- Japan

- /

- Metals and Mining

- /

- TSE:5713

Will Sumitomo Metal Mining’s (TSE:5713) Stake in Winu Reinvent Its Global Resource Strategy?

Reviewed by Sasha Jovanovic

- In October 2025, Sumitomo Metal Mining announced it would acquire a 30% interest in the Winu copper-gold project in Western Australia, increasing the capital of its subsidiary SMM PERTH PTY LTD to fund this participation.

- This marks the company’s entry into a major Australian mining development alongside Rio Tinto, signaling a potential shift in its global resource portfolio.

- We’ll explore how Sumitomo Metal Mining’s direct involvement in the Winu project could influence its long-term investment story.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Sumitomo Metal Mining's Investment Narrative?

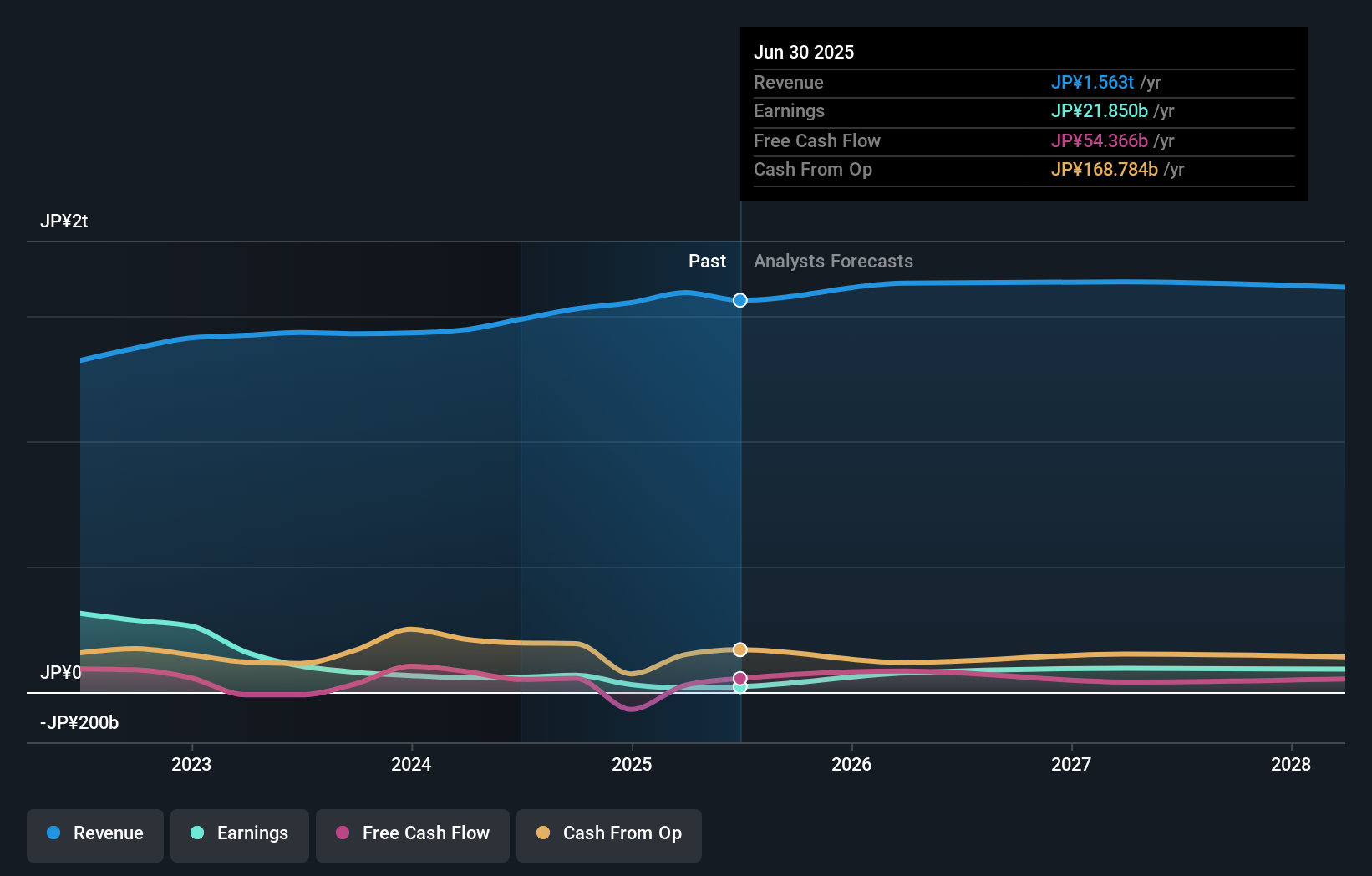

For investors considering Sumitomo Metal Mining, the big-picture belief still orbits around global demand for key metals, especially copper and gold, and the company's push to expand its international mining footprint. The Winu copper-gold project acquisition marks a bold extension outside Japan, and could refresh near-term catalysts by spotlighting new production and revenue prospects. It also signals a willingness to commit sizeable capital and partner with firms like Rio Tinto. Short-term, the deal adds a layer of project execution risk and may affect returns and capital allocations, particularly given an expensive valuation, modest earnings, and limited revenue growth. Before this move, risk factors already included a volatile share price, low profit margins, a recently overhauled board, and dividends not fully covered by earnings. The Winu stake could heighten both opportunity and exposure, possibly altering which risks and levers matter most over the next year.

On the other hand, execution risks around the new Winu project are now front and center for shareholders.

Exploring Other Perspectives

Explore another fair value estimate on Sumitomo Metal Mining - why the stock might be worth just ¥7022!

Build Your Own Sumitomo Metal Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo Metal Mining research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sumitomo Metal Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo Metal Mining's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5713

Sumitomo Metal Mining

Engages in mining, smelting, and refining non-ferrous metals in Japan and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives