Assessing Teijin (TSE:3401) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Shares of Teijin (TSE:3401) have dipped slightly over the past week, catching the attention of investors who follow the Japanese materials sector. Recent trading shows a modest decline in value, which has prompted further examination of the stock’s position.

See our latest analysis for Teijin.

Teijin's recent share price movement, down nearly 6% this past week, reflects some fading momentum after a mixed twelve months. The one-year total shareholder return is -5.1%, but there is a healthy 10.1% gain over the past three years. While the mood around the stock has been cautious lately, there is still interest driven by underlying long-term performance and shifting risk outlooks.

If you’re keeping an eye on stocks showing fresh growth potential, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares ticking down and long-term gains still intact, the question for investors is whether Teijin is trading at an attractive value or if the market has already accounted for its future prospects. Is this a hidden opportunity, or is everything priced in?

Most Popular Narrative: Fairly Valued

With Teijin’s fair value estimate nearly matching its last close, the current share price reflects investor hesitation about future upside and near-term risks. The narrative assumes ongoing transformation is balancing out sector headwinds. So what’s really driving this market call?

Anticipated global growth in demand for lightweight, high-performance materials in automotive, aerospace, and renewable energy sectors, driven by sustainability and stricter environmental regulations, positions Teijin's advanced composites and aramid fibers for revenue recovery and long-term topline growth, especially as cost structure reforms begin to take full effect.

The narrative’s fair value hinges on bold assumptions about future demand and margin improvement. Curious about the revenue and margin leap this outlook is built on? Tap to see what’s powering this valuation vision and discover the numbers that could shift the story.

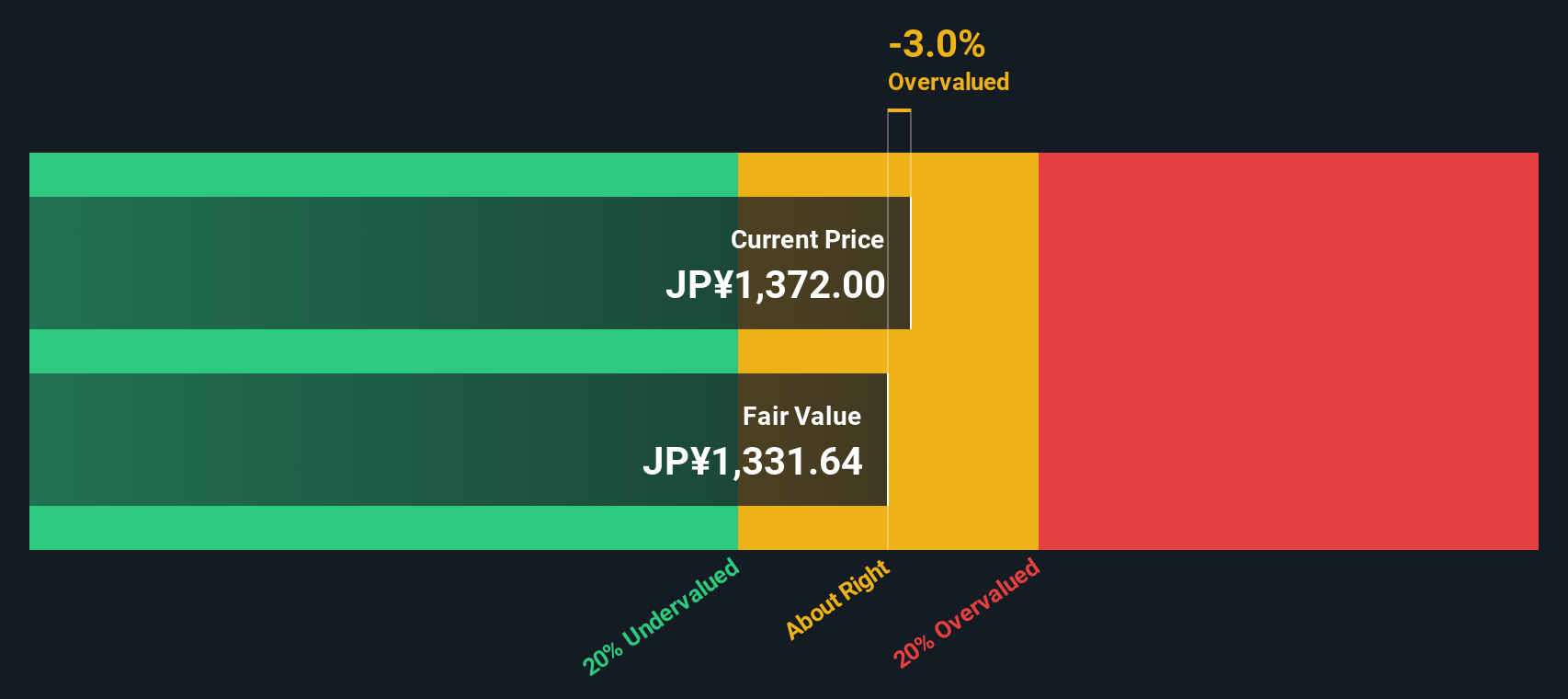

Result: Fair Value of ¥1,246 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks remain, including persistent price pressure from global competitors and slow revenue recovery if recent cost reductions do not deliver sustainable growth.

Find out about the key risks to this Teijin narrative.

Another View: Discounted Cash Flow Perspective

Taking a different approach, the SWS DCF model suggests Teijin might actually be trading below its estimated fair value of ¥1,433. While the current price and consensus targets signal restraint, this model presents a more optimistic scenario and highlights possible upside. Could the market be underestimating Teijin’s future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teijin Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Teijin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your investing horizon with handpicked stock insights that could set your portfolio apart. Don’t let standout opportunities pass you by. Tap into these trends now:

- Accelerate your strategy with reliable income by tapping into these 15 dividend stocks with yields > 3% offering yields greater than 3% for consistent returns.

- Tap into the healthcare revolution by pursuing breakthroughs among these 32 healthcare AI stocks, where innovation fuels both growth and resilience.

- Expand your exposure to futuristic technology by jumping on these 27 quantum computing stocks paving the way in advanced computing and next-gen solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teijin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3401

Teijin

Engages in the fibers, films and sheets, composites, healthcare, and IT businesses in Japan and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives