Toyo Suisan Kaisha (TSE:2875) Valuation in Focus After FY2026 Results and Optimistic Sales Forecast

Reviewed by Simply Wall St

Toyo Suisan Kaisha (TSE:2875) has released its first-half FY2026 financial results, reporting a 1% rise in net sales while operating and ordinary profits edged down. The company is projecting a 4% uptick in sales for the full year, a move that is catching investors’ attention.

See our latest analysis for Toyo Suisan Kaisha.

Toyo Suisan Kaisha’s stock has been building some impressive momentum, with a recent 8.95% 1-day share price return and a total shareholder return of nearly 30% over the past year. The combination of upbeat earnings guidance and robust multi-year returns signals that investors are increasingly optimistic about the company’s growth trajectory, even as profit margins narrow.

If you’re curious about where else momentum might be building, now is a great time to discover fast growing stocks with high insider ownership.

With Toyo Suisan Kaisha’s share price riding high, the real question is whether current valuations still offer upside for new investors, or if the market has already factored in all the anticipated growth. Could there still be a buying opportunity?

Price-to-Earnings of 18.3x: Is it justified?

Toyo Suisan Kaisha’s shares are trading at a price-to-earnings (P/E) ratio of 18.3x based on the latest closing price. This figure is higher than both industry peers and the broader market average. The premium suggests the market values the company’s current and future earnings potential, possibly in anticipation of continued growth or stability.

The price-to-earnings ratio is a common valuation tool that measures how much investors are willing to pay for each yen of the company’s earnings. For food sector companies, this metric often reflects growth expectations and perceived business quality, making it especially relevant for comparing similar firms.

Toyo Suisan Kaisha’s P/E of 18.3x stands above the Japanese Food industry average of 16.2x and the peer group average of 17x. Although the company is also trading below our estimate of its fair value using alternative methods, the current ratio signals that the market is willing to pay more for its earnings than for those of its rivals. Regression analysis suggests a fair P/E multiple for the company could be as high as 21.5x, indicating there may still be room for the market to move toward this level if outlooks improve.

Explore the SWS fair ratio for Toyo Suisan Kaisha

Result: Price-to-Earnings of 18.3x (OVERVALUED)

However, slowing profit growth and a current share price premium could mean that investor optimism is vulnerable if future earnings or margins disappoint.

Find out about the key risks to this Toyo Suisan Kaisha narrative.

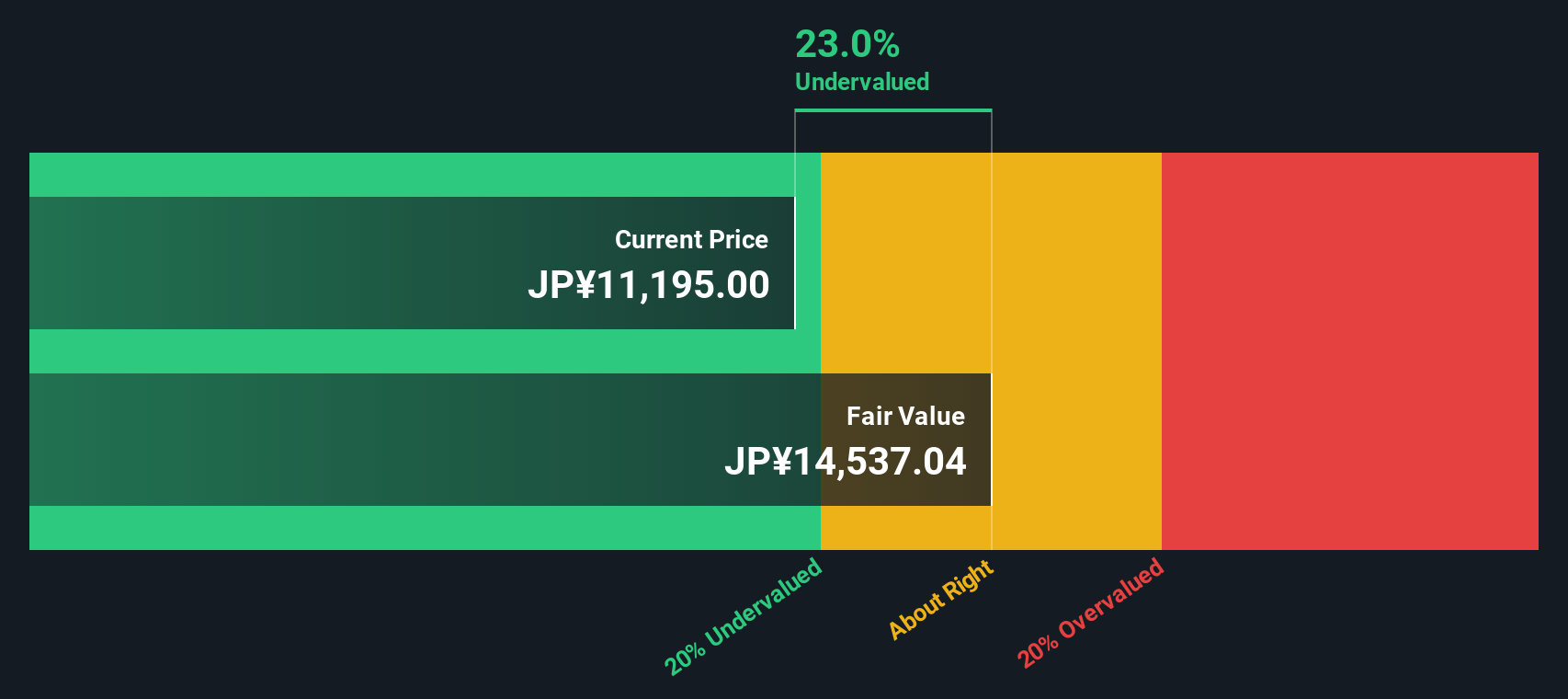

Another View: SWS DCF Model Suggests Undervaluation

While Toyo Suisan Kaisha’s shares appear expensive compared to peers on a price-to-earnings basis, our SWS DCF model offers a different perspective. The shares are trading around 23% below the calculated fair value, which suggests the market may be undervaluing the company’s long-term cash flows. Does this indicate overlooked upside, or are there hidden risks causing the gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyo Suisan Kaisha for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyo Suisan Kaisha Narrative

If you have your own perspective or want to dig deeper into the figures, you can craft a narrative tailored to your view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Toyo Suisan Kaisha.

Looking for more investment ideas?

Smart investors always keep their options open. Take the next step and tap into the hottest opportunities before others beat you to the punch.

- Spot companies with high recurring income and strong yields by checking out these 22 dividend stocks with yields > 3% to find the stocks rewarding shareholders right now.

- Ride the wave of technological disruption and capitalize on sector shifts with these 26 AI penny stocks that are reshaping entire industries.

- Gain an edge by uncovering real value with these 832 undervalued stocks based on cash flows and power sustained growth through attractive fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Suisan Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2875

Toyo Suisan Kaisha

Produces and sells food products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives