- Japan

- /

- Oil and Gas

- /

- TSE:5020

Shareholders Should Be Pleased With ENEOS Holdings, Inc.'s (TSE:5020) Price

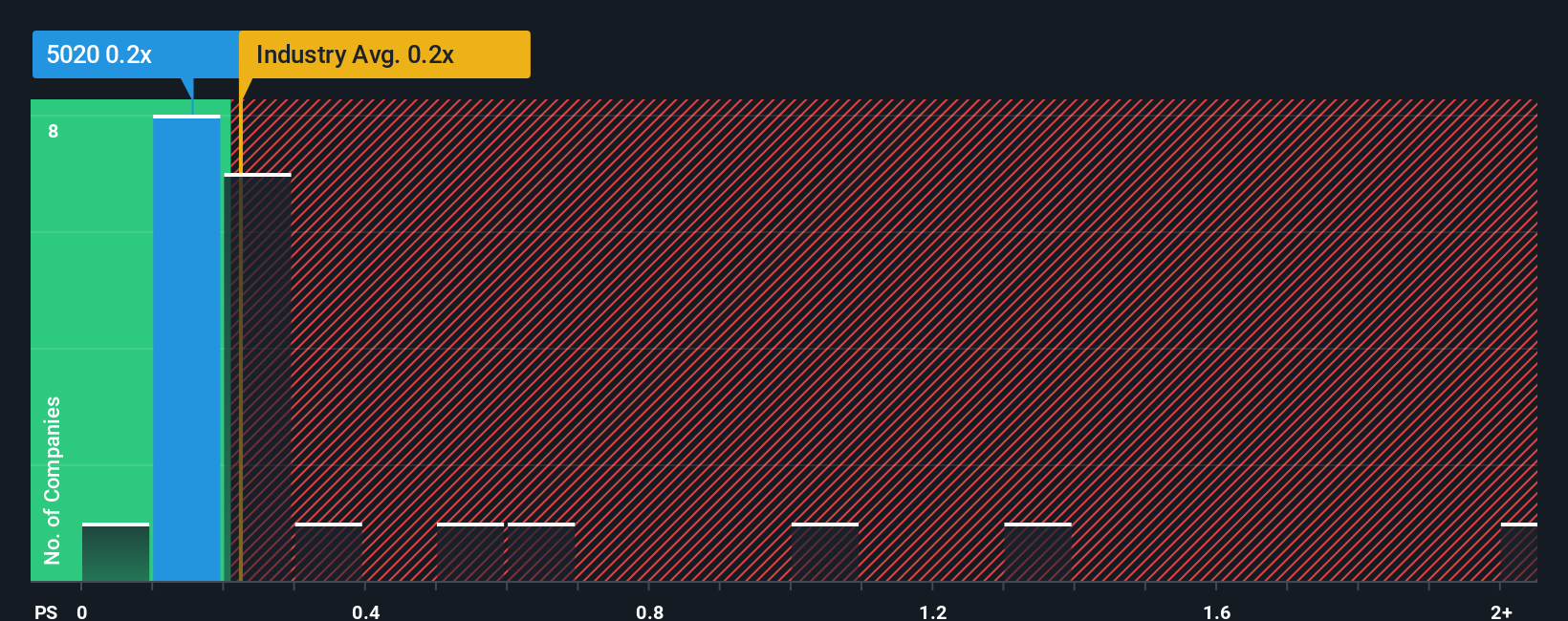

With a median price-to-sales (or "P/S") ratio of close to 0.2x in the Oil and Gas industry in Japan, you could be forgiven for feeling indifferent about ENEOS Holdings, Inc.'s (TSE:5020) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ENEOS Holdings

What Does ENEOS Holdings' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, ENEOS Holdings has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ENEOS Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like ENEOS Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company are not great, suggesting revenue should decline by 3.2% per annum over the next three years. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 4.6% per year.

In light of this, it's understandable that ENEOS Holdings' P/S sits in line with the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On ENEOS Holdings' P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, we see that ENEOS Holdings maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to justify a high or low P/S ratio. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. It seems that unless there's a drastic change, it's hard to imagine that the share price will deviate much from current levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for ENEOS Holdings you should know about.

If you're unsure about the strength of ENEOS Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if ENEOS Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5020

ENEOS Holdings

Through its subsidiaries, operates in the energy, oil and natural gas exploration and production, and metals businesses in Japan, China, Asia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives