A Look at ISE Chemicals (TSE:4107) Valuation Following the 10-for-1 Share Split Announcement

Reviewed by Simply Wall St

ISE Chemicals (TSE:4107) just announced a 10-for-1 share split for shareholders on record as of December 15. Moves like this often aim to boost liquidity and broaden the pool of potential investors.

See our latest analysis for ISE Chemicals.

ISE Chemicals' share split news arrives after a period of strong momentum, with a 1-month share price return of 15.2% and a standout 1-year total shareholder return of 65%. Longer-term holders have seen even bigger gains, as the 3-year total shareholder return tops 530%. These are clear signs that investor interest and confidence have steadily built up in recent years.

If a stock move like this has you wondering what else could surprise you, now’s a great time to discover fast growing stocks with high insider ownership

With such impressive gains, investors may wonder whether ISE Chemicals is still undervalued or if the recent performance means all the good news has already been priced in. This could leave little room for upside from here.

Price-to-Earnings of 26.2x: Is it justified?

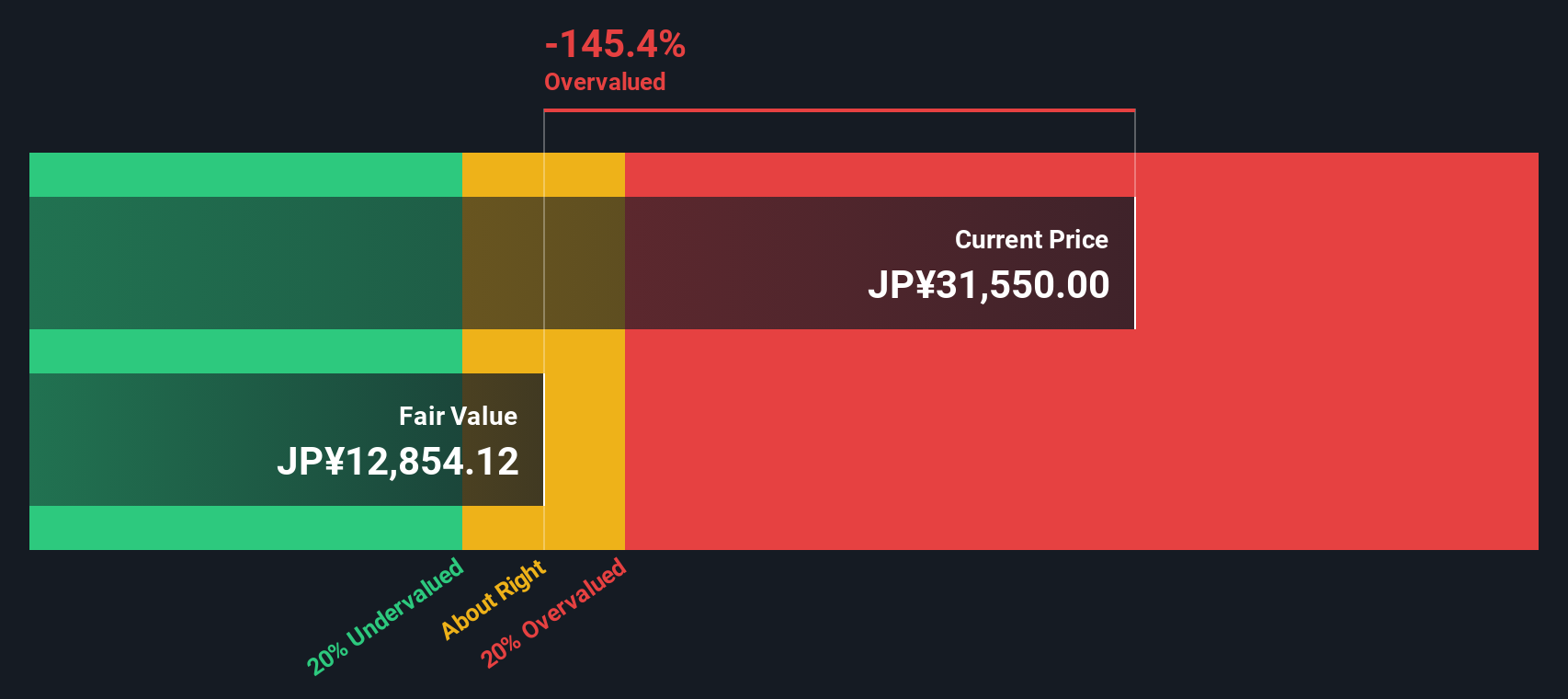

At a current price-to-earnings (P/E) ratio of 26.2x, ISE Chemicals trades at a substantial premium both to its local peers and the broader industry, even after its recent rally to ¥31,550 per share.

The P/E ratio is a key valuation tool that compares a company's share price to its per-share earnings. This metric provides insight into how much investors are willing to pay for current and expected profitability. In the chemicals sector, where competitive dynamics and earnings visibility differ from tech or consumer-focused industries, extreme P/E multiples can raise pressing questions about future growth expectations.

ISE Chemicals’ P/E of 26.2x greatly surpasses both the peer average of 17.4x and the Japanese chemicals industry average of 13x. This sharp premium suggests the market is projecting unusually strong growth or returns ahead. Without supporting evidence for record-setting expansion, this rich multiple sets a high bar for future performance and could amplify downside risk if momentum slows.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 26.2x (OVERVALUED)

However, slower profit growth or shifts in industry demand could temper market enthusiasm and lead to a sharp re-rating for ISE Chemicals shares.

Find out about the key risks to this ISE Chemicals narrative.

Another View: Discounted Cash Flow Signals Overvaluation

Looking from another angle, our DCF model places ISE Chemicals’ fair value at ¥20,321.1 per share, which is far below the current market price of ¥31,550. This suggests the shares could be trading at a significant premium. Does this divergence indicate too much optimism, or is the market looking past fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ISE Chemicals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ISE Chemicals Narrative

If you see things differently or want to dig into the data yourself, it's quick and simple to craft your own perspective in just a few minutes, so why not Do it your way

A great starting point for your ISE Chemicals research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

No smart investor puts all their eggs in one basket. Give yourself the edge by checking out hand-picked strategies that could unlock your next big winner.

- Tap into reliable income by reviewing these 22 dividend stocks with yields > 3% with solid yields and the financial strength to keep paying.

- Zero in on the potential of breakthrough technology by checking out these 26 AI penny stocks. These picks are poised to benefit from the AI revolution.

- Spot companies trading below their true worth and seize pricing opportunities within these 832 undervalued stocks based on cash flows. These selections are now gaining attention for their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4107

ISE Chemicals

Engages in the iodine and natural gas, and metallic compound businesses in Japan.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives