- Japan

- /

- Infrastructure

- /

- TSE:9301

Guangzhou Restaurant Group And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and consumer spending concerns, investors are seeking stability amid the volatility. With major indices experiencing fluctuations, reliable dividend stocks like Guangzhou Restaurant Group offer a potential haven by providing consistent income streams that can help buffer against market uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2012 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Guangzhou Restaurant Group (SHSE:603043)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangzhou Restaurant Group Company Limited operates in food manufacturing and catering both in China and internationally, with a market cap of CN¥8.54 billion.

Operations: Guangzhou Restaurant Group Company Limited generates revenue through its food manufacturing and catering operations within China and internationally.

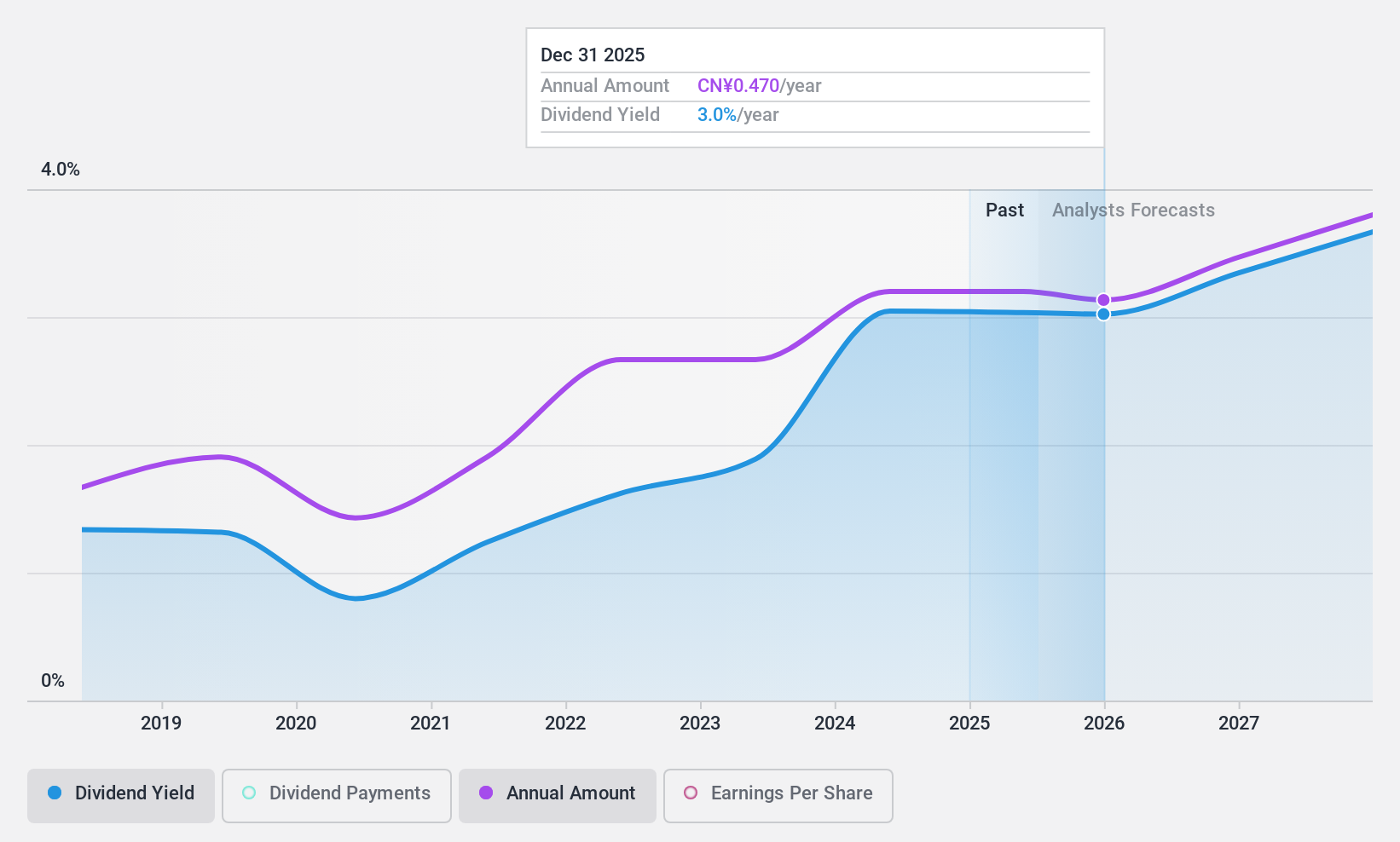

Dividend Yield: 3.2%

Guangzhou Restaurant Group's dividend yield of 3.2% ranks in the top 25% among Chinese dividend payers, supported by a payout ratio of 53.9% and a cash payout ratio of 45.4%, indicating dividends are covered by earnings and cash flows. However, its dividend history is unstable with volatility over seven years, despite trading at a favorable price-to-earnings ratio of 16.8x compared to the market average of 38.1x.

- Click here to discover the nuances of Guangzhou Restaurant Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility Guangzhou Restaurant Group's shares may be trading at a discount.

Mitsui DM Sugar Holdings (TSE:2109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsui DM Sugar Holdings Co., Ltd. operates in Japan, focusing on the manufacturing and sale of sugar and food materials, with a market cap of ¥112.17 billion.

Operations: Mitsui DM Sugar Holdings Co., Ltd. generates revenue from its Sugar segment at ¥150.75 billion, Life Energy Business at ¥25.66 billion, and Real Estate Business at ¥3.26 billion.

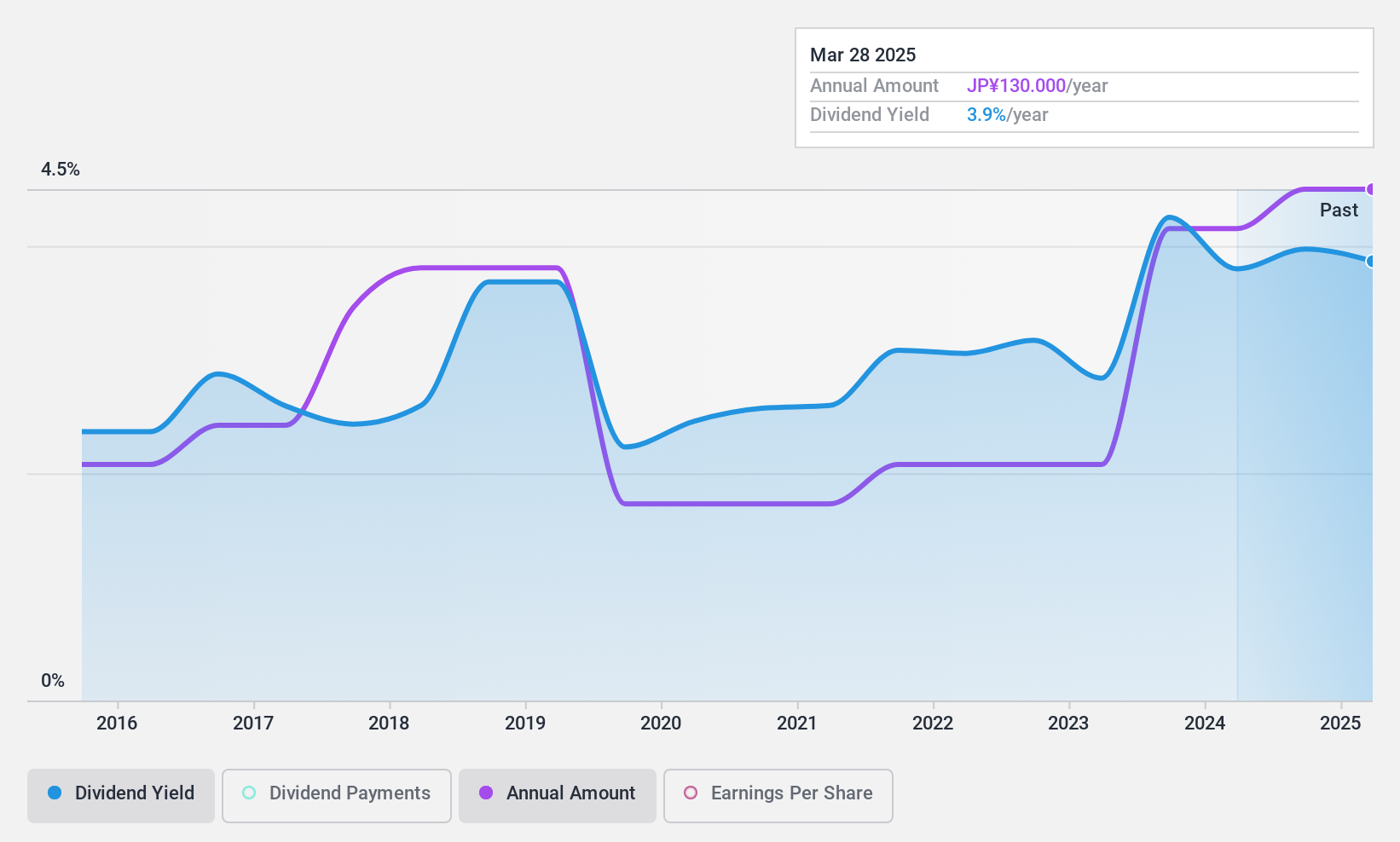

Dividend Yield: 3.7%

Mitsui DM Sugar Holdings' dividend yield of 3.74% is slightly below the top 25% of Japanese dividend payers. Despite a low cash payout ratio of 29.7%, indicating dividends are well covered by cash flows, its dividend history is unreliable with volatility over the past decade. The company expects ¥180 billion in net sales and ¥9 billion in profit for the fiscal year ending March 2025, potentially impacting future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsui DM Sugar Holdings.

- Our expertly prepared valuation report Mitsui DM Sugar Holdings implies its share price may be lower than expected.

Mitsubishi Logistics (TSE:9301)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Logistics Corporation offers logistic services both in Japan and internationally, with a market cap of ¥3.59 billion.

Operations: Mitsubishi Logistics Corporation's revenue segments include logistic services provided both domestically and internationally.

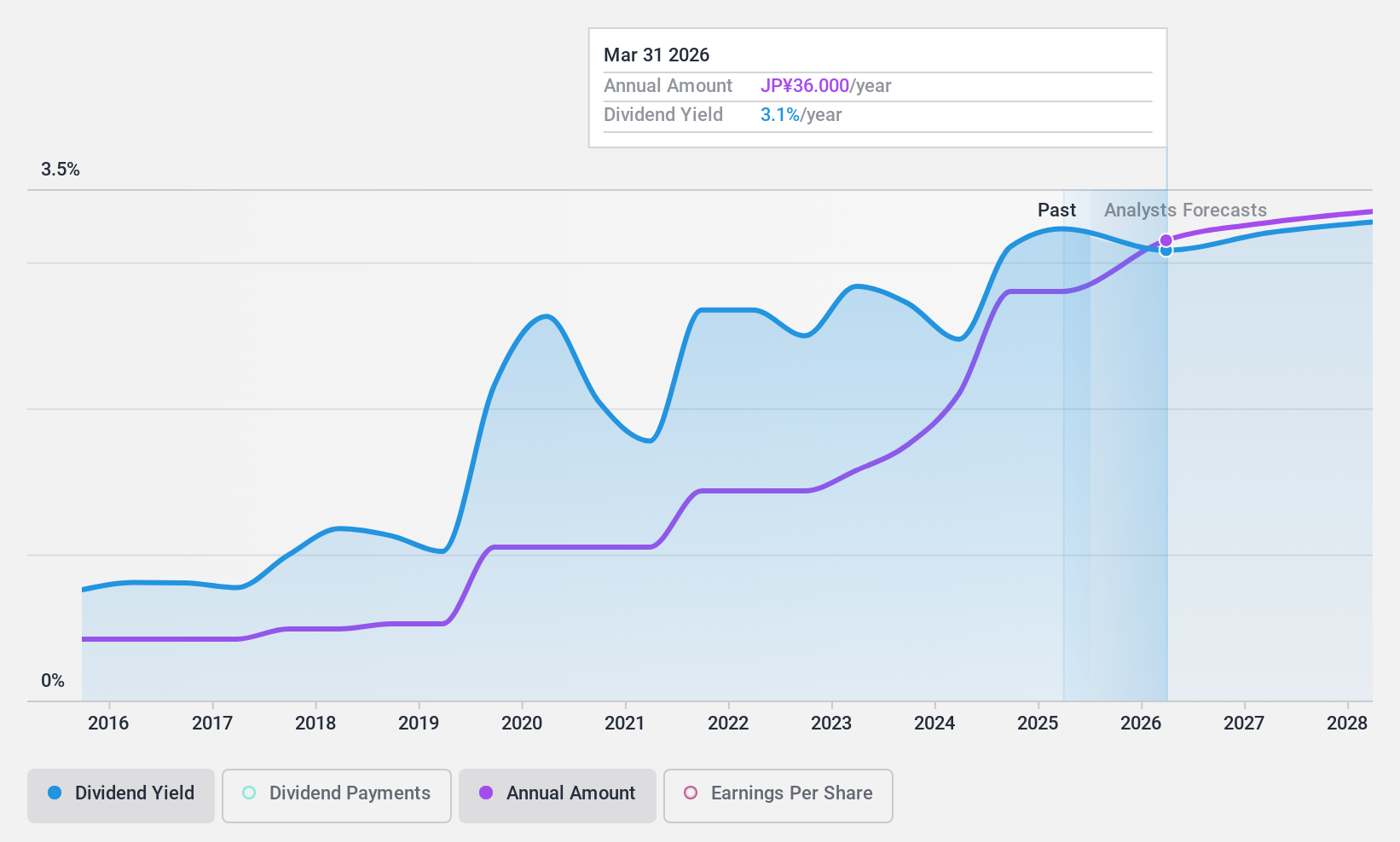

Dividend Yield: 3.1%

Mitsubishi Logistics offers a reliable dividend history with stable growth over the past decade, supported by a low payout ratio of 20.6% and a cash payout ratio of 52.3%, ensuring dividends are well covered by earnings and cash flows. Although its 3.09% yield is below the top tier in Japan, recent share buybacks totaling ¥316.31 million may enhance shareholder value despite forecasts of declining earnings impacting future growth prospects.

- Take a closer look at Mitsubishi Logistics' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Mitsubishi Logistics is priced higher than what may be justified by its financials.

Summing It All Up

- Investigate our full lineup of 2012 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9301

Mitsubishi Logistics

Provides logistic services in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives