- Japan

- /

- Capital Markets

- /

- TSE:8624

Ichiyoshi Securities (TSE:8624) Margin Miss Reinforces Bearish Narrative on Profit Outlook

Reviewed by Simply Wall St

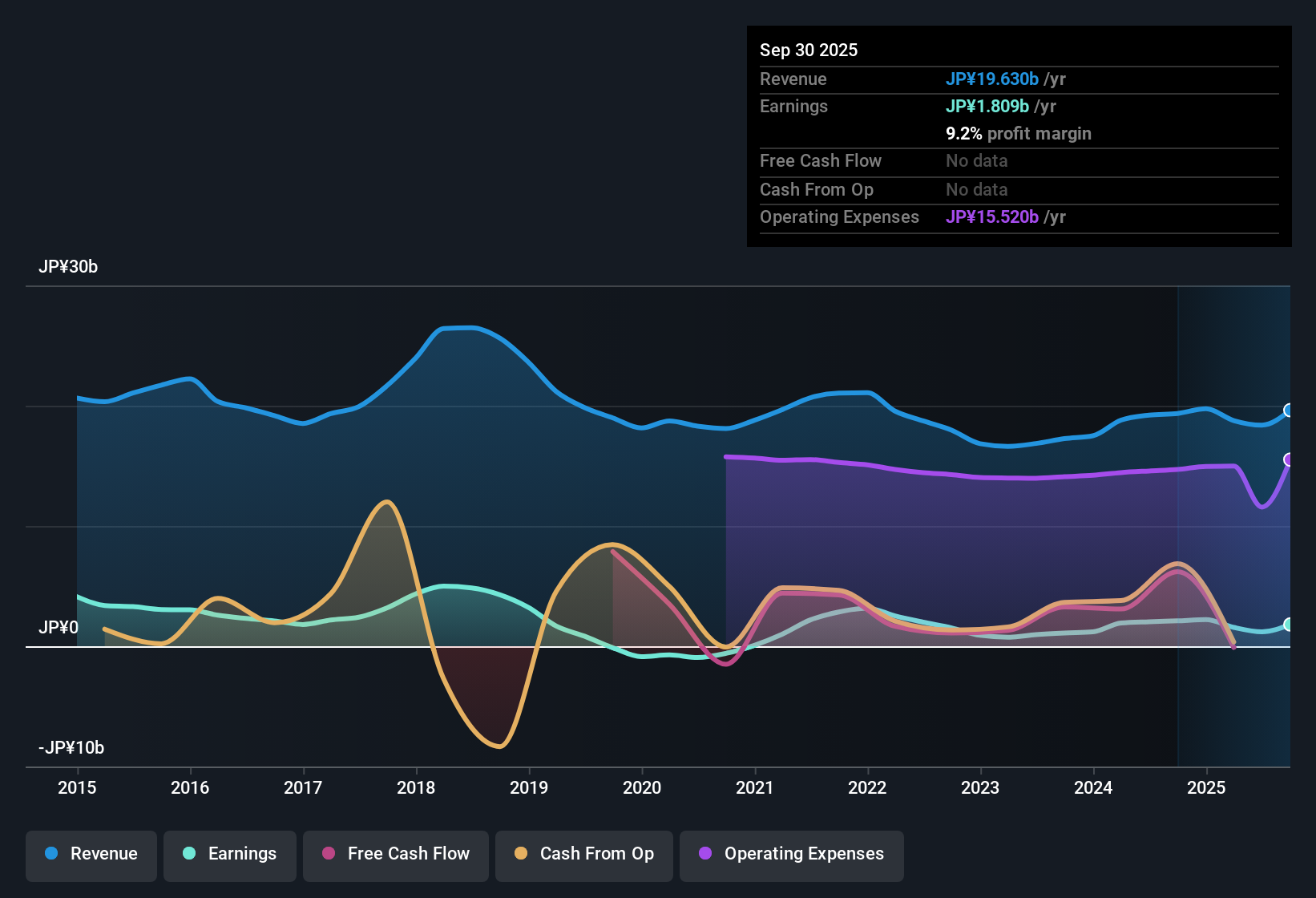

Ichiyoshi Securities (TSE:8624) reported a net profit margin of 9.2%, down from last year’s 10.9%. The business had previously grown profits by an average of 7.5% per year over the past five years, but now faces negative momentum. Earnings and revenue are forecast to decline by 9.7% and 0.9% per year, respectively, over the next three years. Margins are compressing, so investors will be watching how the company manages through this period of expected contraction.

See our full analysis for Ichiyoshi Securities.The real question is how these numbers match up with the narratives shaping opinion. Some commonly held views could be reinforced, while others might get called into question in the sections ahead.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Squeeze Signals Shift

- With the net profit margin declining to 9.2%, compared to last year’s 10.9%, the trend signals that profitability is under pressure even before further negative growth forecasts take hold.

- What is striking is how the current margin squeeze coincides with the prospect of annual earnings falling 9.7% and revenue 0.9% over the next three years.

- Despite historically high-quality earnings and an average 7.5% annual profit growth over five years, the numbers now point directly at a reversal in the firm’s fortunes.

- This contrasts sharply with previous optimism that the company could keep outperforming wider market conditions based on its past track record.

Dividend Sustainability: A Key Concern

- Risks highlighted in the assessment focus on both declining earnings and revenue, which could make sustaining current dividend levels increasingly challenging.

- Critics highlight the risk that a shrinking profit pool, especially when combined with future earnings deterioration, might force Ichiyoshi Securities to reconsider its current payout approach.

- This risk stands out even more when compared to the company’s period of strong, stable profits in recent years, which made dividend payments look reliable until now.

- Any negative shift could impact investor perception and lead to broader questions about income stability from the company’s shares going forward.

Valuation: Peer Discount, But Fair Value Gap

- At a P/E ratio of 15x, Ichiyoshi Securities is cheaper than the Japanese capital markets industry average of 16.1x, but pricier than peer firms at 12.4x, and it trades a significant 56% above its DCF fair value of ¥545.05, given the actual share price of ¥850.

- What stands out is how this valuation profile introduces mixed signals: the industry discount may look appealing, but the sharp premium to intrinsic value heightens investor caution.

- Even with market optimism around the sector, investors need to weigh Ichiyoshi’s premium pricing against its forecasted earnings decline.

- Momentum traders may be tempted by the industry discount, but those tracking fair value could see more risk than reward in the current market price.

There’s a lot more to the valuation, margins, and dividend outlook. See the key debates and data in our deep-dive narrative. 📊 Read the full Ichiyoshi Securities Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ichiyoshi Securities's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Ichiyoshi Securities faces margin compression, shrinking profits, and valuation risks. These factors make its outlook less attractive for value-focused investors.

If you want stronger upside for every yen invested, target opportunities trading below intrinsic value by checking out these 832 undervalued stocks based on cash flows before your next move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8624

Ichiyoshi Securities

Provides investment and financial services in Japan.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives