- Japan

- /

- Healthcare Services

- /

- TSE:2784

A Look at Alfresa Holdings (TSE:2784) Valuation Following Upgraded H1 Profit Outlook and Cost Controls

Reviewed by Simply Wall St

Alfresa Holdings (TSE:2784) has updated its first half fiscal 2025 forecast, now expecting higher operating and ordinary profits. This outlook comes as a result of tighter cost controls, deferred expenses, and gains from investment securities sales.

See our latest analysis for Alfresa Holdings.

After a steady stretch earlier this year, Alfresa Holdings' recent gains have picked up steam, with a 4.01% 1-month share price return and a solid 4.68% total shareholder return over the past year. This momentum follows the company’s profit upgrade and signals renewed optimism as management tightens costs and takes advantage of additional earnings drivers.

If this uptick in momentum has you looking for new ideas beyond pharmaceuticals, it could be a perfect time to discover See the full list for free.

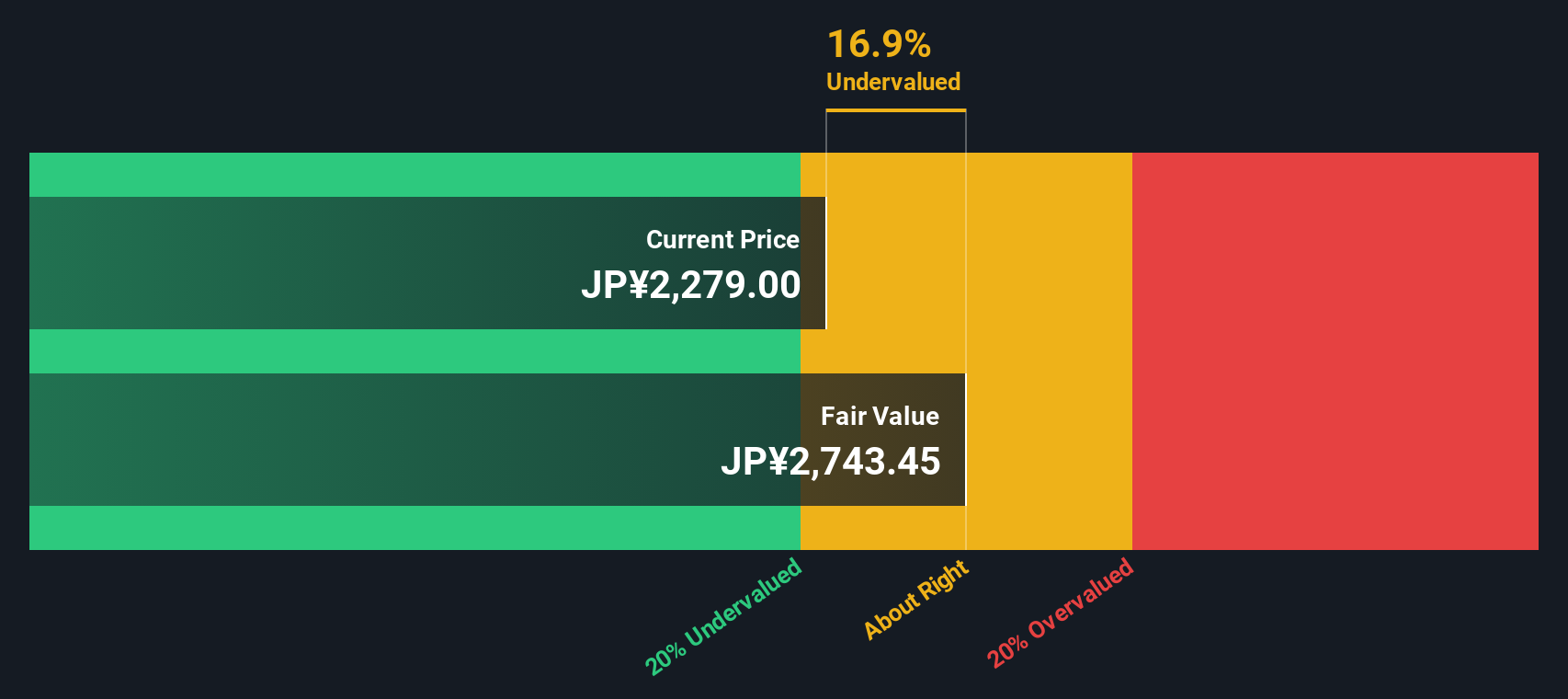

With profit upgrades and share price momentum building, is Alfresa Holdings now trading below its true value, or has the market already factored in the company’s improved outlook and future growth prospects?

Price-to-Earnings of 14.2x: Is it justified?

Alfresa Holdings currently trades at a price-to-earnings (P/E) ratio of 14.2x, slightly above its Healthcare industry peers and the broader peer group, yet just below the Japanese market average. At ¥2,176.5 per share, the stock does not screen as a clear value opportunity relative to domestic rivals.

The price-to-earnings ratio shows how much investors are paying for each yen of Alfresa Holdings’ earnings. For healthcare distributors and operators, this metric can reflect both current profitability and expectations for earnings momentum going forward.

The market is assigning a higher price to Alfresa’s earnings compared to similar companies in the industry (13.9x) and to its typical peer (13.5x). While the P/E ratio is below the broader Japanese market (14.4x), it remains above what statistical models suggest as the “fair” trading level (19.6x). This may indicate some room to move if the company sustains its improved outlook.

Explore the SWS fair ratio for Alfresa Holdings

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, slower revenue growth or a reversal in net income trends could challenge the current valuation and share price momentum of Alfresa Holdings.

Find out about the key risks to this Alfresa Holdings narrative.

Another View: Discounted Cash Flow Perspective

Taking a step back from traditional valuation metrics, our DCF model estimates Alfresa Holdings' fair value at ¥1,737.14. This is well below the current price of ¥2,176.5, which suggests the shares may actually be overvalued despite the profit upgrades and industry comparisons. Can the upbeat outlook and cost controls justify paying a premium, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alfresa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alfresa Holdings Narrative

Feeling skeptical, or eager to dive deeper into the data on your own terms? You can explore and build your own conclusions in just minutes: Do it your way

A great starting point for your Alfresa Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don’t limit your portfolio to a single opportunity. You could be capturing untapped value. Make your next move intelligently with these powerful tools:

- Supercharge your potential returns by targeting market-beating yielders with these 20 dividend stocks with yields > 3% offering consistently high payouts and stable fundamentals.

- Spot tomorrow’s groundbreaking businesses early and seize an edge with these 27 AI penny stocks fueling progress in artificial intelligence across multiple industries.

- Capitalize on mispriced opportunities by acting on these 841 undervalued stocks based on cash flows uniquely positioned for growth, but still trading below fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2784

Alfresa Holdings

Through its subsidiaries, engages in the manufacture, wholesale, marketing, and import/export of pharmaceuticals, diagnostic reagents, and medical devices/equipment in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives