- Japan

- /

- Metals and Mining

- /

- TSE:5401

NN Steel’s Low‑CO2 Furnace Joint Venture Might Change The Case For Investing In Nippon Steel (TSE:5401)

Reviewed by Sasha Jovanovic

- In November 2025, NN STEEL Corporation approved a joint venture with Nippon Steel to own and lease new low-CO2 electric arc furnace facilities at NN STEEL’s Funamachi Plant, supplying steel slabs and hot-rolled products between the partners.

- This joint venture advances both companies’ decarbonization and resource-recycling ambitions by expanding electric arc furnace capacity and aligning production with growing demand for lower-emission steel.

- Next, we’ll explore how this low-CO2 electric arc furnace joint venture shapes Nippon Steel’s investment narrative and long-term positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Nippon Steel's Investment Narrative?

For Nippon Steel, shareholders need to be comfortable owning a cyclical, capital‑intensive business that is currently unprofitable but investing heavily in cleaner steel. The new low‑CO2 electric arc furnace joint venture with NN STEEL fits that story neatly: it supports the company’s broader ¥869 billion domestic decarbonization capex plan and could reinforce medium‑term demand for its slabs and hot‑rolled products. In the near term, though, the key catalysts still sit with earnings execution, progress on U.S. Steel regulatory approvals, and how quickly loss‑making operations can be brought under control. The JV itself is unlikely to move the needle on results over the next few quarters, but it does tilt the risk balance slightly toward project delivery, capital discipline, and the ability to keep funding investment while dividends are not well covered by earnings.

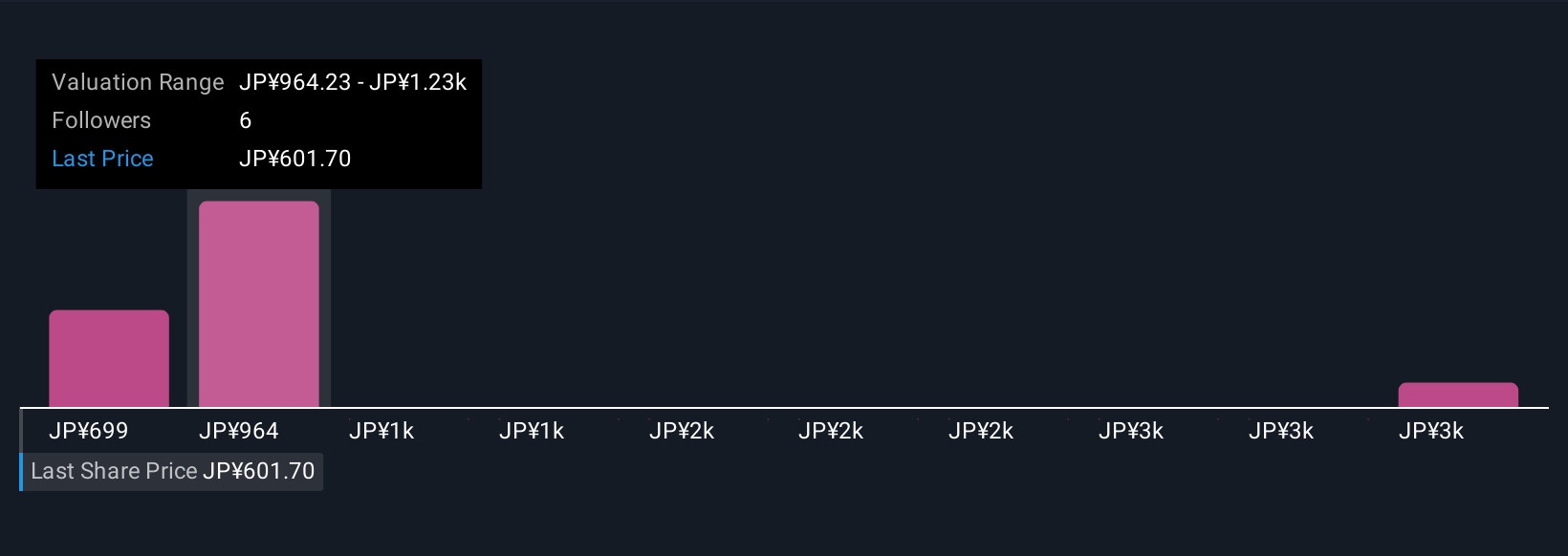

However, one risk investors should not overlook relates to those large, long‑dated decarbonization projects. Nippon Steel's shares are on the way up, but they could be overextended by 47%. Uncover the fair value now.Exploring Other Perspectives

Explore 4 other fair value estimates on Nippon Steel - why the stock might be worth 32% less than the current price!

Build Your Own Nippon Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Steel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Steel's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026