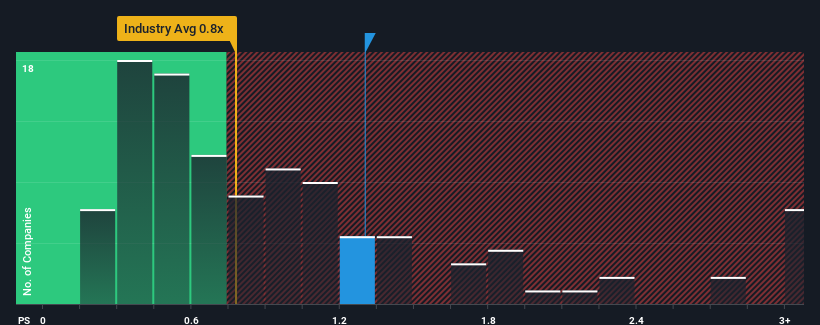

When close to half the companies in the Media industry in Japan have price-to-sales ratios (or "P/S") below 0.8x, you may consider Birdman Inc. (TSE:7063) as a stock to potentially avoid with its 1.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Birdman

How Birdman Has Been Performing

For instance, Birdman's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Birdman's earnings, revenue and cash flow.How Is Birdman's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Birdman's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 74% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 7.7% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Birdman's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Birdman maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Birdman (of which 3 can't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Birdman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7063

Birdman

Engages in the marketing transformation business in Japan and internationally.

Medium-low with weak fundamentals.