Nisshin Seifun Group (TSE:2002) Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

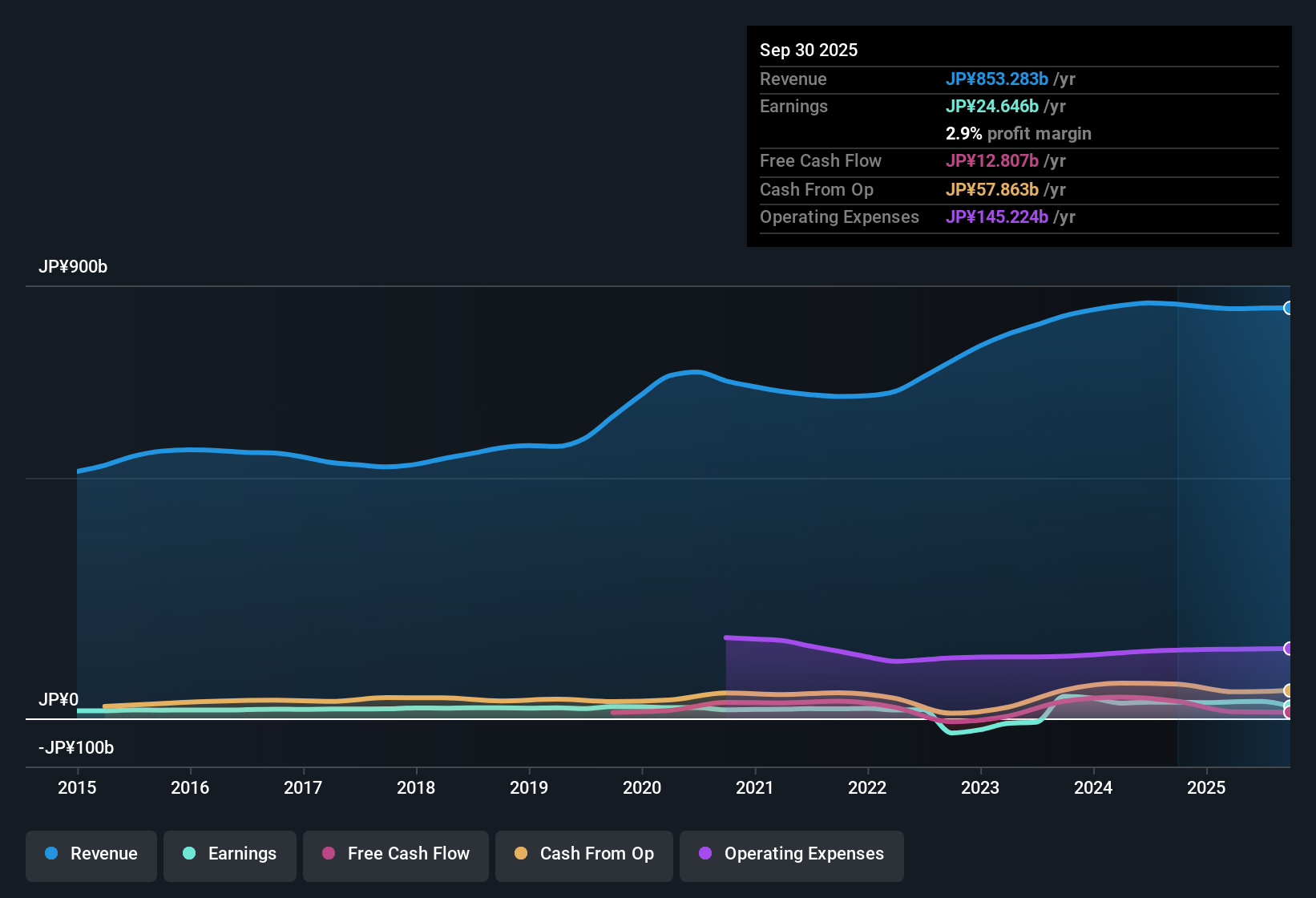

Nisshin Seifun Group (TSE:2002) reported a net profit margin of 2.9%, down from 3.9% a year ago. While there was a recent dip in earnings growth, the company’s five-year average earnings growth still stands at 17.7% per year and is now expected to climb at 9.9% annually going forward, comfortably ahead of the Japanese market’s projected 7.9%. Despite lagging revenue growth forecasts, investors may look past the dip in profit margins, focusing on the company’s solid historical earnings expansion and growth outlook.

See our full analysis for Nisshin Seifun Group.Next, we’ll see how these headline numbers compare with the dominant narratives around Nisshin Seifun Group, and where this quarter’s results might confirm or challenge market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Under Pressure

- Net profit margin sits at 2.9%, down from last year's 3.9%. This highlights a squeeze on profitability despite a strong long-term average earnings growth of 17.7% per year.

- Margin compression stands out as a concern since bulls see past earnings quality as a bedrock for future growth, but the current figure grounds optimism:

- Margin pressure could test how well Nisshin Seifun Group can defend its earnings trajectory, especially as revenue growth of 1.6% per year is expected to lag the market average of 4.5%.

- Even with robust historic growth, headline margins matter given steady cost increases. Lower margin safety may limit flexibility for navigating future headwinds.

DCF Fair Value Sits Above Market

- Nisshin Seifun Group’s share price of 1,741.50 trades at a discount to the DCF fair value of 1,930.82, and is also below the analyst target price of 2,125.00.

- A significant gap between current price and fair value strongly supports the outlook of upside potential, but this discount must be weighed against the slower projected sales growth:

- Share price appears attractive versus both DCF and analyst targets, introducing a margin of safety for value-focused investors.

- However, since price-to-earnings multiples remain higher than peer and sector averages, the stock may be exposed if growth fails to outpace those expectations.

Dividend Durability Faces Minor Risk

- The sustainability of the dividend is noted as a minor risk in the latest filing, but there are no major flagged risks affecting core earnings or financial health.

- While investors often depend on stable payouts in staple sectors, the combination of moderating profit margins and slowing sales raises questions about long-term payout sustainability:

- Still, the absence of significant risk warnings supports the case for ongoing resilience, especially given the company's record of high-quality earnings.

- With no immediate red flags, watchful investors may focus on whether margins can recover enough to support both growth and shareholder returns.

- The latest numbers highlight tension between reliable income and profit pressures. Discover what the community thinks about Nisshin Seifun Group’s long-term story. See what the community is saying about Nisshin Seifun Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nisshin Seifun Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Nisshin Seifun Group’s slipping profit margins and muted sales growth cast doubt on its ability to sustain consistent income and long-term shareholder rewards.

If you’re looking for steadier performance, use our stable growth stocks screener (2103 results) to find companies delivering reliable growth regardless of market ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nisshin Seifun Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2002

Nisshin Seifun Group

Through its subsidiaries, engages in the flour milling, processed foods, prepared dishes and other prepared foods, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives