- Japan

- /

- Entertainment

- /

- TSE:3723

There's Reason For Concern Over Nihon Falcom Corporation's (TSE:3723) Massive 28% Price Jump

Despite an already strong run, Nihon Falcom Corporation (TSE:3723) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

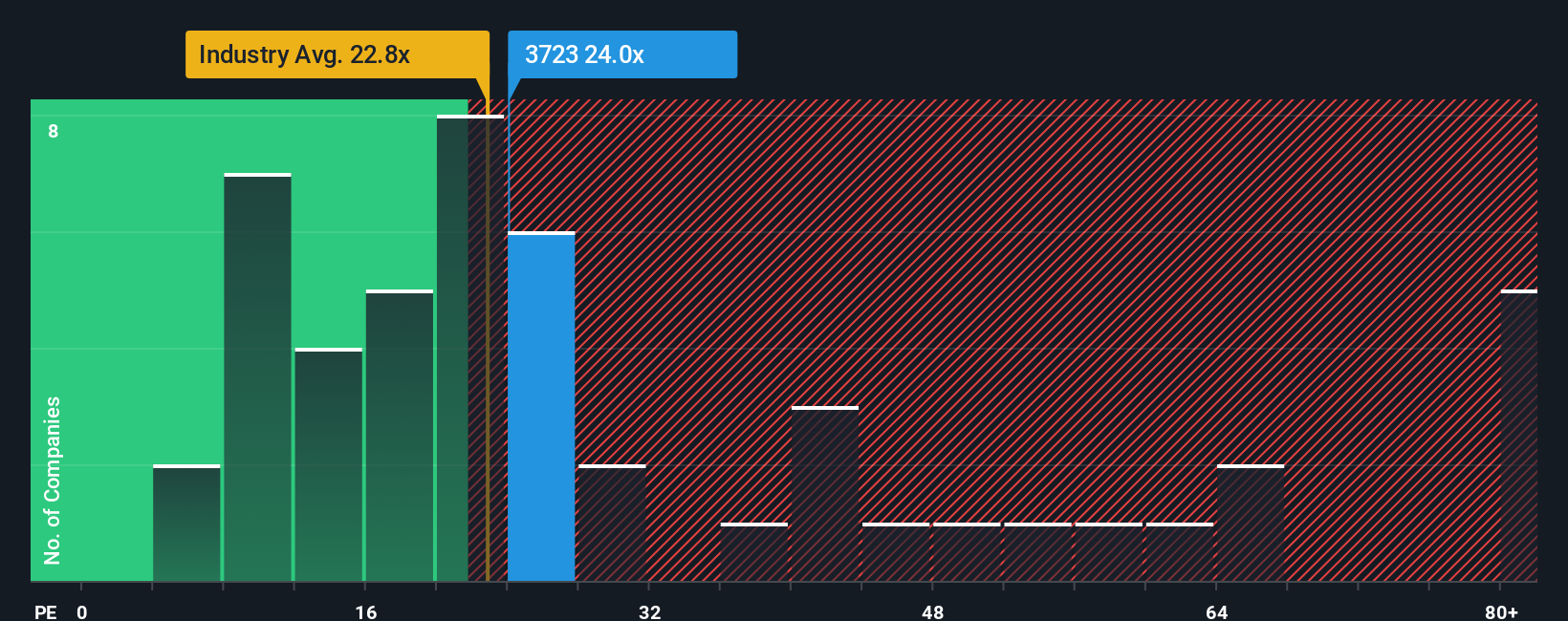

Since its price has surged higher, Nihon Falcom may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 24x, since almost half of all companies in Japan have P/E ratios under 14x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Nihon Falcom over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Nihon Falcom

Does Growth Match The High P/E?

In order to justify its P/E ratio, Nihon Falcom would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.6%. The last three years don't look nice either as the company has shrunk EPS by 37% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this information, we find it concerning that Nihon Falcom is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

The strong share price surge has got Nihon Falcom's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Nihon Falcom currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Nihon Falcom has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Nihon Falcom, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nihon Falcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3723

Nihon Falcom

Engages in the development and production of title game software in Japan and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives