The Asian market has been experiencing a wave of investor enthusiasm, particularly in technology and artificial intelligence sectors, as seen with the rise of key indices like China's CSI 300 and Hong Kong's Hang Seng Index. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate resilience amid economic fluctuations and evolving consumer trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.90% | 35.72% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Fositek | 37.50% | 49.56% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services and solutions globally with a market cap of CN¥18.01 billion.

Operations: The company generates revenue primarily from its Information Network Security segment, which accounts for CN¥2.51 billion. The business focuses on providing comprehensive security solutions and platforms worldwide.

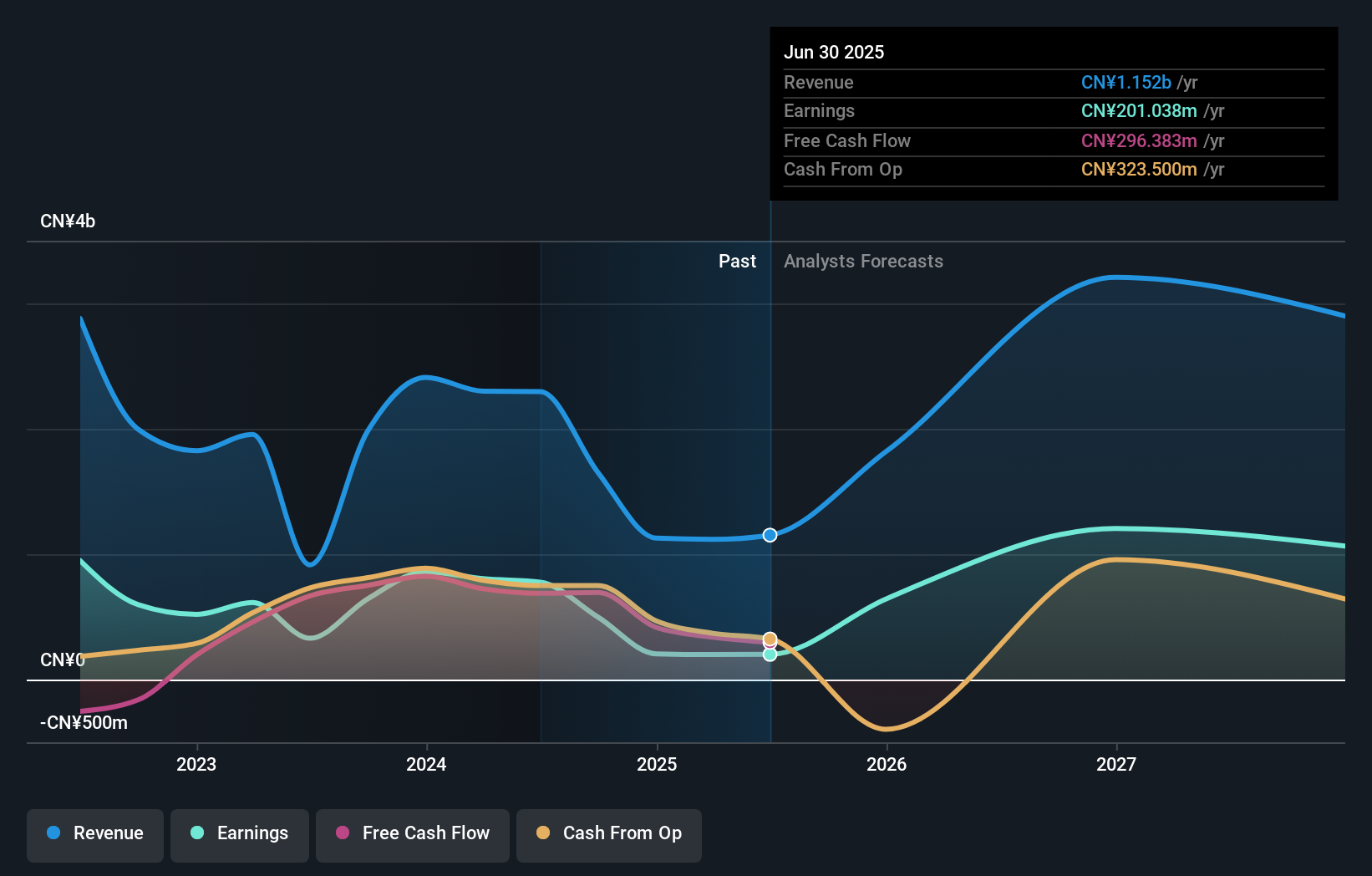

Venustech Group, amidst a challenging financial period with a net loss widening to CNY 215.76 million from CNY 210.07 million year-over-year, still shows promising growth prospects. The company's revenue is expected to expand by 21.2% annually, outpacing the Chinese market forecast of 14.6%. Despite current unprofitability impacting its comparative analysis within the software industry, Venustech is poised for a turnaround with anticipated profitability in three years fueled by robust revenue growth and strategic R&D investments which are essential for maintaining competitive edge in high-tech sectors. This focus on innovation could potentially transform Venustech's market standing and financial health, aligning it with broader industry trends towards enhanced digital security solutions—a sector becoming increasingly vital as cyber threats evolve. While recent earnings depict short-term hurdles, the strategic emphasis on R&D and expected revenue surges hint at a brighter horizon, provided they navigate upcoming challenges effectively.

- Delve into the full analysis health report here for a deeper understanding of Venustech Group.

Gain insights into Venustech Group's past trends and performance with our Past report.

Hualan Biological Vaccine (SZSE:301207)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines and genetic engineering biological products in China, with a market cap of CN¥13.73 billion.

Operations: Hualan Biological Vaccine Inc. generates revenue primarily through the sale of vaccines and genetic engineering biological products in China. The company operates within the biotechnology sector, focusing on innovative health solutions.

Despite a recent dip in sales to CNY 805.99 million from CNY 957.36 million, Hualan Biological Vaccine's robust earnings growth forecast of 66.4% annually surpasses the Chinese market projection of 27.7%. This biotech firm, navigating through a challenging phase with net income halving to CNY 132.31 million, remains a beacon for potential due to its strategic R&D investments—critical for staying at the forefront of vaccine development and innovation in Asia's competitive biotechnology landscape. With an anticipated revenue growth rate of 45.1%, significantly outpacing the market average of 14.6%, Hualan is poised to leverage its scientific research capabilities effectively, provided it can streamline operations and enhance profitability metrics which currently reflect a profit margin reduction from last year’s 30.2% to this year’s 7.2%.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

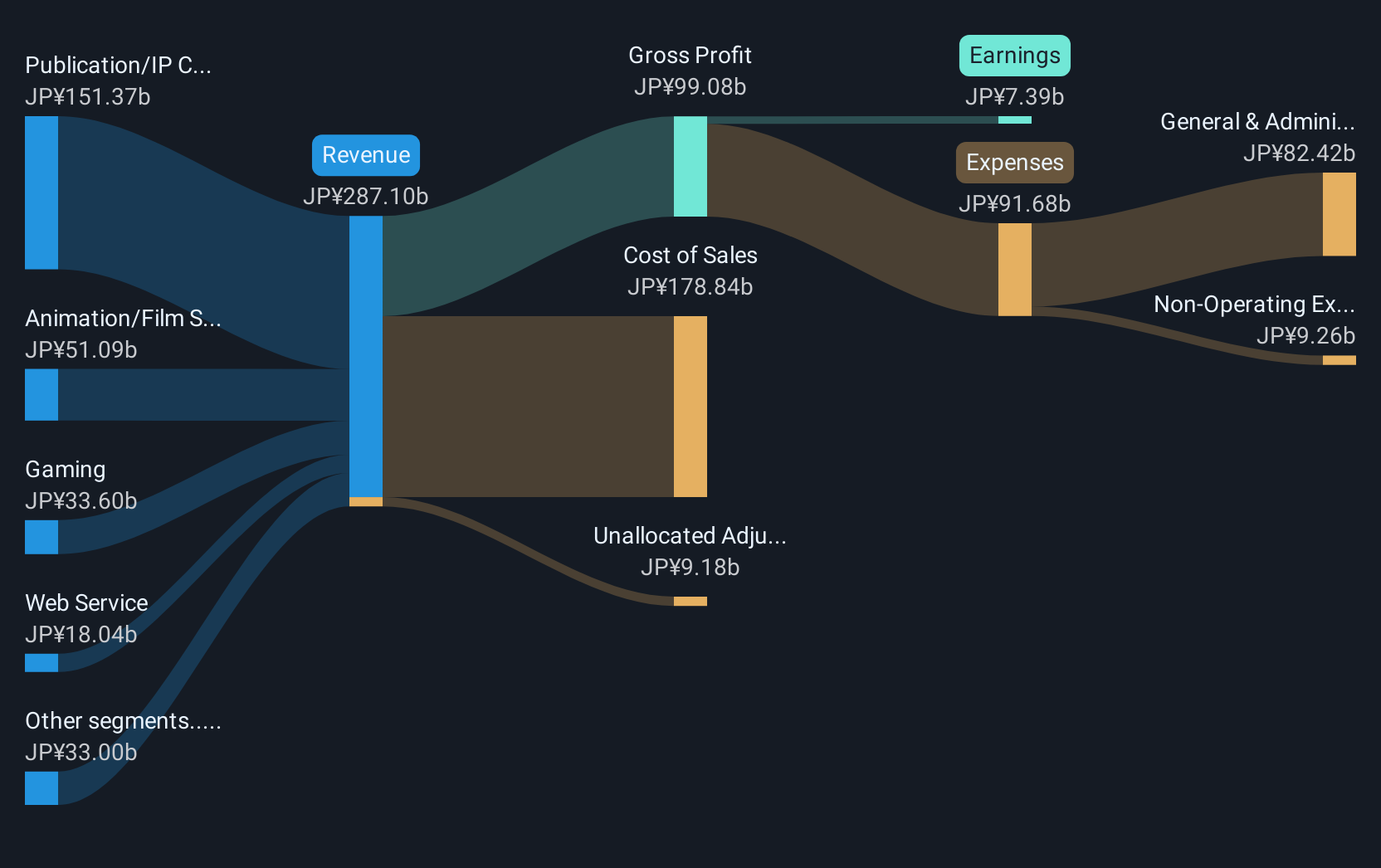

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market cap of ¥486.63 billion.

Operations: Kadokawa generates revenue primarily through publishing, film and video production, and digital content distribution. The company's focus on diverse entertainment offerings positions it within the broader Japanese media landscape.

Kadokawa's recent downward revision in earnings guidance contrasts with its robust strategic collaborations, like the global distribution deal with iQIYI for animated series, signaling a mixed yet dynamic operational landscape. Despite a challenging fiscal outlook with net sales now projected at JPY 278.2 billion, down from JPY 291.9 billion, and operating profit cut to JPY 10.3 billion from JPY 16.7 billion due to underperforming segments and extraordinary losses of JPY 2.7 billion, Kadokawa's engagement in high-profile international partnerships exemplifies its commitment to expanding its cultural influence globally through innovative content distribution strategies. This approach may bolster its long-term positioning in the competitive media sector despite short-term financial adjustments and underscores an adaptive strategy in leveraging creative IP amidst fluctuating market demands.

- Click to explore a detailed breakdown of our findings in Kadokawa's health report.

Explore historical data to track Kadokawa's performance over time in our Past section.

Key Takeaways

- Navigate through the entire inventory of 187 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026