- Japan

- /

- Entertainment

- /

- TSE:7974

Nintendo (TSE:7974) Expands With New Game And Super Mario Galaxy Movie Announcements

Reviewed by Simply Wall St

Nintendo (TSE:7974) recently experienced a 21% price increase over the past quarter, potentially strengthened by its strategic collaborations and new product announcements. The launch of the new action rogue-like game, *Storm Lancers*, available on Nintendo Switch, and the announcement of *The Super Mario Galaxy Movie* were significant milestones. Meanwhile, the Nasdaq's rise to record highs drove tech shares up, aligning with Nintendo's growth trend. These announcements, alongside related gaming releases and film news, provided positive momentum contributing to the company's robust quarter amidst a favorable market environment where the broader market gained 20% over the year.

Buy, Hold or Sell Nintendo? View our complete analysis and fair value estimate and you decide.

Nintendo's total shareholder returns have been impressive over a five-year period, increasing by 175.46%. In the last year alone, the company's performance outpaced the JP Entertainment industry return of 57.1% and the broader JP market's 20.6% increase. This exceptional long-term growth showcases investor confidence in Nintendo's strategic initiatives and its robust market position.

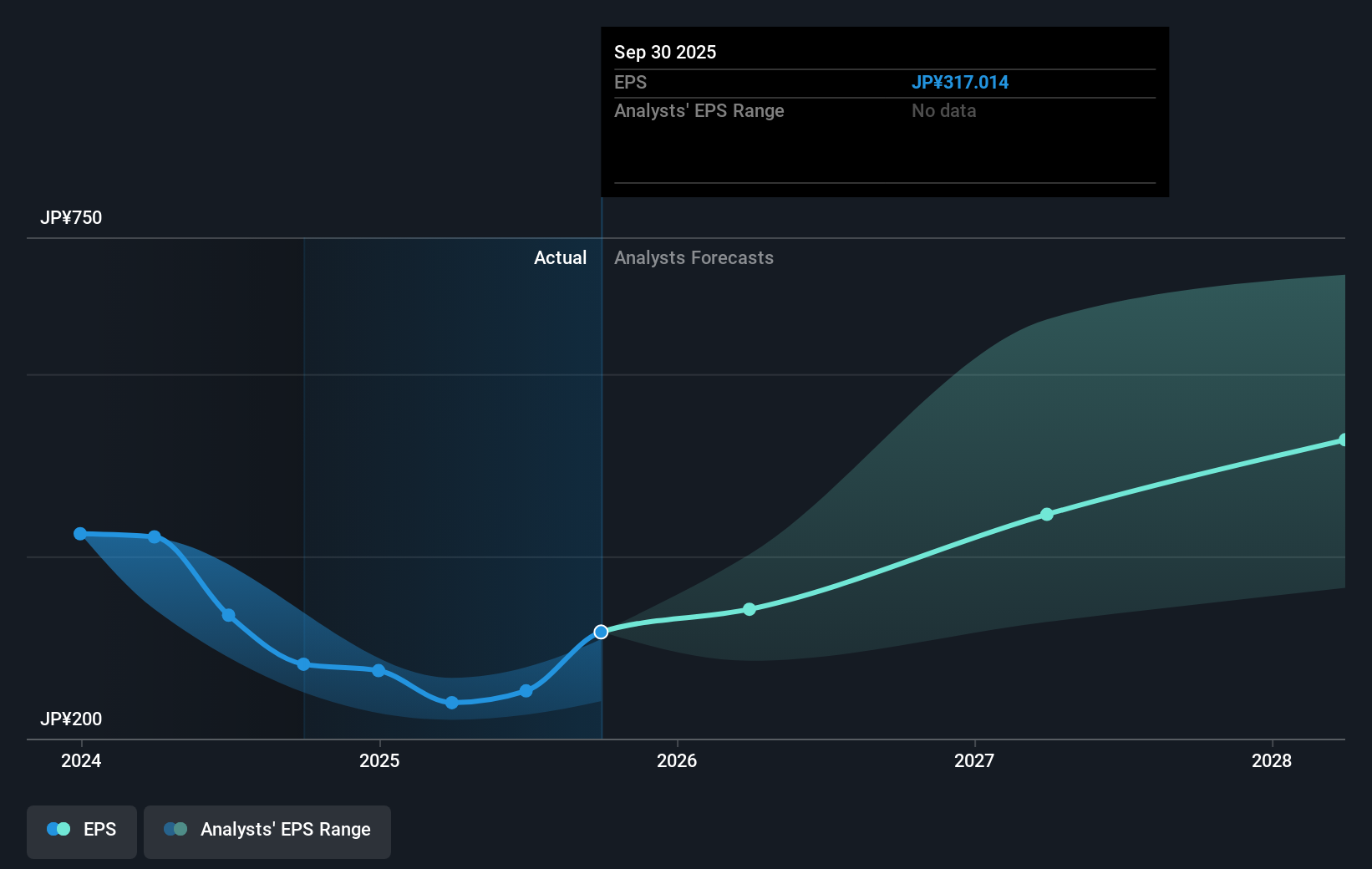

The recent product announcements and collaborations highlighted earlier, such as the launch of Storm Lancers and the upcoming Super Mario Galaxy Movie, potentially bode well for revenue and earnings forecasts. These developments could provide new streams of income and bolster Nintendo's financial health. Despite these efforts, shares are currently trading at ¥14,240, above the consensus analyst price target of ¥13,757.53, implying a potential overvaluation in the short term. Investors should weigh the positive momentum from recent announcements against this valuation context while monitoring how these initiatives affect Nintendo's future growth and profitability.

Our valuation report here indicates Nintendo may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nintendo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7974

Nintendo

Develops, manufactures, and sells home entertainment products in Japan, the Americas, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives