- Japan

- /

- Entertainment

- /

- TSE:2432

Is DeNA's (TSE:2432) AI Investment a Signal of Strategic Discipline or Bold Ambition?

Reviewed by Sasha Jovanovic

- Earlier this week, DeNA Co., Ltd. approved the establishment and investment in the Delight Ventures Builder III Investment Limited Partnership to bolster its AI initiatives as part of its AI-ALL-IN policy and support the startup ecosystem.

- While the immediate financial effect is expected to be limited, this move signals DeNA's intention to embed AI-driven innovation deeper into its business for medium- to long-term growth.

- We'll explore how DeNA's strengthened AI focus and recent strong profit growth impact its investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DeNA Investment Narrative Recap

To be a DeNA shareholder, you need to believe in the company's ability to turn its diversified internet, gaming, and healthcare operations, and new tech like AI, into sustained profits, despite market headwinds. The recent investment in Delight Ventures Builder III Investment Limited Partnership is a sign of long-term innovation ambition, but it does not change the most important short-term catalyst: ongoing user engagement and monetization in flagship games, especially in the absence of new Q4 releases. The biggest current risk remains the volatility around earnings if flagship game performance falters, which this investment does not directly address.

One recent announcement that stands out in light of this is DeNA’s strong half-year earnings, highlighted by an 18.3% jump in revenue and a surge in operating profit. These figures underscore how much recent profit growth is linked to the success of major gaming titles, a catalyst that remains front and center as the company looks to embed AI and innovation to support future growth.

By contrast, investors should be aware that the strong profit story depends heavily on current hit games, but if user activity wanes or monetization weakens…

Read the full narrative on DeNA (it's free!)

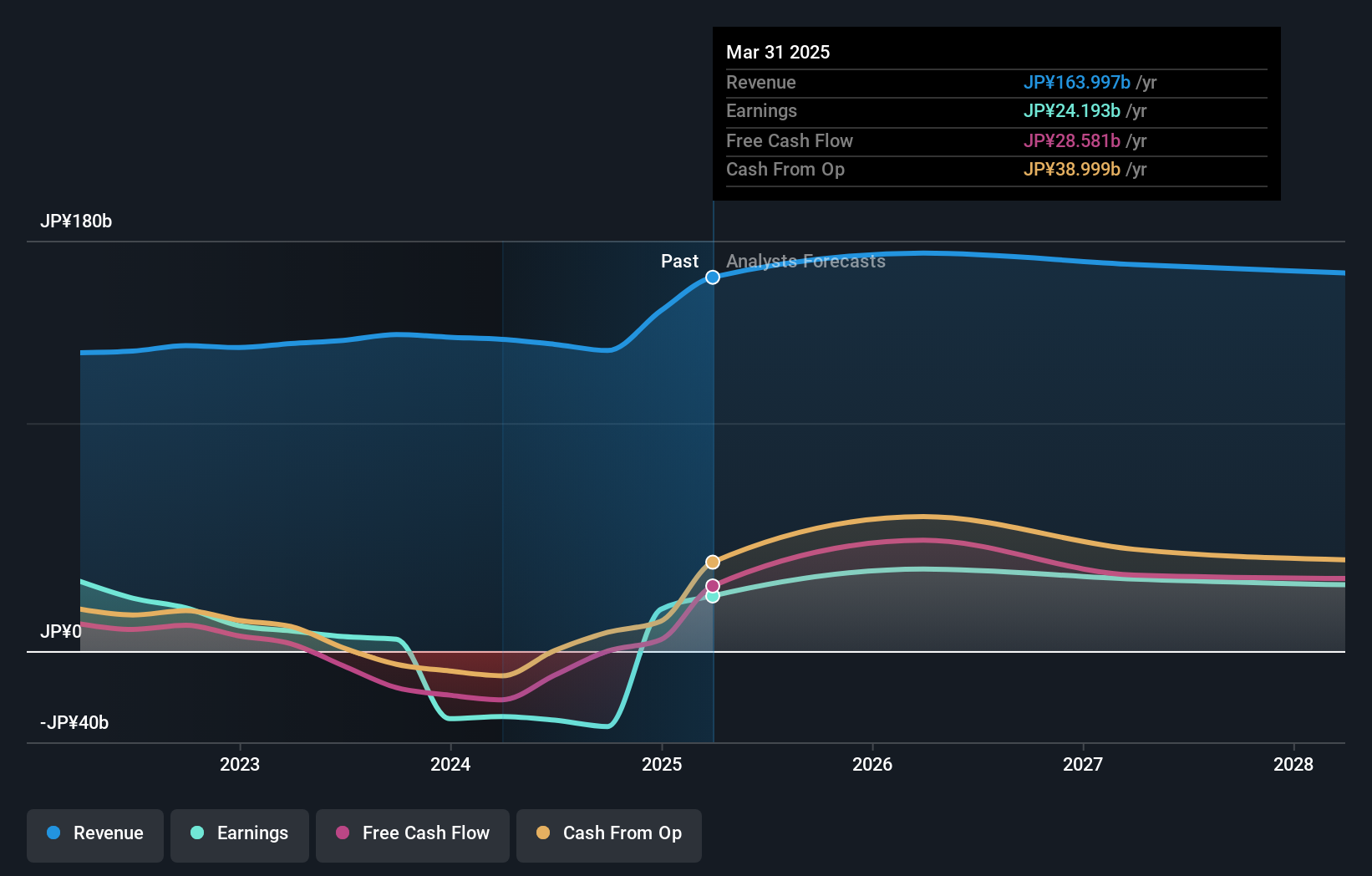

DeNA's outlook projects ¥156.9 billion in revenue and ¥24.8 billion in earnings by 2028. This assumes a 3.0% annual revenue decline and a decrease of ¥7.5 billion in earnings from the current ¥32.3 billion.

Uncover how DeNA's forecasts yield a ¥3214 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 1 fair value estimate for DeNA at ¥1,207, with no divergence across views. While this gives a single valuation approach, the company’s reliance on headline gaming titles brings key questions for future growth and earnings stability.

Explore another fair value estimate on DeNA - why the stock might be worth as much as ¥1207!

Build Your Own DeNA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DeNA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DeNA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DeNA's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2432

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives