- Singapore

- /

- Hospitality

- /

- Catalist:1D0

Kimly Joins 2 Leading Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

In the face of geopolitical tensions, tariff uncertainties, and mixed economic signals from major global markets, investors are increasingly seeking stable income sources amidst fluctuating indices. Dividend stocks have long been favored for their potential to provide reliable income streams, especially during times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.11% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

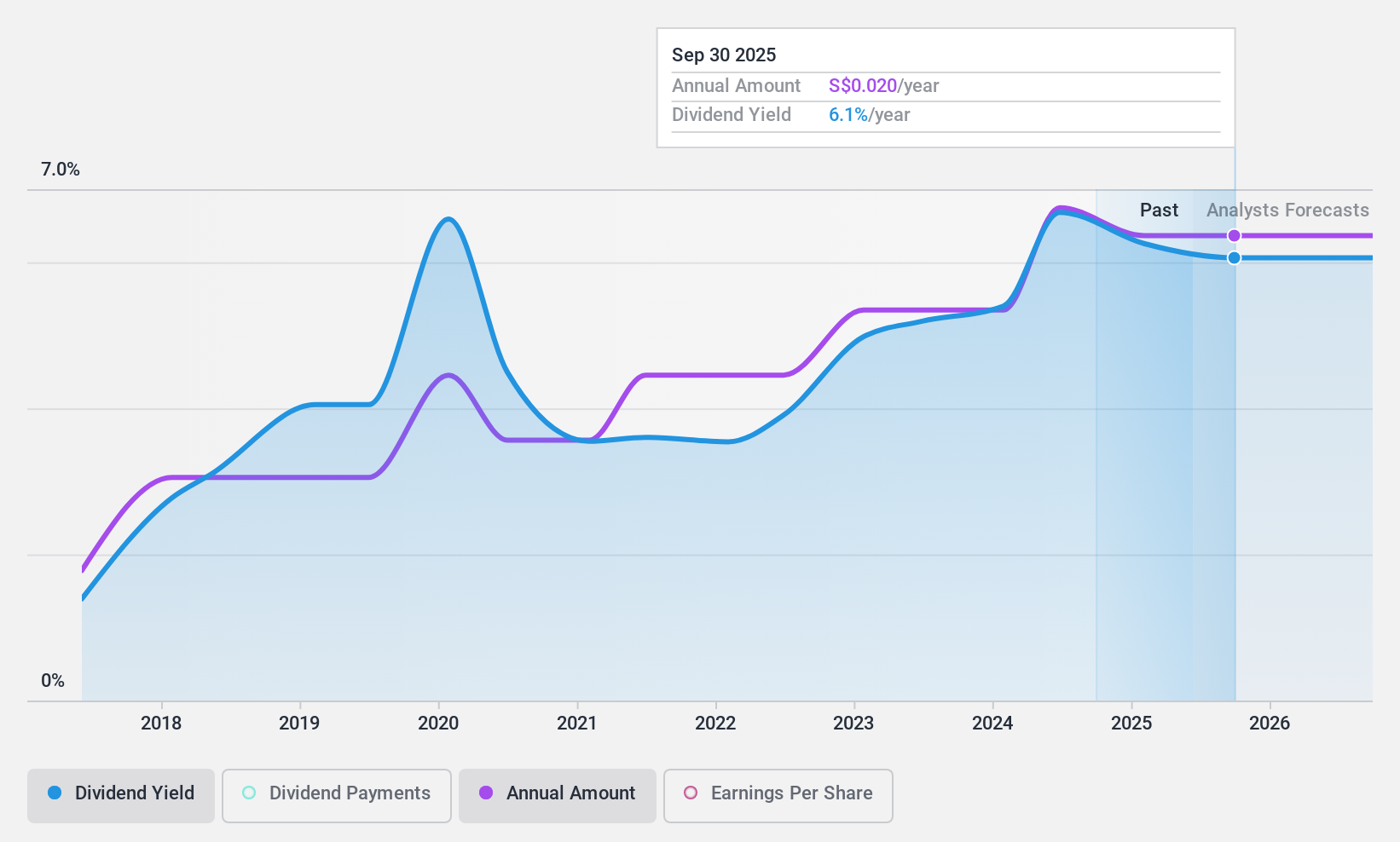

Kimly (Catalist:1D0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kimly Limited is an investment holding company that operates coffee shops in Singapore with a market capitalization of SGD391.79 million.

Operations: Kimly Limited generates revenue from its Food Retail segment with SGD260.69 million, Outlet Management at SGD162.31 million, and Outlet Investment Business contributing SGD9.22 million.

Dividend Yield: 6.2%

Kimly's dividend payments, though in the top 25% of the Singapore market, have been volatile over its eight-year history. The company recently approved a final dividend of S$0.01 per share for FY2024 despite a decrease in net income to S$33.12 million from S$36.47 million the previous year. While dividends are well-covered by earnings and cash flows with payout ratios at 75% and 30.3%, respectively, stability remains a concern for investors seeking consistent returns.

- Delve into the full analysis dividend report here for a deeper understanding of Kimly.

- Upon reviewing our latest valuation report, Kimly's share price might be too pessimistic.

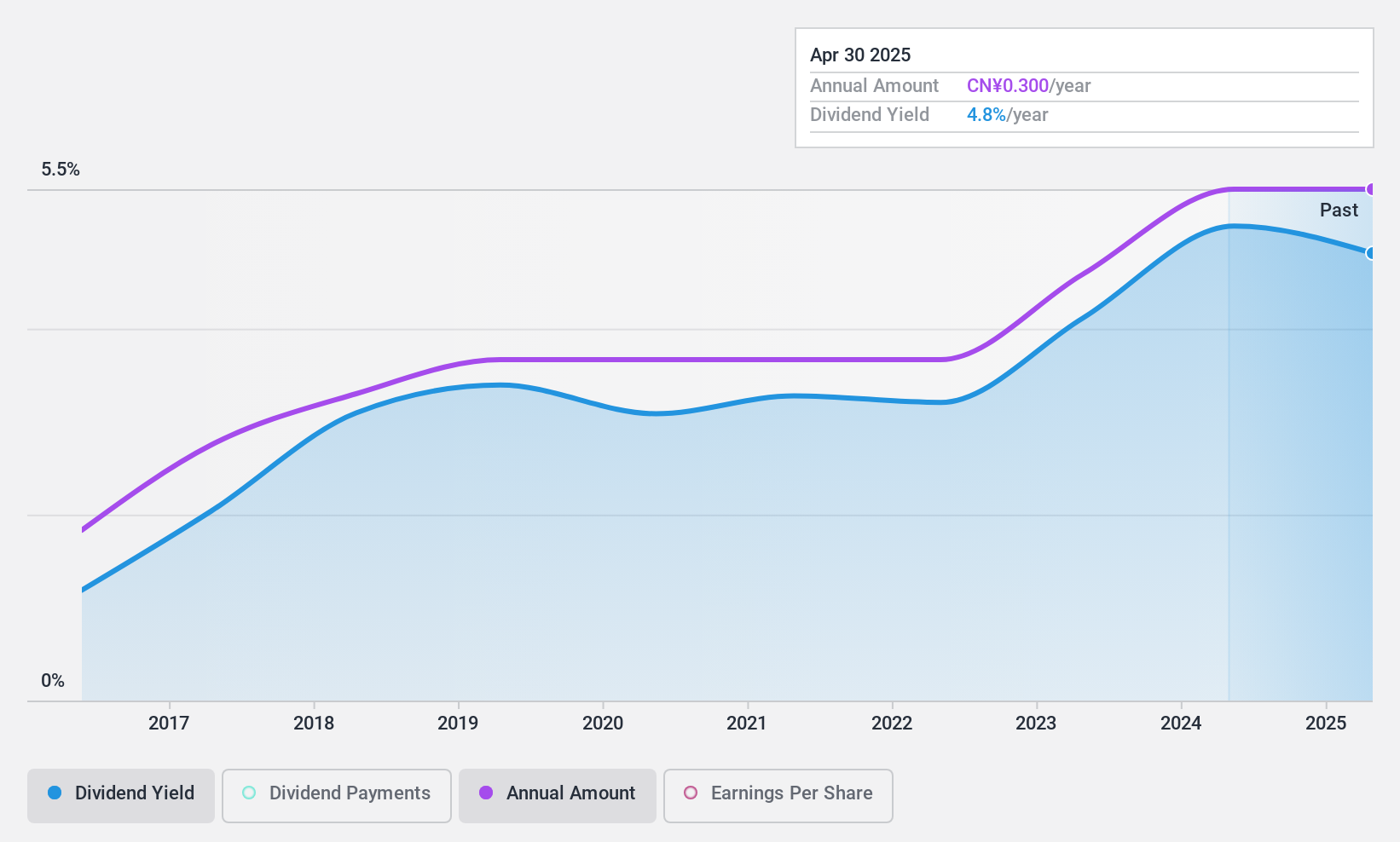

Zhejiang Jiaxin SilkLtd (SZSE:002404)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zhejiang Jiaxin Silk Corp., Ltd. engages in the research, development, production, and sales of silk products both in China and internationally, with a market cap of CN¥3.43 billion.

Operations: Zhejiang Jiaxin Silk Corp., Ltd. generates its revenue through the research, development, production, and sales of silk products both domestically in China and on an international scale.

Dividend Yield: 4.9%

Zhejiang Jiaxin Silk Ltd offers a compelling dividend profile, with a yield of 4.89%, placing it in the top 25% of CN market payers. The company has consistently increased its dividends over the past decade, supported by stable earnings growth of 8.1% annually over five years. Its dividends are well-covered by both earnings (payout ratio: 85.6%) and cash flows (cash payout ratio: 39.7%), ensuring sustainability and reliability for income-focused investors.

- Get an in-depth perspective on Zhejiang Jiaxin SilkLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Zhejiang Jiaxin SilkLtd's shares may be trading at a discount.

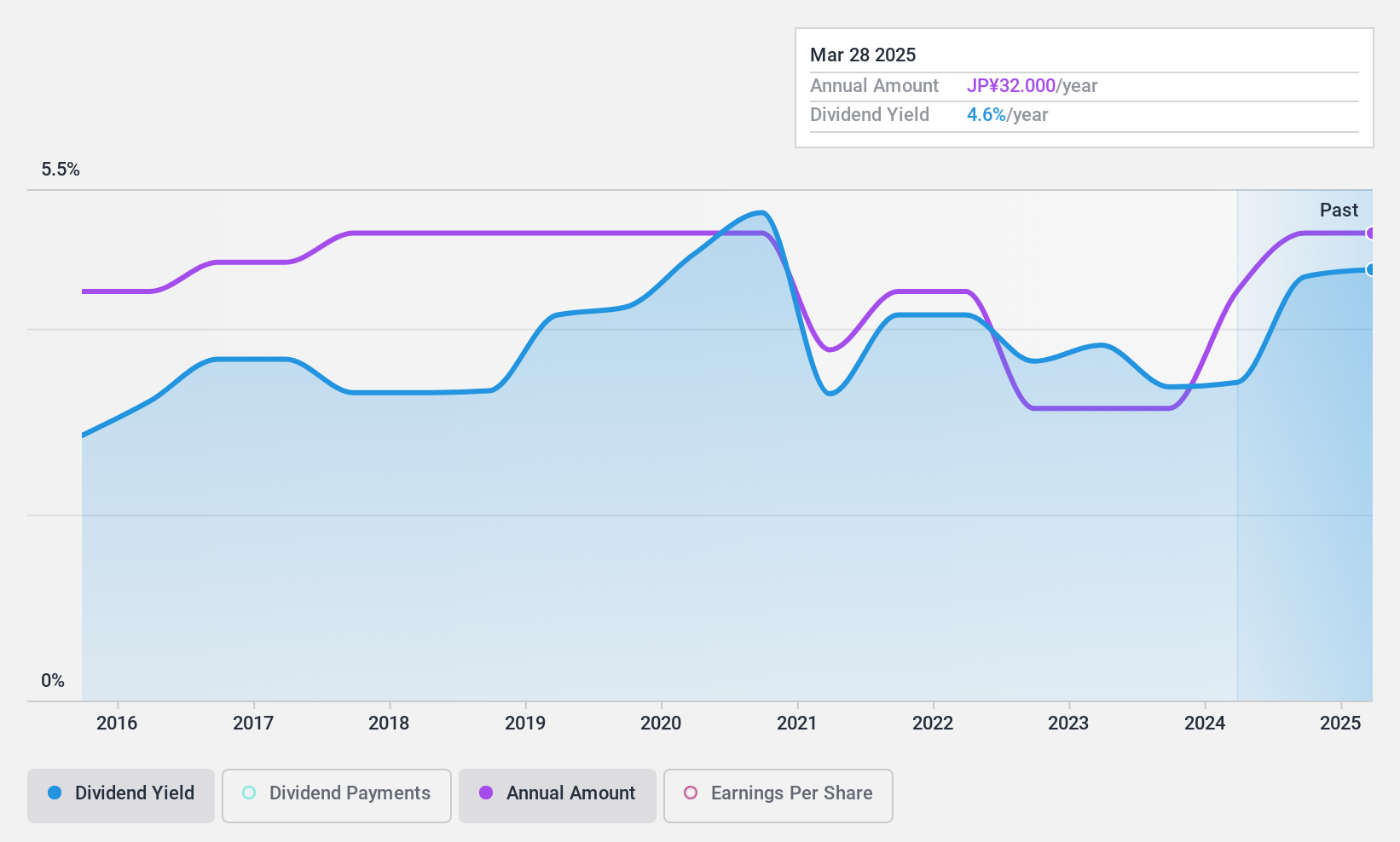

Kyowa Leather Cloth (TSE:3553)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kyowa Leather Cloth Co., Ltd. is a Japanese company that specializes in the manufacturing and sale of synthetic leather cover materials, with a market cap of ¥17.28 billion.

Operations: Kyowa Leather Cloth Co., Ltd. generates revenue from its segment focused on the manufacture and sale of various synthetic skin materials, amounting to ¥53.32 billion.

Dividend Yield: 4.4%

Kyowa Leather Cloth's dividend yield of 4.38% ranks it among the top 25% in Japan, though its payments have been volatile over the past decade. Despite a reasonable payout ratio of 56.3%, dividends are not supported by free cash flows, raising sustainability concerns. The company's price-to-earnings ratio of 12 is slightly below the market average, offering potential value but posing risks for income investors due to unreliable and unsustainable dividend coverage.

- Unlock comprehensive insights into our analysis of Kyowa Leather Cloth stock in this dividend report.

- In light of our recent valuation report, it seems possible that Kyowa Leather Cloth is trading beyond its estimated value.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2005 more companies for you to explore.Click here to unveil our expertly curated list of 2008 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About Catalist:1D0

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives