing Konami (TSE:9766) Valuation Following Management’s Dividend Hike and Shareholder-Focused Outlook

Reviewed by Simply Wall St

Konami Group (TSE:9766) just announced a higher second quarter-end dividend of JPY 83.00 per share, up from JPY 66.00 a year ago. Payments will begin on November 20, 2025. This move highlights management’s confidence in the company’s financial health and focus on rewarding shareholders.

See our latest analysis for Konami Group.

Konami Group’s bigger dividend comes on the heels of remarkable momentum, with a 67.6% share price return year to date and an even stronger 71.3% total shareholder return over the last twelve months. The stock’s recent climb highlights growing investor confidence, building on steady profit and revenue growth. This week saw some short-term profit taking after prolonged gains.

If Konami’s surge has you thinking bigger, it could be the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares near record highs and only a slight discount to analyst targets, investors may wonder whether Konami Group’s impressive run justifies further gains, or if the stock’s strong outlook is already fully priced in.

Price-to-Earnings of 38.8x: Is it justified?

Konami Group’s shares are currently trading at a price-to-earnings (P/E) ratio of 38.8x, which signals the market is willing to pay a premium for each yen of earnings compared to competitors. The last close price of ¥24,270 reflects this premium and stands notably above peer and industry averages.

The P/E ratio is a quick indicator of how much investors value a company's current and future earnings. In sectors like entertainment, where profit growth and intellectual property can drive investor optimism, a higher multiple often means market participants expect above-average future growth or profitability.

However, Konami’s P/E ratio outpaces both its peer average (31.2x) and the Japanese entertainment industry average (22.1x). The stock also trades above what regression analysis suggests would be a fair P/E (36.6x). This implies the market is pricing in optimistic growth and profitability scenarios that may not be fully supported by underlying fundamentals.

Explore the SWS fair ratio for Konami Group

Result: Price-to-Earnings of 38.8x (OVERVALUED)

However, slowing revenue growth or a reversal in investor sentiment could quickly challenge the premium valuation and put pressure on Konami Group's share price.

Find out about the key risks to this Konami Group narrative.

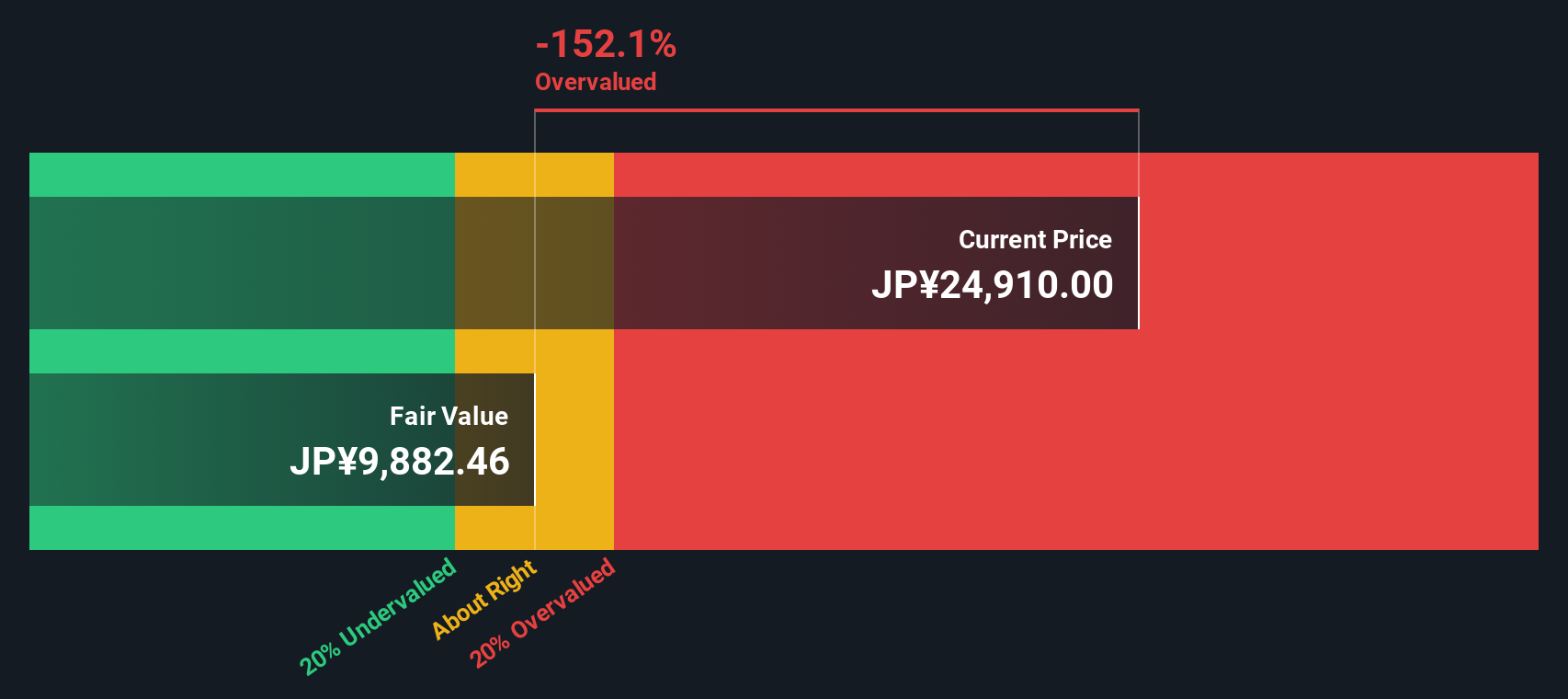

Another View: Discounted Cash Flow Model Tells a Different Story

Looking at the SWS DCF model, the picture shifts dramatically. This model estimates Konami Group's fair value at ¥9,796.08 per share, which is far below the current market price of ¥24,270. This suggests the stock may be considerably overvalued from a cash flow perspective. Could the market’s optimism be overshooting the underlying value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Konami Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Konami Group Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Konami Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Opportunity?

Don't let market highs hold you back. Broaden your investment outlook and spot what others might miss by tapping into these standout opportunities right now.

- Capitalize on market inefficiencies and spot potential breakout performers by sifting through these 856 undervalued stocks based on cash flows for attractive valuations based on robust cash flows.

- Supercharge your portfolio's growth prospects as you scan these 25 AI penny stocks featuring innovative companies at the frontier of artificial intelligence breakthroughs.

- Secure ongoing returns by reviewing these 15 dividend stocks with yields > 3% and find reliable stocks offering yields greater than 3% to strengthen your income strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konami Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9766

Konami Group

Primarily engages in the digital entertainment, amusement, gaming and systems, and sports businesses in Japan, Asia/Oceania countries, the United States, and Europe.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives