Osaka Soda (TSE:4046) Authorizes Major Share Buyback Is Management Signaling Confidence or Caution?

Reviewed by Sasha Jovanovic

- On November 7, 2025, Osaka Soda Co., Ltd. announced board approval for a share repurchase program, aiming to buy back 5,000,000 shares, about 3.99% of its outstanding shares, for ¥5,000 million by January 30, 2026.

- This move highlights the company's priority to enhance shareholder returns and capital efficiency, reflecting management's confidence in its outlook.

- We'll explore how Osaka Soda's significant buyback initiative shapes its investment narrative and what this means for shareholder value.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Osaka Soda's Investment Narrative?

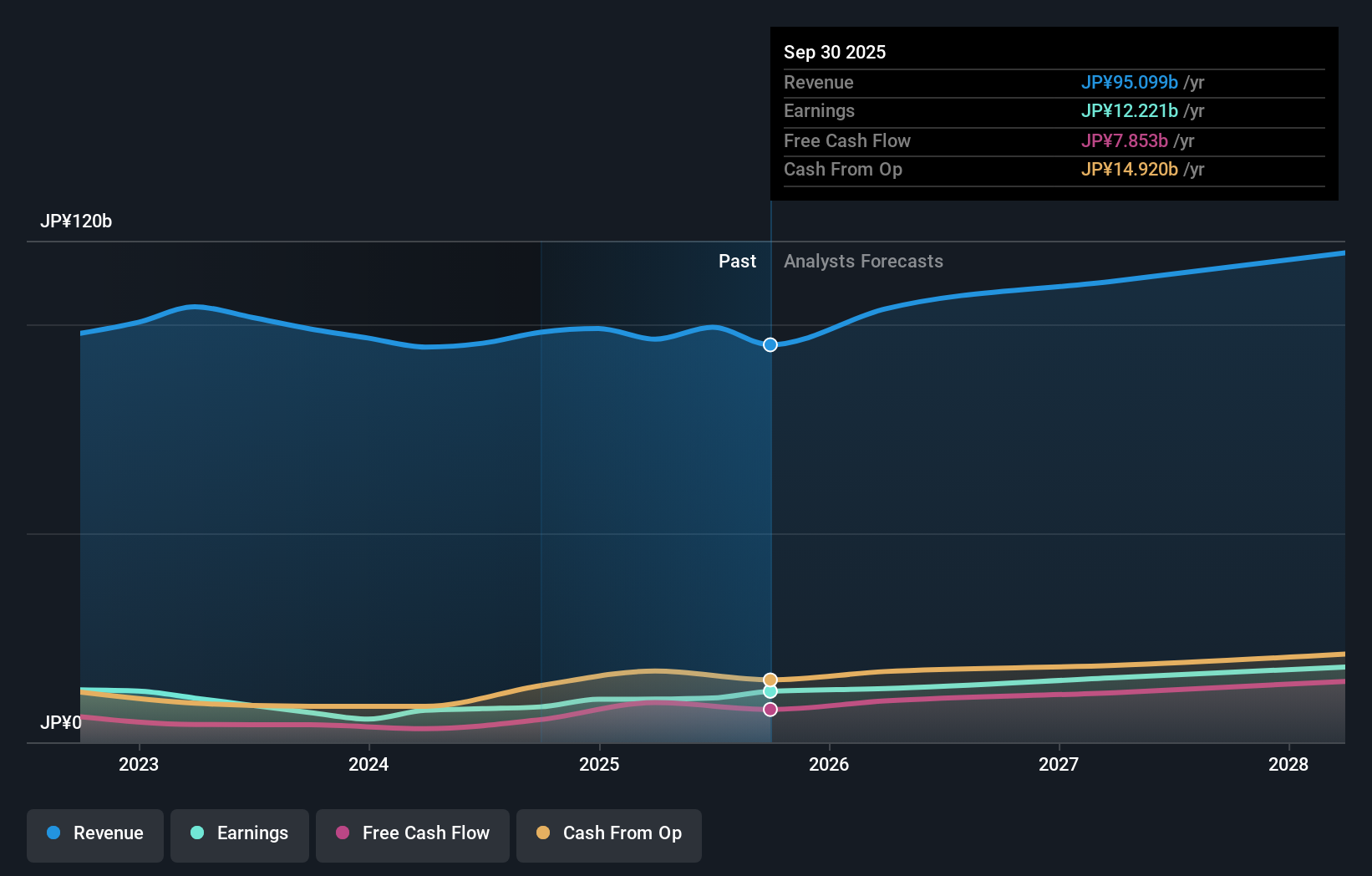

For anyone considering Osaka Soda, the big picture centers on whether you believe the company’s efforts to reward shareholders and improve capital efficiency will offset some meaningful risks. The new share buyback program notably signals management’s commitment to shareholder returns, and, combined with past buybacks, could help underpin near-term support for the share price. However, some headwinds still deserve attention: most importantly, the pronounced drop in dividends over the past year, rising concerns about valuation given the premium price-to-earnings ratios, and a volatile share price in recent months. The buyback may help soften the risk of near-term volatility and could be a short-term catalyst by providing liquidity and boosting confidence. But it doesn’t fully address the longer-term challenge of sustained earnings growth or whether the dividend can recover, so investors will have to weigh if the program is enough to offset these risks amid changing market sentiment.

On the other hand, investors should watch for signals that the dividend policy may not stabilize soon. Osaka Soda's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Osaka Soda - why the stock might be worth over 2x more than the current price!

Build Your Own Osaka Soda Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Osaka Soda research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Osaka Soda research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Osaka Soda's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4046

Osaka Soda

Manufactures and sells basic and functional products in Asia, Europe, North America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives