- Japan

- /

- Healthcare Services

- /

- TSE:7476

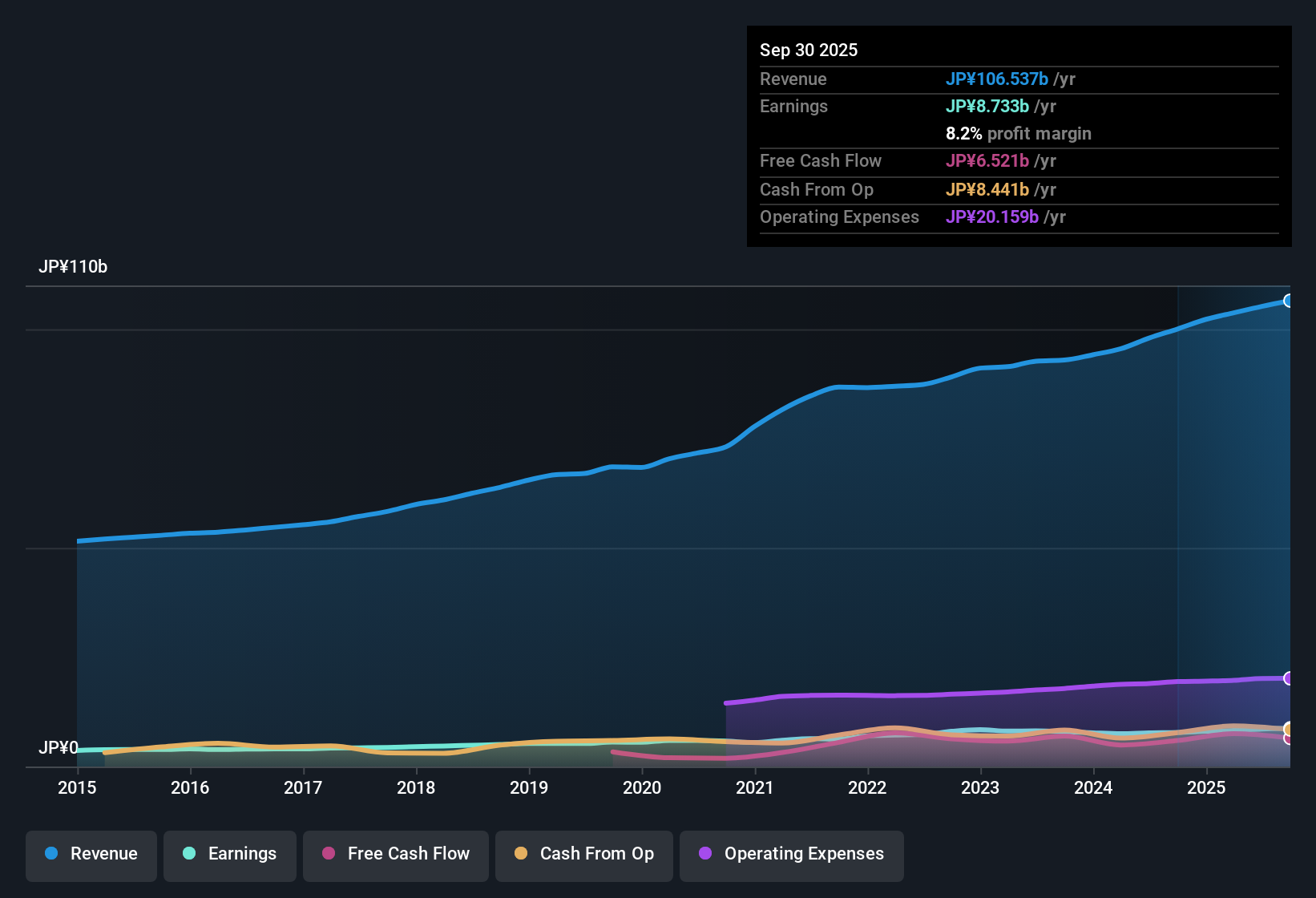

AS ONE (TSE:7476) Delivers 12.4% Earnings Growth, Reinforcing Bullish Market Narratives

Reviewed by Simply Wall St

AS ONE (TSE:7476) reported earnings growth of 12.4% over the past year, outpacing its five-year average growth rate of 7% annually. Net profit margins improved to 8.2% from 7.8% last year, while earnings quality remains high and both earnings and revenue are forecast to outpace the Japanese market, with projected annual gains of 7.8% and 5.6% respectively. Investors will see a balance between impressive growth rates, premium valuation multiples versus sector peers, and some value based on discounted cash flow, though ongoing attention to dividend sustainability is warranted.

See our full analysis for AS ONE.The next section puts these headline results side by side with the current market narratives. We will see which expectations the numbers reinforce and which they might surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Reach 8.2% on Strong Quality

- Net profit margins advanced to 8.2%, up from 7.8% the previous year. This distinguishes AS ONE from many competitors who have struggled to hold profitability in the current sector climate.

- With high earnings quality recognized in the latest filing, AS ONE’s margin improvements reinforce the view that reliable customers in core industries are helping drive steady profits.

- The expansion of margins aligns with the thesis that specialized suppliers like AS ONE can defend pricing even if input costs fluctuate.

- Market observers highlight that this margin trajectory is consistent with manufacturers benefiting from stable demand in healthcare and science.

Premium 20.7x P/E Signals Growth Expectations

- The price-to-earnings ratio of 20.7x stands notably above both peer group and wider Japanese healthcare averages of 13.9x. This highlights that investors pay up for growth visibility here.

- Bulls point to the above-market valuation multiple as evidence the business’s combination of sector resilience and consistent execution justifies optimism on future earnings.

- Being priced at a premium compared to similar companies shows investor confidence that forecast earnings growth of 7.8% annually is sustainable.

- High valuation could limit further upside unless AS ONE delivers fresh drivers or consistently outpaces market EPS trends.

Share Price Below DCF Fair Value Benchmark

- Although shares trade at ¥2518.50, discounted cash flow analysis suggests a fair value closer to ¥2765.50. This indicates potential upside if forecasts are achieved.

- Prevailing market perspectives emphasize the tension between the current premium valuation and calculated fundamental value. This raises the question of whether renewed revenue and earnings strength can unlock this latent value.

- DCF models reflect expectations for ongoing top-line growth outpacing the Japanese average in the coming years.

- Still, investors remain watchful of dividend sustainability, which could influence whether the gap to DCF fair value closes or persists.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AS ONE's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite solid top-line growth and strong margins, AS ONE’s high valuation and concerns about dividend sustainability may limit future upside for investors.

Put your money to work in companies trading at a more attractive price by using our these 831 undervalued stocks based on cash flows to uncover better value opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7476

AS ONE

Engages in the sale of research instruments and equipment, nursing and care products, and other scientific instruments in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives