As global markets grapple with renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, the tech sector remains a focal point for investors, particularly those companies involved in artificial intelligence which continue to attract enthusiasm despite broader market volatility. In such an environment, identifying high growth tech stocks often involves looking for firms that demonstrate strong adaptability and innovation capabilities, allowing them to thrive amid economic uncertainties and shifting geopolitical landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 34.27% | 44.80% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 23.54% | 74.03% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.64% | 43.11% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

Indra Sistemas (BME:IDR)

Simply Wall St Growth Rating: ★★★★☆☆

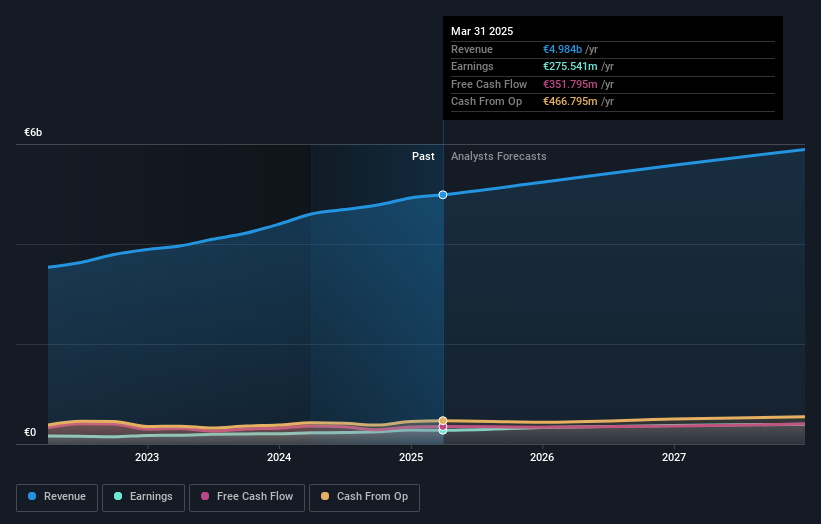

Overview: Indra Sistemas, S.A. is a global technology and consulting company specializing in aerospace, defense, and mobility sectors with a market capitalization of €7.41 billion.

Operations: The company generates revenue primarily from its Minsait (IT) segment, contributing approximately €3.03 billion, followed by the Defense segment at about €1.11 billion. The Mobility and Air Traffic segments add around €362 million and €520 million, respectively.

Indra Sistemas has demonstrated robust financial and technological advancements, evidenced by a significant 64% earnings growth over the past year and an anticipated annual revenue increase of 10.1%. This growth trajectory is complemented by strategic innovations such as the C-V2X tolling solution on I-485, setting a precedent in U.S. toll systems with enhanced road safety features through integrated 3D LiDAR technology. The firm's commitment to R&D is evident from its collaboration with Bittium to develop Software Defined Radio solutions, aligning with modern defense needs and potentially expanding its market footprint in tactical communications. This blend of financial strength and strategic partnerships positions Indra well for sustained advancement in technology-driven sectors.

Baiwang (SEHK:6657)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baiwang Co., Ltd. offers enterprise digitalization solutions via the Baiwang Cloud platform in China, with a market capitalization of HK$3.79 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to CN¥725.25 million.

Baiwang's recent pivot towards its AI and digitalization solutions is showing promising results, with a notable revenue jump from CNY 281.55 million to CNY 347.59 million in the first half of 2025. This growth is significantly bolstered by its AI business, which contributed up to CNY 63.0 million, a stark increase from zero in the previous period. The strategic shift not only reversed a hefty net loss into a profit of CNY 3.72 million but also enhanced the gross profit margin from 39.2% to nearly 50%. These financial improvements reflect Baiwang's adept adaptation to market demands and efficient cost management, positioning it well amidst tech companies capitalizing on AI and cloud-based transformations.

- Click here and access our complete health analysis report to understand the dynamics of Baiwang.

Evaluate Baiwang's historical performance by accessing our past performance report.

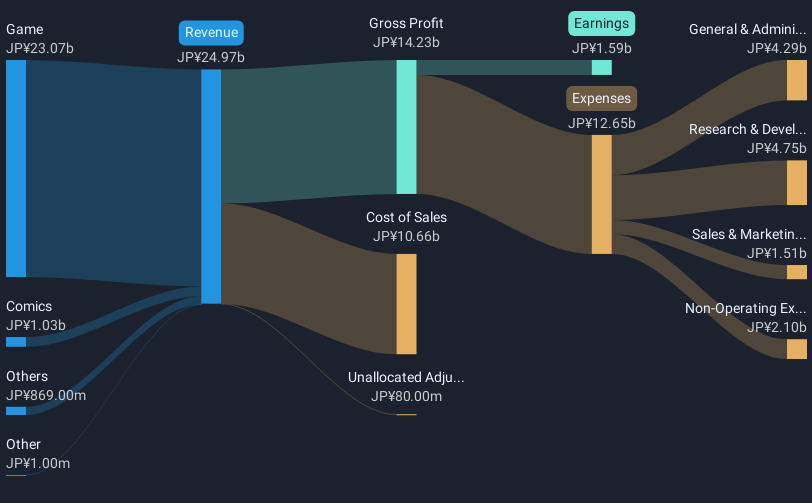

Akatsuki (TSE:3932)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Akatsuki Inc. operates in the gaming and comic industries, among other ventures, primarily within Japan, with a market capitalization of ¥38.01 billion.

Operations: The company generates revenue primarily from its gaming segment, which accounts for ¥19.34 billion, while the comics segment contributes ¥1.14 billion. The net profit margin trend is a notable aspect of its financial performance, reflecting the company's efficiency in managing costs relative to its revenue streams.

Akatsuki's agile response to evolving market demands is evident from its impressive annual earnings growth of 40.83%, significantly outpacing the Japanese market's average of 8.1%. Despite a challenging past year with earnings declining by 56.5% compared to the industry average, the company has managed to maintain a positive free cash flow and an anticipated revenue growth rate of 8% per year, which is nearly double that of the broader Japanese market at 4.4%. This resilience is further underscored by a strategic dividend payout in July, reinforcing its commitment to shareholder value amidst fluctuations. The firm’s focus on innovative practices and effective adaptation strategies positions it well for future growth within the tech sector.

- Unlock comprehensive insights into our analysis of Akatsuki stock in this health report.

Gain insights into Akatsuki's past trends and performance with our Past report.

Next Steps

- Explore the 246 names from our Global High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives