Evaluating Morinaga After Recent Stock Slide and Industry Shifts in 2025

Reviewed by Bailey Pemberton

Trying to figure out whether Morinaga&Co is a good buy right now? You are definitely not alone. With so many moving parts in today's markets, it's easy to get caught up in short-term dips and surges. Morinaga&Co’s stock has slid by 3.8% in the last week and is down 4.9% over the past month. Year to date, shares are off 5.2%, adding up to a 7.3% dip over the last twelve months. However, if you take a step back, there is an interesting twist: over the last 3 and 5 years, the stock posted cumulative gains of 41.5% and 38.2%, respectively. That mix of recent weakness and longer-term strength is making some investors take a closer look.

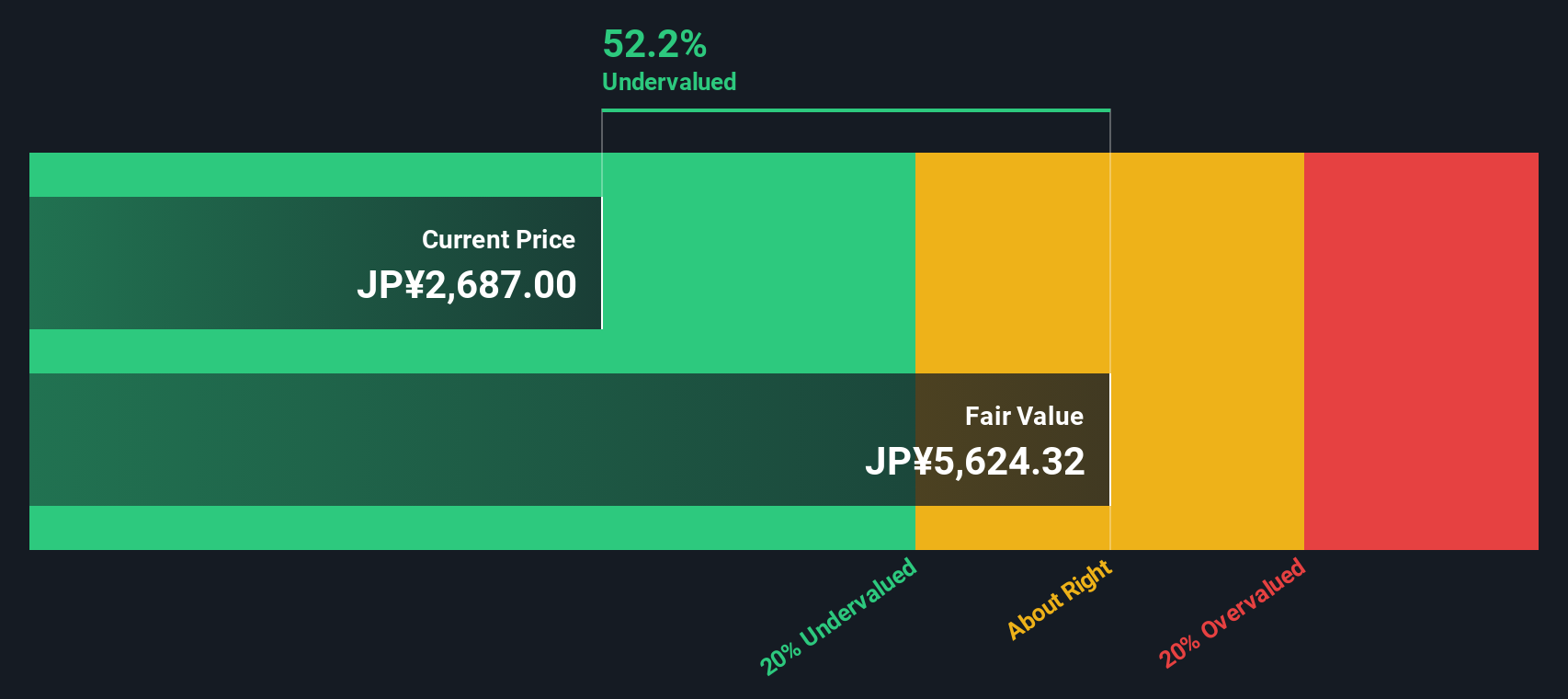

Some of this shift in price appears to mirror broader market developments, especially changing attitudes toward household goods companies, rather than any fundamental issues with Morinaga&Co itself. This creates an opportunity to focus directly on what matters most: valuation. Our analysis gives Morinaga&Co a valuation score of 5 out of 6, indicating the company appears undervalued by almost every metric we reviewed.

In the next section, I will break down each of the main valuation methods and show you where Morinaga&Co stands on each count. If you are looking for a smarter way to cut through the noise, be sure to stick around for a powerful perspective at the end of the article.

Why Morinaga&Co is lagging behind its peers

Approach 1: Morinaga&Co Discounted Cash Flow (DCF) Analysis

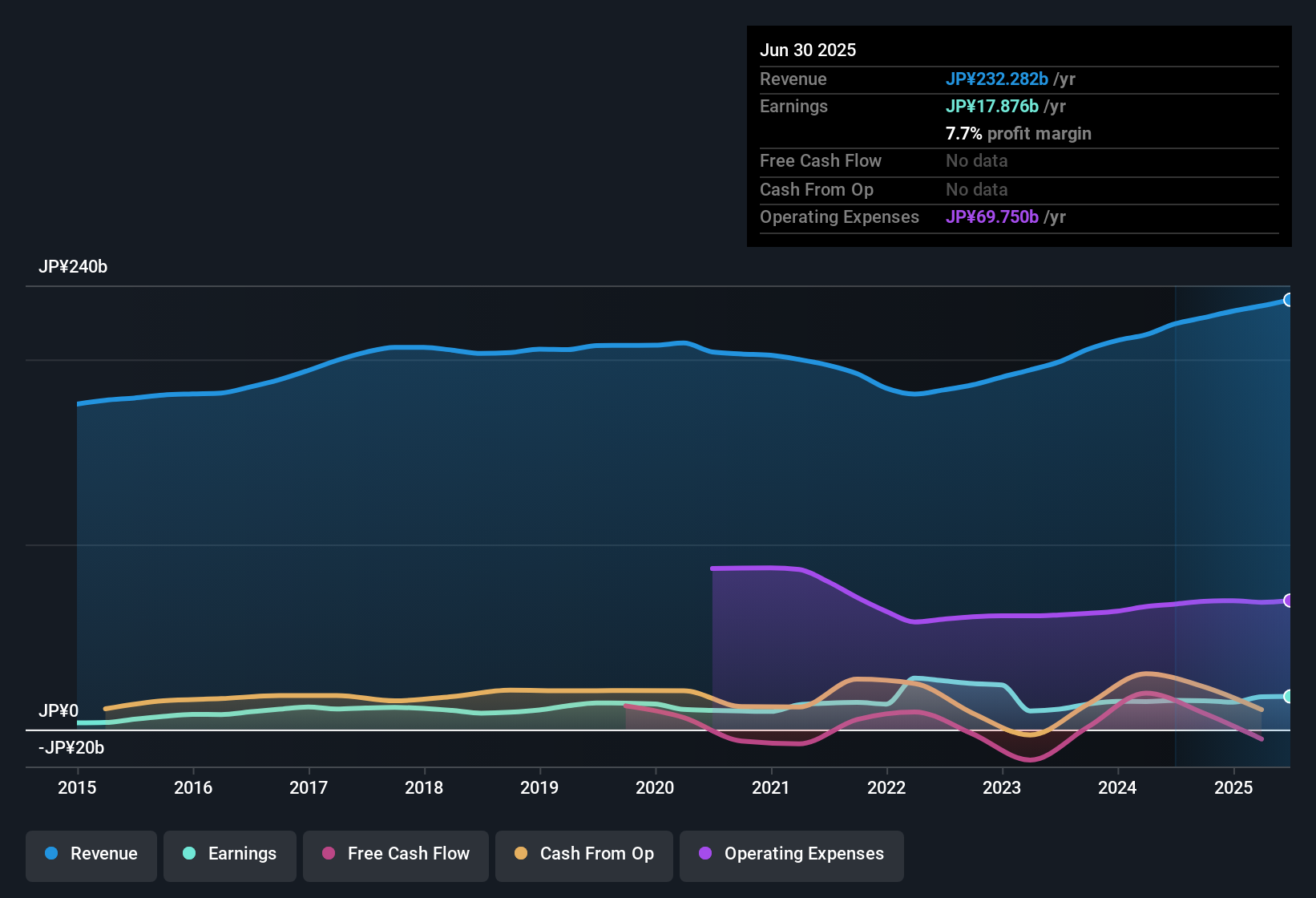

The Discounted Cash Flow (DCF) model estimates the true value of a company by predicting its future cash flows and then reducing those future values back to today using a discount rate. For Morinaga&Co, this approach starts with the company's latest reported Free Cash Flow (FCF), which stands at a negative ¥3.3 billion. Despite that rough starting point, analyst projections see a rebound, with FCF expected to reach ¥19.8 billion by the year ending March 2029. After that, projections for the next decade are extrapolated, reflecting steady, if modest, growth in cash generation for the business.

All cash flow forecasts are based on the 2 Stage Free Cash Flow to Equity model. This means both the near-term analyst estimates and longer-term extrapolations are factored in. Once discounted back to present value, this analysis results in an intrinsic fair value estimate of ¥6,658 per share. This is a significant 61.3% above the current market price, indicating the stock trades well below its calculated true worth and appears deeply undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Morinaga&Co is undervalued by 61.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Morinaga&Co Price vs Earnings (PE Ratio)

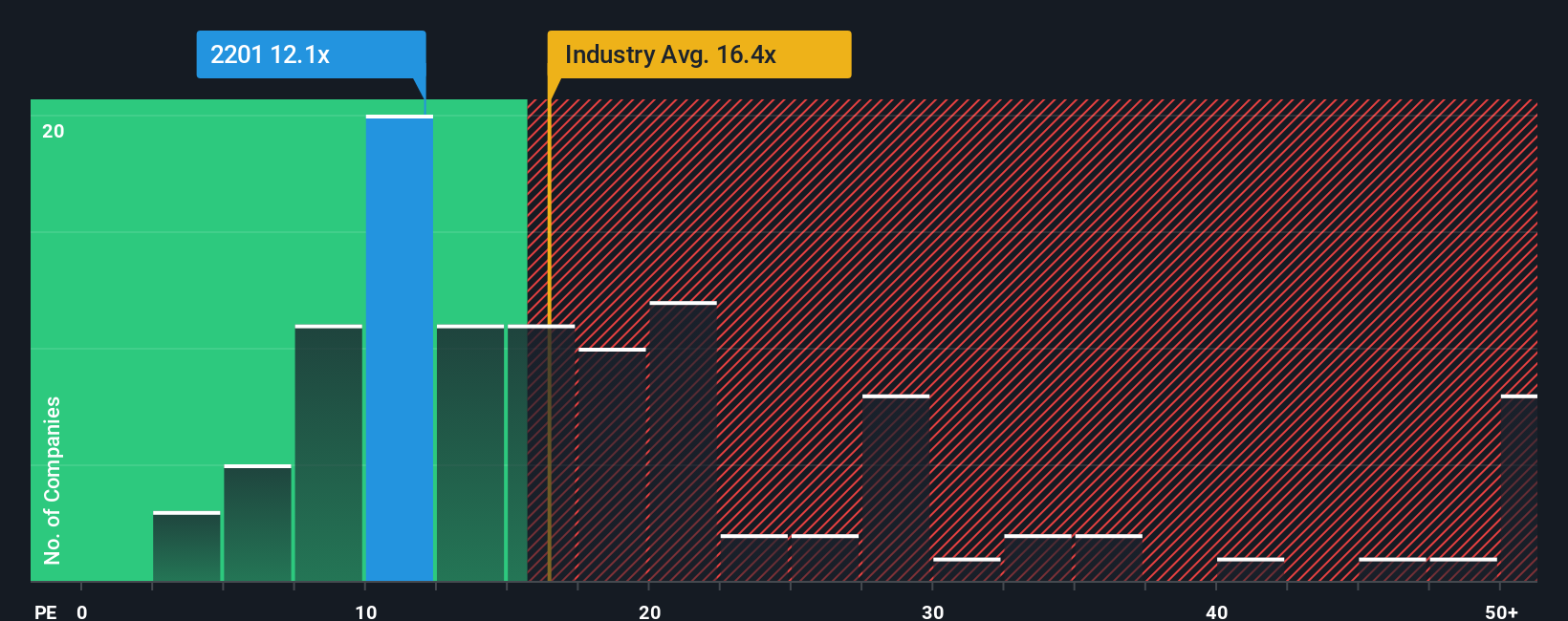

For profitable companies like Morinaga&Co, the Price-to-Earnings (PE) ratio is often seen as the go-to measure of value because it directly relates a company’s market value to its bottom-line profits. Generally, higher-growth and lower-risk firms tend to justify higher PE ratios, while slower-growing or riskier businesses warrant a lower multiple.

Currently, Morinaga&Co trades at a PE ratio of 12.1x. This is notably below both the average PE ratio of its industry peers (16.4x) and the broader Food sector average of 16.4x as well. While these benchmarks provide context, they do not always tell the full story about what a fair valuation should be for Morinaga&Co specifically.

To address this, Simply Wall St calculates a “Fair Ratio” that factors in the company’s earnings growth, profit margins, risks, industry conditions, and market cap. This proprietary metric aims to deliver a tailored benchmark rather than a one-size-fits-all figure. For Morinaga&Co, the Fair Ratio is 16.0x, reflecting all of these variables in a nuanced way. With its current PE at 12.1x, well below both the Fair Ratio and industry averages, Morinaga&Co appears attractively valued based on its earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Morinaga&Co Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story. It connects what you believe about a company, like your forecasts for future revenue, earnings, and margins, to a specific fair value estimate. Narratives make the investment process more dynamic and meaningful by allowing you to combine your own insights with hard numbers, bridging the gap between a company’s financials and the bigger picture of where it is heading.

With Narratives, you can easily create, follow, and share your views directly on Simply Wall St’s platform, right within the Community page used by millions of investors. They help you decide when to buy or sell by continuously comparing your fair value estimate to the current market price, so you always know whether your thesis still stands. Narratives also update automatically whenever new information, such as earnings or breaking news, comes in, keeping your analysis relevant without extra effort.

For example, some investors might set a high fair value for Morinaga&Co based on optimism for sustained growth, while others see a much lower value due to concerns about profit margins and market trends.

Do you think there's more to the story for Morinaga&Co? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2201

Morinaga&Co

Manufactures, purchases, and sells confectionaries, food, frozen desserts, and health products in Japan and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives