3 Stocks That May Be Priced Below Their Estimated Worth In November 2024

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes approaching record highs and broad-based gains reported, investors are navigating a landscape marked by geopolitical tensions and economic policy shifts. Amid this environment, identifying stocks that may be priced below their estimated worth can offer potential opportunities for those looking to capitalize on market inefficiencies. Understanding the value of a stock in relation to its current price is crucial, especially when broader macroeconomic factors suggest room for growth or recovery in certain sectors.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.44 | CN¥18.82 | 49.8% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.11 | CN¥124.15 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.27 | 49.9% |

| Insyde Software (TPEX:6231) | NT$463.00 | NT$923.49 | 49.9% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| EnomotoLtd (TSE:6928) | ¥1470.00 | ¥2936.12 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| DUG Technology (ASX:DUG) | A$1.705 | A$3.40 | 49.8% |

| Audinate Group (ASX:AD8) | A$8.79 | A$17.54 | 49.9% |

Let's dive into some prime choices out of the screener.

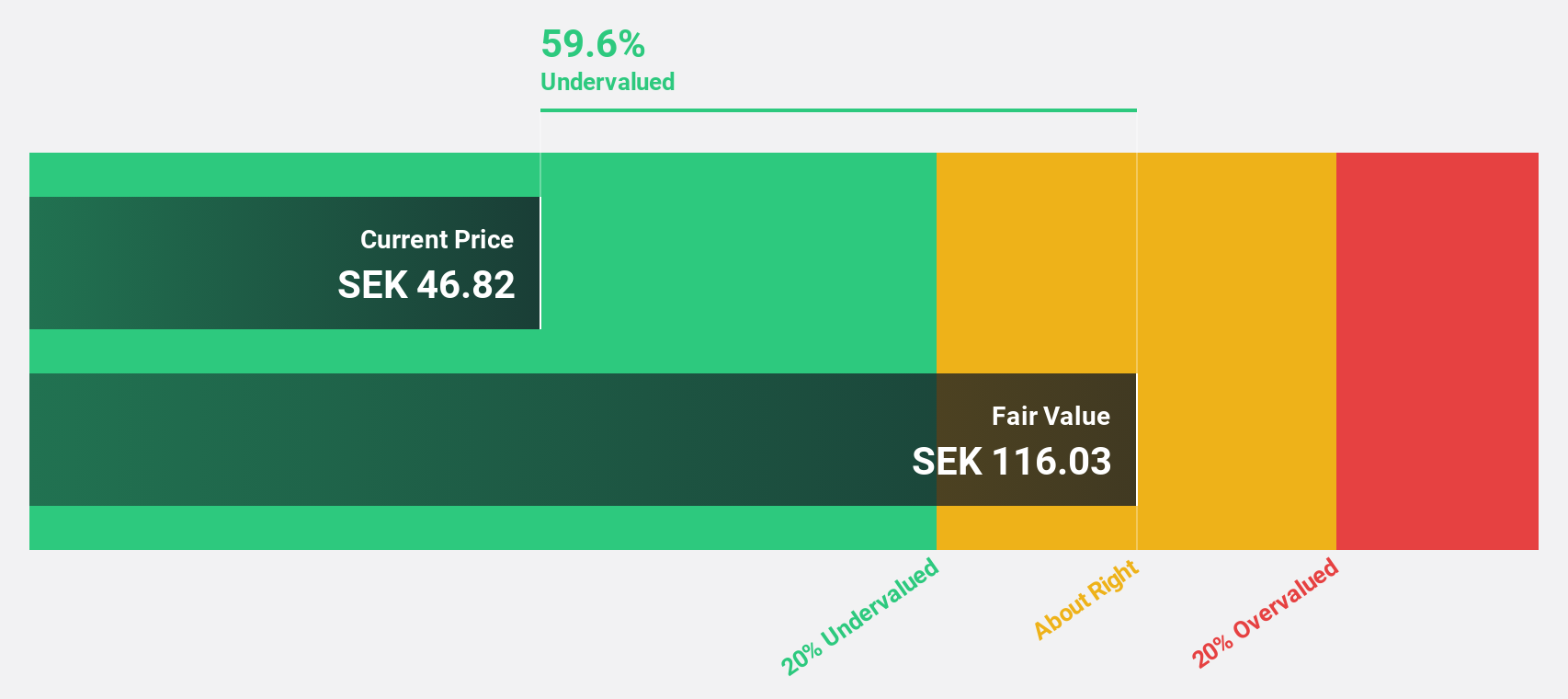

Elekta (OM:EKTA B)

Overview: Elekta AB (publ) is a medical technology company that provides clinical solutions for treating cancer and brain disorders globally, with a market cap of approximately SEK24.49 billion.

Operations: Elekta's revenue is derived from its clinical solutions for cancer and brain disorder treatments on a global scale.

Estimated Discount To Fair Value: 48.6%

Elekta is trading at SEK 64.1, significantly below its fair value estimate of SEK 124.77, indicating potential undervaluation based on discounted cash flow analysis. Despite a high debt level and recent earnings decline—sales dropped to SEK 4.34 billion from SEK 4.73 billion—the company forecasts significant annual profit growth of over 20%, outpacing the Swedish market's average growth rate. However, its dividend coverage remains weak, posing a risk for income-focused investors.

- Insights from our recent growth report point to a promising forecast for Elekta's business outlook.

- Dive into the specifics of Elekta here with our thorough financial health report.

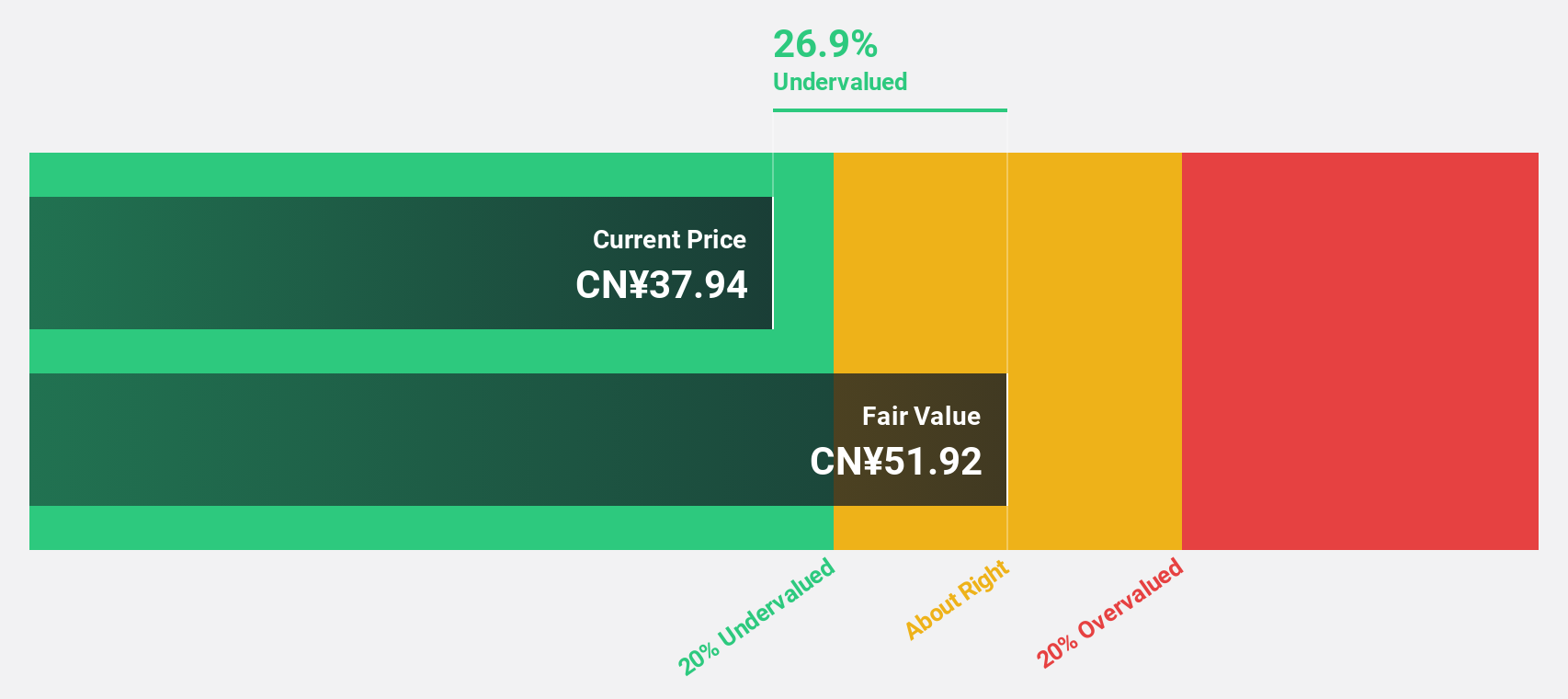

SKSHU PaintLtd (SHSE:603737)

Overview: SKSHU Paint Co., Ltd. operates in China producing and selling paints, coatings, and building materials under the 3trees brand, with a market cap of CN¥25.22 billion.

Operations: The company's revenue is primarily derived from its production and sale of paints, coatings, and building materials under the 3trees brand in China.

Estimated Discount To Fair Value: 14.2%

SKSHU Paint Ltd. is trading at CNY 47.86, below its fair value estimate of CNY 55.77, suggesting undervaluation based on discounted cash flow analysis. Despite recent declines in sales and net income—sales fell to CNY 9.15 billion from CNY 9.41 billion—the company forecasts significant earnings growth of over 60% annually, surpassing the Chinese market average. However, profit margins have decreased significantly and interest payments are not well covered by earnings.

- Our earnings growth report unveils the potential for significant increases in SKSHU PaintLtd's future results.

- Delve into the full analysis health report here for a deeper understanding of SKSHU PaintLtd.

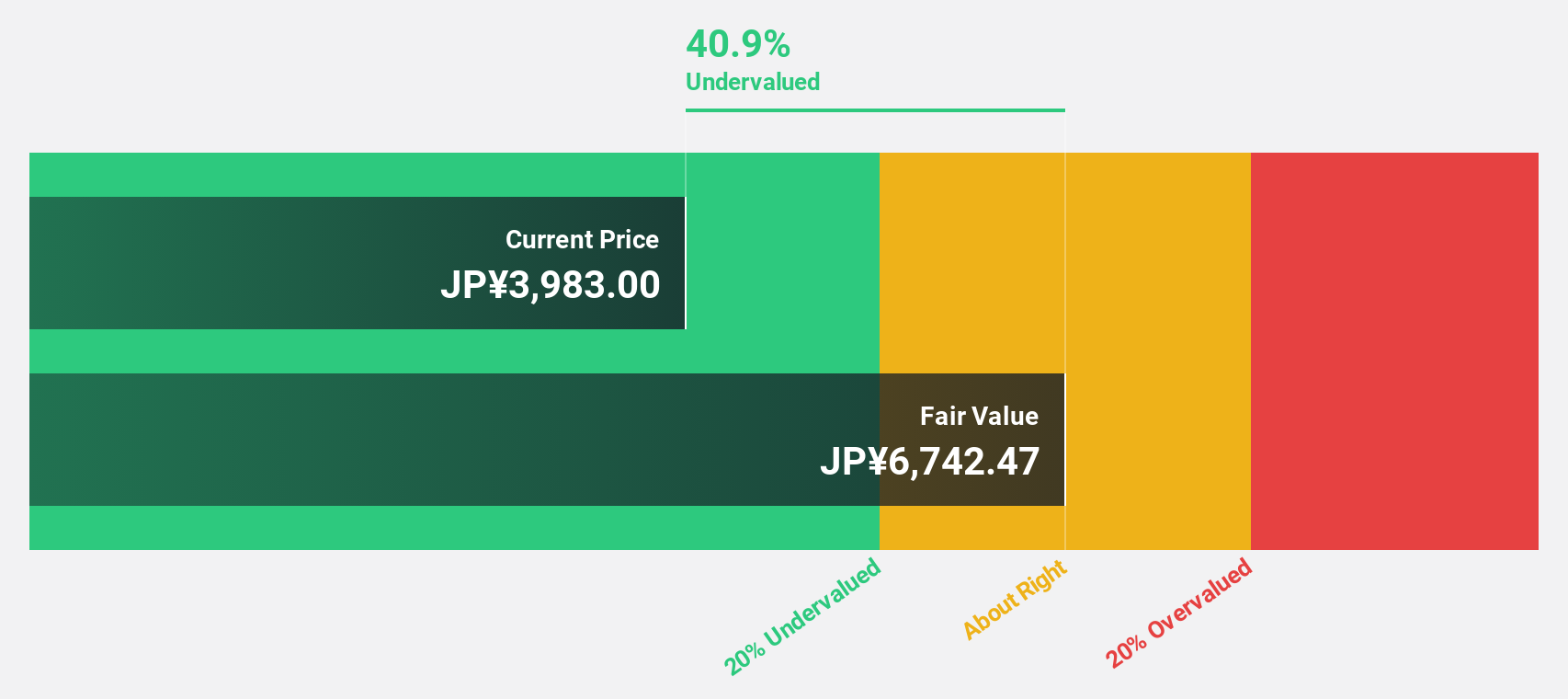

Kadokawa (TSE:9468)

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market cap of ¥579.81 billion.

Operations: The company's revenue is primarily derived from its Publication segment at ¥146 billion, followed by Animation/Film at ¥49.40 billion, Game at ¥29.66 billion, Web Service at ¥18.47 billion, and Education/Edtech at ¥14.34 billion.

Estimated Discount To Fair Value: 22.2%

Kadokawa is trading at ¥4,312, significantly below its estimated fair value of ¥5,545.7 based on discounted cash flow analysis. Earnings grew by 65.2% last year and are forecast to grow 24% annually, outpacing the Japanese market's average growth rate. Despite this strong earnings potential, Kadokawa's share price has been highly volatile recently. Additionally, ongoing acquisition talks with Sony could impact future valuations and strategic direction.

- Our comprehensive growth report raises the possibility that Kadokawa is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Kadokawa.

Key Takeaways

- Discover the full array of 920 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.