- Japan

- /

- Metals and Mining

- /

- TSE:5016

JX Advanced Metals (TSE:5016): Evaluating Valuation After Strong 132% Three-Month Share Price Surge

Reviewed by Simply Wall St

JX Advanced Metals (TSE:5016) stock has caught some attention lately, given its recent share price changes and shifts in revenue and profit growth over the past year. Investors seem to be weighing up what these performance trends could mean going forward.

See our latest analysis for JX Advanced Metals.

The share price return for JX Advanced Metals has been eye-catching, with a 132% gain over the past three months and a 135% move year-to-date. This suggests momentum is still building. This recent surge hints that investors are seeing fresh growth potential or a shift in risk sentiment following improvements in the company’s results.

If you’re intrigued by these kinds of sharp moves, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after such a sharp rally, the question now is whether JX Advanced Metals is still undervalued or if all that future growth is already accounted for in the share price. Is there a real buying opportunity here, or is the market already pricing in the next chapter?

Price-to-Earnings of 26.3x: Is It Justified?

JX Advanced Metals is currently trading at a price-to-earnings (P/E) ratio of 26.3x, which is significantly higher than many of its peers and the broader industry. With the last close at ¥2,054, the stock appears richly valued compared to the sector.

The price-to-earnings ratio measures how much investors are paying for each unit of company earnings. For industrials and materials stocks like JX Advanced Metals, this ratio helps signal market attitude toward growth and profitability potential. A high P/E can indicate expectations of strong future earnings or, in some cases, the market may be overvaluing the company's prospects.

In the current context, JX Advanced Metals' P/E of 26.3x stands out when compared to its industry, where the average is only 12.9x. Additionally, regression analysis suggests a fair P/E for the stock is closer to 19.6x. This hints the market may be assigning a premium beyond what fundamentals justify. If sentiment shifts or the company's growth does not keep pace, there is potential for the valuation to revert toward this fair ratio.

Explore the SWS fair ratio for JX Advanced Metals

Result: Price-to-Earnings of 26.3x (OVERVALUED)

However, the stock trades at a notable discount to analyst targets, and any slowdown in earnings growth could quickly change market sentiment.

Find out about the key risks to this JX Advanced Metals narrative.

Another View: What Does the SWS DCF Model Say?

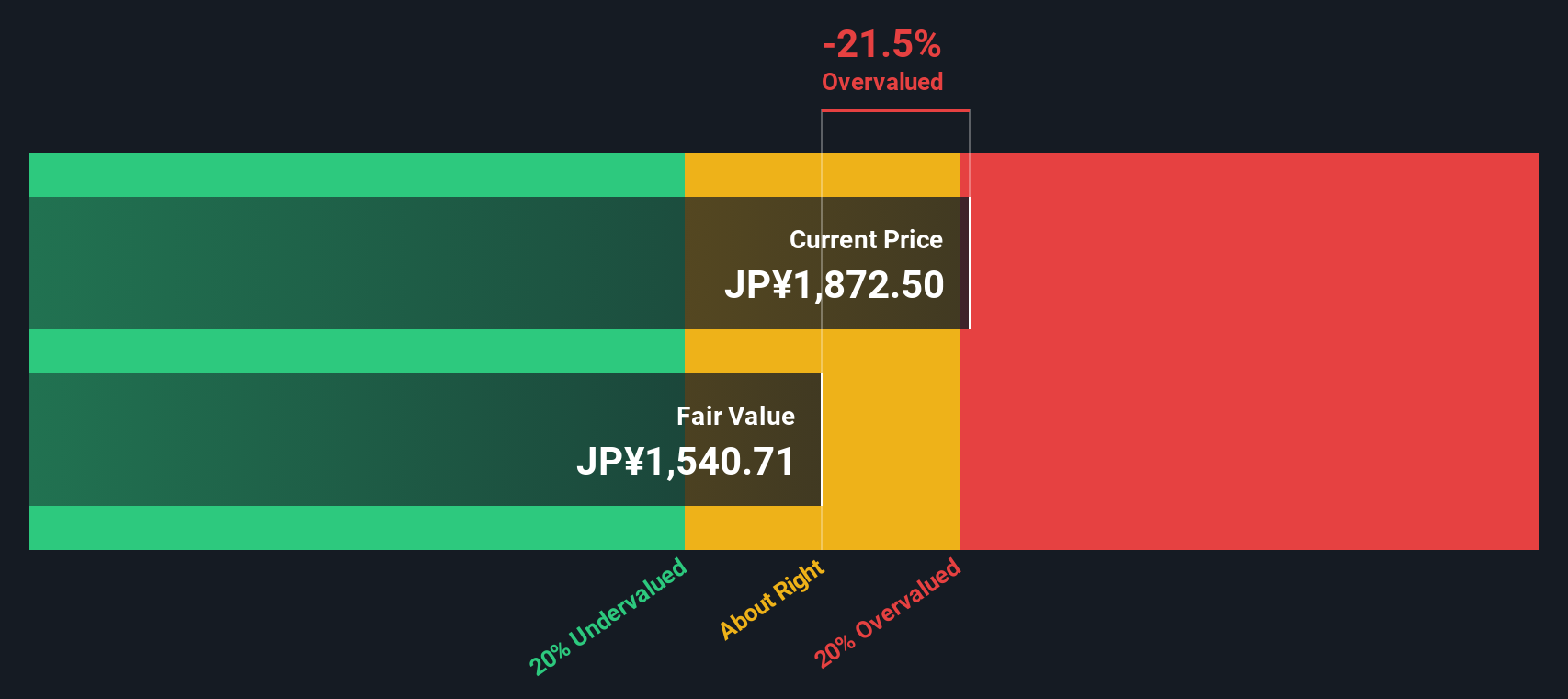

Not everyone relies solely on price-to-earnings ratios. Looking at our DCF model for JX Advanced Metals, the calculated fair value is ¥1,672, which is below the current share price of ¥2,054. This difference suggests the stock might actually be overvalued based on future cash flows. Could this be a sign to tread carefully?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JX Advanced Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JX Advanced Metals Narrative

If you see things differently or want to dive deeper into the numbers, you can create your own view of JX Advanced Metals in just a few minutes, your way with Do it your way.

A great starting point for your JX Advanced Metals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop here when some of the market’s most exciting opportunities are only a click away? Don’t let the next breakout stock pass you by.

- Capitalize on untapped value by researching these 831 undervalued stocks based on cash flows, which stand out for their strong cash flow potential and surprising market discounts.

- Target reliable income streams and secure your financial future with these 22 dividend stocks with yields > 3%, offering yields above 3%.

- Ride the next wave of innovation and see how your portfolio could benefit from these 26 AI penny stocks, which are driving major transformations in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5016

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives