- Japan

- /

- Personal Products

- /

- TSE:4452

Cosmetics Recovery and Upbeat 2025 Guidance Might Change The Case For Investing In Kao (TSE:4452)

Reviewed by Sasha Jovanovic

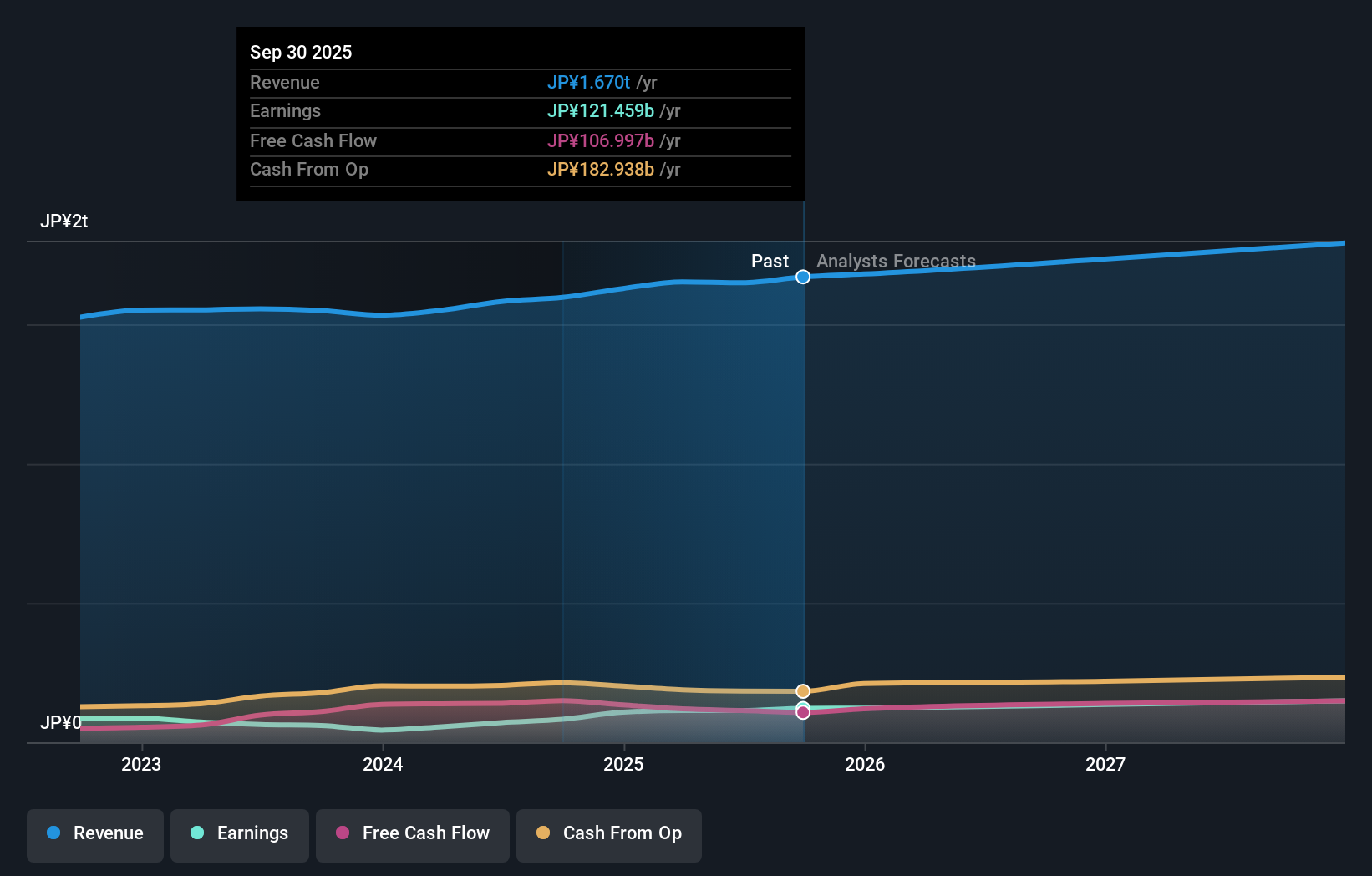

- Kao Corporation recently released consolidated earnings guidance for fiscal 2025, projecting net sales of ¥1.69 trillion, operating income of ¥165 billion, and net income attributable to owners of ¥121 billion, along with positive Q3 FY2025 results driven by improvements in the cosmetics sector and global expansion progress.

- This outlook reflects significant gains in profitability, particularly within cosmetics, supported by focused brand growth, cost reforms, and restructuring efforts in Asia, signaling confidence in meeting medium-term business goals.

- We'll examine how Kao's renewed confidence in its cosmetics segment's recovery, highlighted in recent guidance, shapes its evolving investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Kao Investment Narrative Recap

To believe in Kao as a shareholder right now, you would need confidence in the company's ability to drive profit recovery in its cosmetics segment and materially scale its global business, especially outside Japan’s mature market. The recent strong earnings guidance and improved Q3 results reinforce the short-term catalyst of a cosmetics turnaround, but do not materially change the biggest risk: overseas competition and slow international revenue growth remain a concern for future expansion.

One recent announcement that stands out is Kao’s completed share repurchase program in October 2025, amounting to 6,232,400 shares bought back for ¥41,728.12 million. This move is relevant because it reflects management’s approach to capital allocation and could influence short-term share price movement, yet it does not directly address the challenge of ramping up overseas sales that underpins the most important catalyst.

In contrast, while profitability in cosmetics has improved, investors should not overlook the ongoing risk of slow demand and intense competition in key international markets...

Read the full narrative on Kao (it's free!)

Kao's narrative projects ¥1,815.8 billion revenue and ¥149.9 billion earnings by 2028. This requires 3.3% yearly revenue growth and a ¥35.9 billion earnings increase from ¥114.0 billion today.

Uncover how Kao's forecasts yield a ¥7630 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate Kao’s fair value between ¥7,630 and ¥7,639, based on 2 analyses. While some see potential, the ongoing challenge for Kao lies in boosting international growth, suggesting the need to consider different viewpoints on future performance.

Explore 2 other fair value estimates on Kao - why the stock might be worth just ¥7630!

Build Your Own Kao Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kao research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kao research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kao's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4452

Kao

Develops and sells hygiene living care, health beauty care, life care, cosmetics, and chemical products.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives