A Look at NH Foods (TSE:2282) Valuation Following Strategic CPF Joint Venture Expansion

Reviewed by Simply Wall St

NH Foods (TSE:2282) shares surged after the company announced a joint venture with Charoen Pokphand Foods to produce and distribute processed pork products across Thailand and other Asian markets, including Japan and Singapore.

See our latest analysis for NH Foods.

The joint venture announcement comes on the back of accelerating momentum for NH Foods, as the stock notched a five-year high after climbing over 13% in a single session. This is an impressive move, especially given the broader Nikkei 225 lost ground the same day. That rally capped a positive trend, with a year-to-date share price return of 32.39% and a 1-year total shareholder return of 38.58%, highlighting both near-term excitement and solid long-term value creation.

Curious what other fast movers or hidden gems are out there? Now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

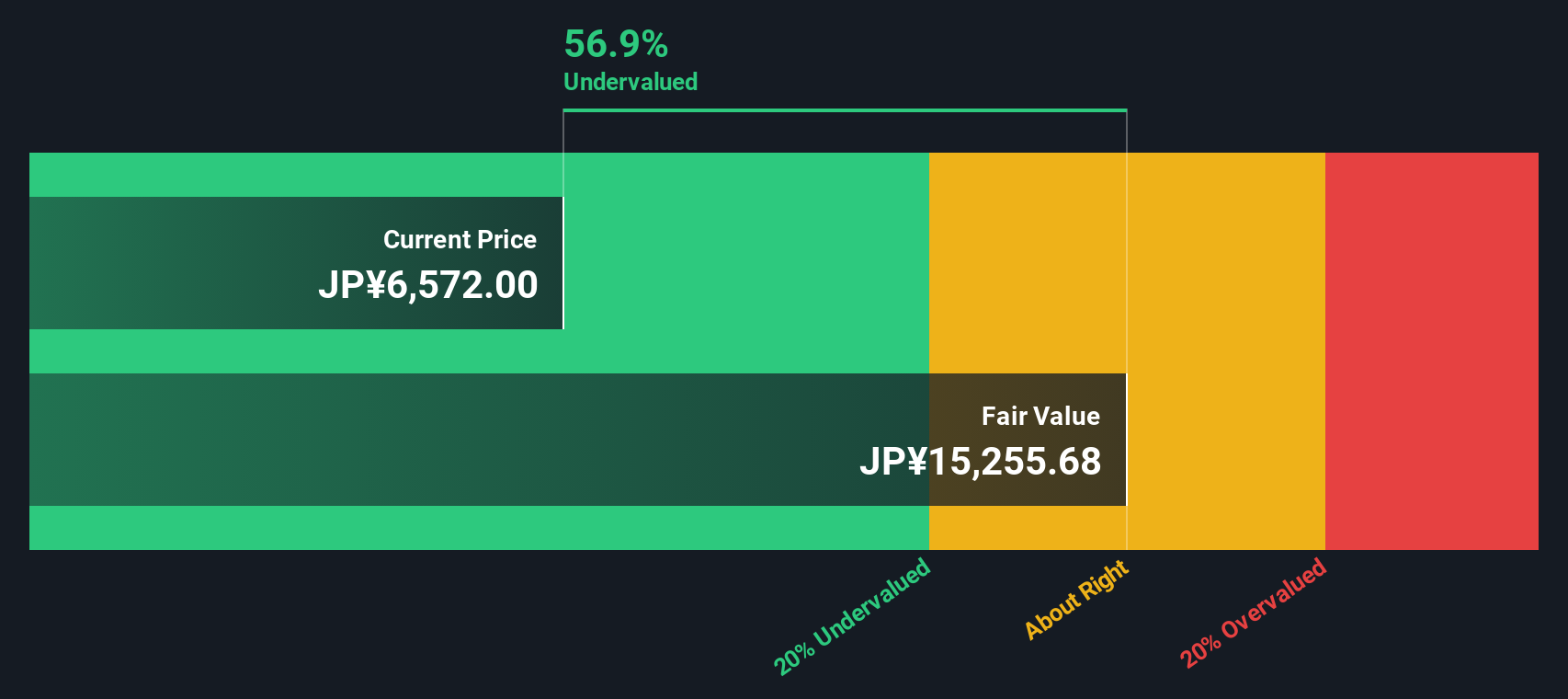

With momentum running high and a major new partnership in play, the key question now is whether NH Foods remains undervalued, offering further upside, or if the recent rally means future growth is already factored into the stock price.

Price-to-Earnings of 20x: Is it justified?

NH Foods is currently trading at a price-to-earnings (P/E) ratio of 20x, putting it above both the Japanese food industry average of 16.1x and the peer average of 19.4x. This means investors are paying a premium for each yen of earnings compared to similar companies.

The P/E ratio measures how much investors are willing to pay for a company's earnings, reflecting expectations for future growth and profitability. For a food producer, a higher multiple often signals the market is anticipating continued strong performance or a competitive advantage in the sector.

In NH Foods' case, the premium could be justified by its significant earnings growth over the past year, far outpacing both its own historical trend and industry averages. However, the company's current multiple also suggests that the market may be pricing in ambitious expectations for ongoing profit expansion. Based on the estimated fair price-to-earnings ratio of 20.6x, the current level is close to where the market could recalibrate if future results justify such optimism.

Explore the SWS fair ratio for NH Foods

Result: Price-to-Earnings of 20x (ABOUT RIGHT)

However, slower revenue growth and a slight discount to analyst price targets suggest recent gains may not be sustainable if profit expansion stalls.

Find out about the key risks to this NH Foods narrative.

Another View: Discounted Cash Flow Shows a Different Story

Looking at NH Foods through the lens of our DCF model paints a much more optimistic picture. The shares are trading at a steep discount, over 56% below our estimate of fair value, implying the market could be overlooking significant upside. Can this deep discount hold as fundamentals evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NH Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NH Foods Narrative

If you feel the analysis above does not fully capture what you are seeing, take a few minutes to explore the numbers yourself and shape your own perspective, all in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding NH Foods.

Looking for more investment ideas?

Smart investing means staying ahead of the curve. Don’t miss out on exciting companies. Take control of your portfolio by uncovering opportunities across breakthrough sectors and unique strategies.

- Capitalize on strong income by uncovering companies offering reliable yields with these 16 dividend stocks with yields > 3%, adding steady cash flow to your investment mix.

- Make your money work harder and get ahead of the crowd with these 870 undervalued stocks based on cash flows. Here you’ll find quality stocks trading below their true worth.

- Tap into the power of artificial intelligence by checking out these 24 AI penny stocks and see which innovative businesses are driving tomorrow’s tech landscape today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NH Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2282

NH Foods

Engages in manufacturing and selling ham, sausage, processed food, meat, and dairy product in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives