- Japan

- /

- Entertainment

- /

- TSE:7974

Nintendo (TSE:7974) Is Up 5.2% After Raising Earnings Outlook and Strengthening Dividend Policy – What’s Changed

Reviewed by Sasha Jovanovic

- Nintendo recently announced a significant upward revision of its full-year earnings and dividend guidance, including an enhanced payout policy and higher interim dividend, following strong sales momentum and a reassessment of exchange rate assumptions.

- This move underscores management’s confidence in its financial outlook and marks a greater emphasis on returning profits to shareholders by directly linking dividends more closely to company performance.

- We’ll explore how Nintendo’s decision to strengthen its dividend policy could reshape its investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Nintendo's Investment Narrative?

Nintendo’s recent move to raise both its full-year earnings forecast and dividend, while strengthening its payout policy, signals renewed management confidence and a more direct connection between shareholder returns and business results. Investors are now presented with a clearer and potentially more generous framework for capital returns, buoyed by strong early sales for the Switch 2 and new, highly anticipated game launches like Animal Crossing. This is likely to drive some market interest in the short term and could shift the narrative toward income appeal, possibly reducing the risk attached to Nintendo’s historically unpredictable earnings profile. However, with shares already trading at a substantial earnings multiple relative to peers and consensus forecasts of moderate long-term growth, the catalyst from this news may be more about sentiment than a material reset of fundamental risks, which still center on hit-driven revenue, hardware cycles, and changing consumer behaviors. On the other hand, the risks tied to high valuation and industry cycles remain worth tracking for anyone following Nintendo’s story.

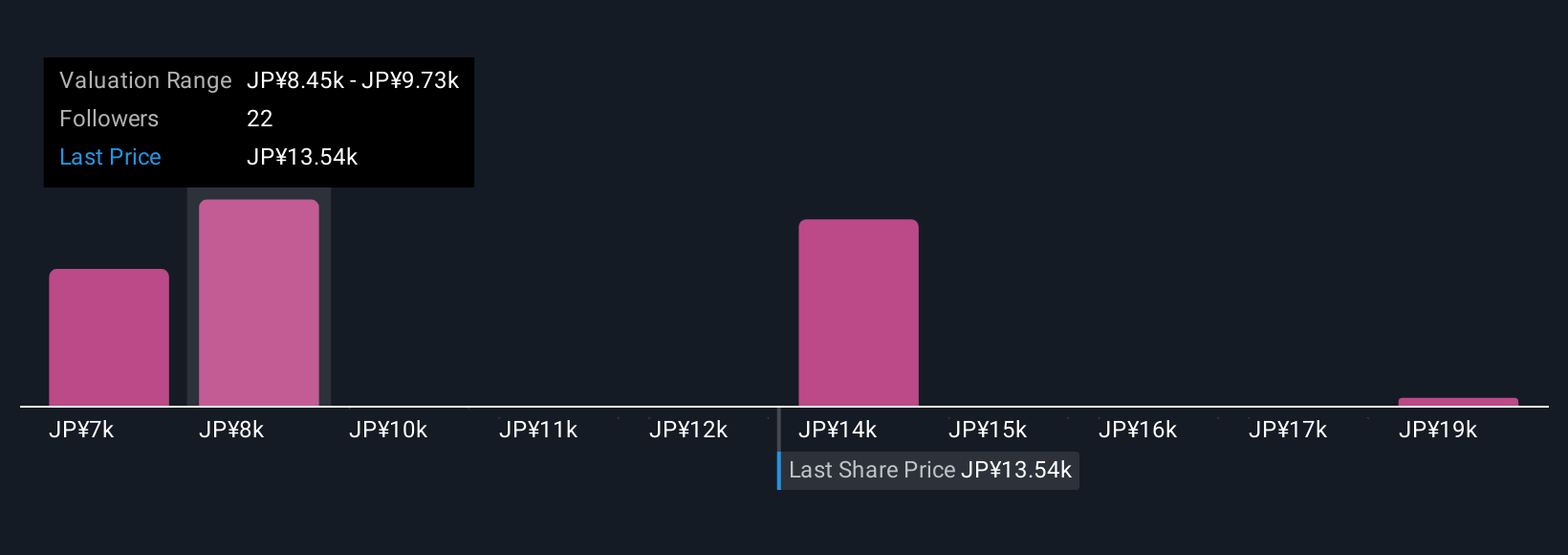

Nintendo's shares are on the way up, but they could be overextended by 27%. Uncover the fair value now.Exploring Other Perspectives

Explore 7 other fair value estimates on Nintendo - why the stock might be worth as much as 44% more than the current price!

Build Your Own Nintendo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nintendo research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Nintendo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nintendo's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives