Mitsubishi Chemical Group (TSE:4188): Assessing Valuation After Earnings Forecast Cut and Softer Segment Margins

Reviewed by Simply Wall St

Mitsubishi Chemical Group (TSE:4188) revised its earnings forecast for the current fiscal year, citing lower expected sales, operating income, and net income as margins and volumes in several segments come under pressure.

See our latest analysis for Mitsubishi Chemical Group.

Despite trimming forecasts and navigating softer volumes in core segments, Mitsubishi Chemical Group's 1-year total shareholder return stands at 6.7%, while the share price has added 8.5% year-to-date. Investors have seen significant gains over the longer term, with a 32.8% three-year and 73.7% five-year total shareholder return, even as the company manages new headwinds and resets expectations. Recent positive price momentum suggests that, while near-term challenges remain, the market continues to see underlying value in the stock.

If you’re interested in what else is gaining traction beyond the major industry players, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With forecasts reset and shares still building momentum, the question for investors is whether Mitsubishi Chemical Group is trading at a discount or if the market has already factored in its future growth potential.

Most Popular Narrative: 4.5% Undervalued

With Mitsubishi Chemical Group closing at ¥860, the most widely followed narrative estimates fair value at ¥900.91. This suggests there may be hidden factors supporting a premium above the current price, which may interest investors considering the company’s future outlook.

Mitsubishi Chemical Group's ongoing shift towards specialty and high value-added materials, evidenced by significant structural reforms, business divestitures, and cost reductions, should enhance the product mix, improve net margins, and provide greater earnings stability as global demand for advanced, sustainable materials grows.

Want an inside look at the drivers behind this valuation call? The most surprising factor is how the narrative expects margin upgrades and specialty materials to set a new benchmark for future profitability. Curious what other aggressive assumptions build this price target? The full narrative unpacks all the bold numbers at play.

Result: Fair Value of ¥900.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in global MMA markets or delays in shifting toward higher-margin composites could put further pressure on Mitsubishi Chemical Group’s profitability outlook.

Find out about the key risks to this Mitsubishi Chemical Group narrative.

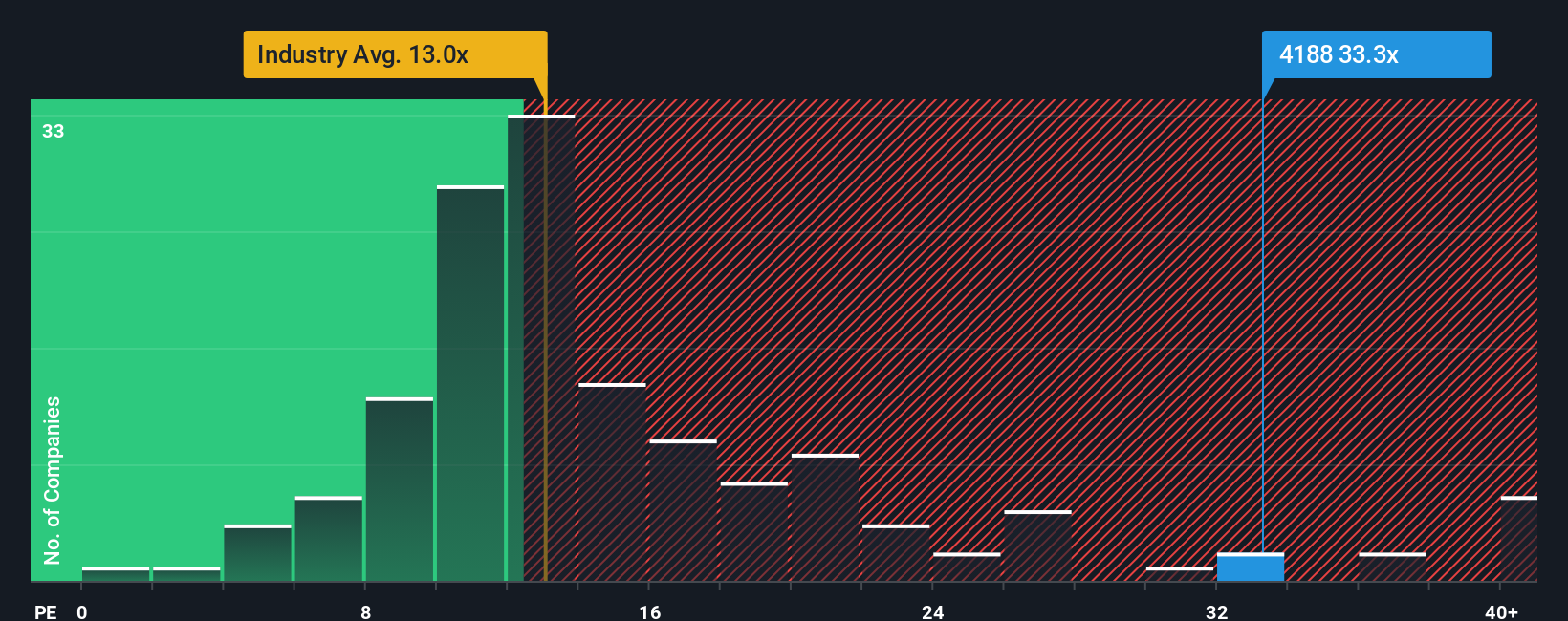

Another View: Market Multiples Signal Caution

While narrative-based fair value estimates point to Mitsubishi Chemical Group being undervalued, the company's price-to-earnings ratio of 31.7x is much higher than both the peer average (15.5x) and the broader Japanese Chemicals industry (12.8x). The market’s optimism seems well ahead of where fundamentals or fair ratios (22.3x) indicate shares might settle.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Chemical Group Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can craft a customized view of Mitsubishi Chemical Group’s story in just a few minutes, your way. Do it your way

A great starting point for your Mitsubishi Chemical Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd and give yourself the edge by uncovering investments that others might overlook. You could be just a click away from your next winning stock idea.

- Maximize potential returns by tapping into these 3591 penny stocks with strong financials, where promising companies with robust fundamentals are ready for a breakout.

- Secure steady income streams and review these 14 dividend stocks with yields > 3%, which consistently offer yields above 3% for reliable long-term growth.

- Ride the innovation wave as you check out these 27 AI penny stocks, companies on the leading edge of artificial intelligence advancements reshaping entire sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4188

Mitsubishi Chemical Group

Provides performance products, industrial materials, industrial gases, and others in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives