How Investors May Respond To Fuji Media Holdings (TSE:4676) Profit Surge Despite Slower Sales Growth

Reviewed by Sasha Jovanovic

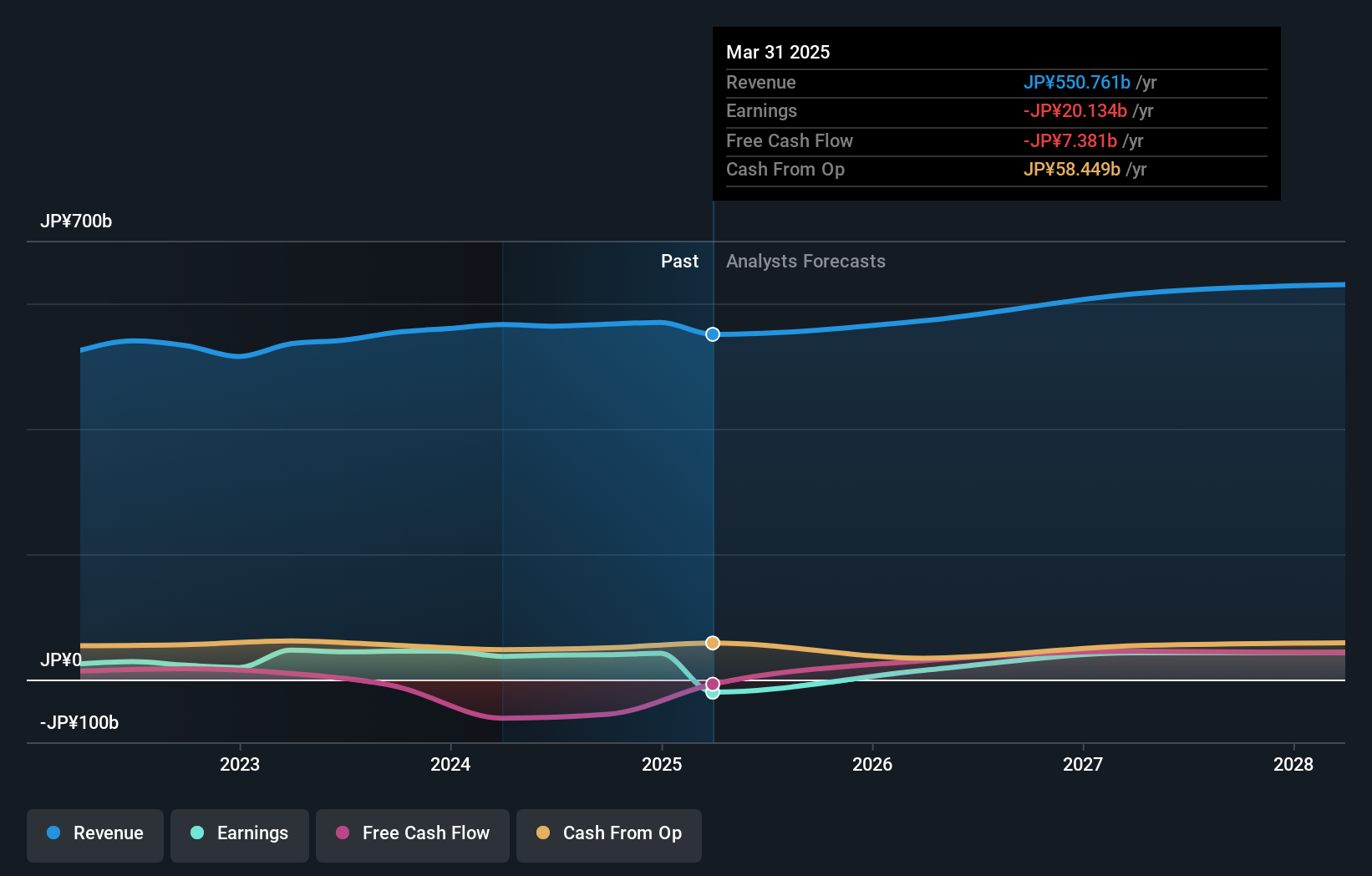

- Fuji Media Holdings recently reported a decline in net sales and operating profit for the six months ended September 30, 2025, compared to the same period last year.

- Interestingly, the company achieved a sharp increase in profit attributable to owners of the parent, pointing to significant changes in cost management or financial strategy.

- We'll explore how Fuji Media Holdings' focus on profitability, despite softer sales, could impact its broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Fuji Media Holdings' Investment Narrative?

At its core, the Fuji Media Holdings investment story now centers on the company’s ability to drive profits even as revenue growth stalls, a theme reinforced by the recent jump in profit attributable to shareholders, despite declines in top-line sales and operating profit. For investors, the big picture has shifted toward whether ongoing cost control, financial restructuring, and the sizeable share buyback program can deliver sustained value in the face of unsteady advertising revenues and a new, relatively untested management team. The recent news event amplifies this shift, as it directly highlights both the potential upside in improved profitability and reinforces risks tied to execution, board turnover, and governance as seen with recent executive departures. While longer-term catalysts like a turnaround in advertising and successful buybacks remain unchanged, the latest results add weight to near-term skepticism around consistent revenue and leadership depth. For now, the fundamental risks and opportunities are more balanced, as reflected by muted price moves post-announcement. On the other hand, governance and management changes are important for investors to keep on their radar.

Fuji Media Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Fuji Media Holdings - why the stock might be worth as much as ¥1486!

Build Your Own Fuji Media Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fuji Media Holdings research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Fuji Media Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fuji Media Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4676

Fuji Media Holdings

Through its subsidiaries, engages in the broadcasting activities in Japan.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026