- Japan

- /

- Capital Markets

- /

- TSE:8473

Should Suspected North Korean Cyberattack on SBI Crypto Prompt Action From SBI Holdings (TSE:8473) Investors?

Reviewed by Sasha Jovanovic

- In recent days, a suspected North Korean cyberattack reportedly drained US$21 million from SBI Crypto, a subsidiary of Japan’s SBI Holdings, according to findings by blockchain investigators, though the company has not confirmed the losses. This incident underscores intensified cyber threats and heightened security risks as SBI Holdings expands its cryptocurrency and digital asset activities.

- With the security breach spotlighting operational vulnerabilities, we’ll examine how SBI Holdings’ crypto sector ambitions could reshape its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SBI Holdings Investment Narrative Recap

For shareholders in SBI Holdings, the core investment belief centers on the group's ability to marry robust financial performance across diversified segments with outsized upside from early bets on digital assets and technology. The recent reported cyberattack on SBI Crypto raises fresh concerns about operational resilience, but while reputational and short-term costs may emerge, this event does not appear to materially affect the company’s largest current catalyst, profit growth from digital expansion, although it does highlight cybersecurity as an escalating risk to monitor.

Expansion of XRP-related lending services by SBI Holdings, as announced recently, directly ties into its digital asset strategy and the headline ambitions in crypto. This move marks a deeper commitment to new revenue streams in the sector, and it remains to be seen whether enhanced exposure can meaningfully strengthen near-term profit margins while navigating evolving security and compliance challenges.

By contrast, as SBI accelerates into advanced technologies and blockchain, investors should be aware that...

Read the full narrative on SBI Holdings (it's free!)

SBI Holdings' outlook anticipates ¥1,696.9 billion in revenue and ¥181.7 billion in earnings by 2028. This is based on a yearly revenue growth rate of 2.9% and reflects a ¥43.7 billion decrease in earnings from the current ¥225.4 billion.

Uncover how SBI Holdings' forecasts yield a ¥5950 fair value, a 6% downside to its current price.

Exploring Other Perspectives

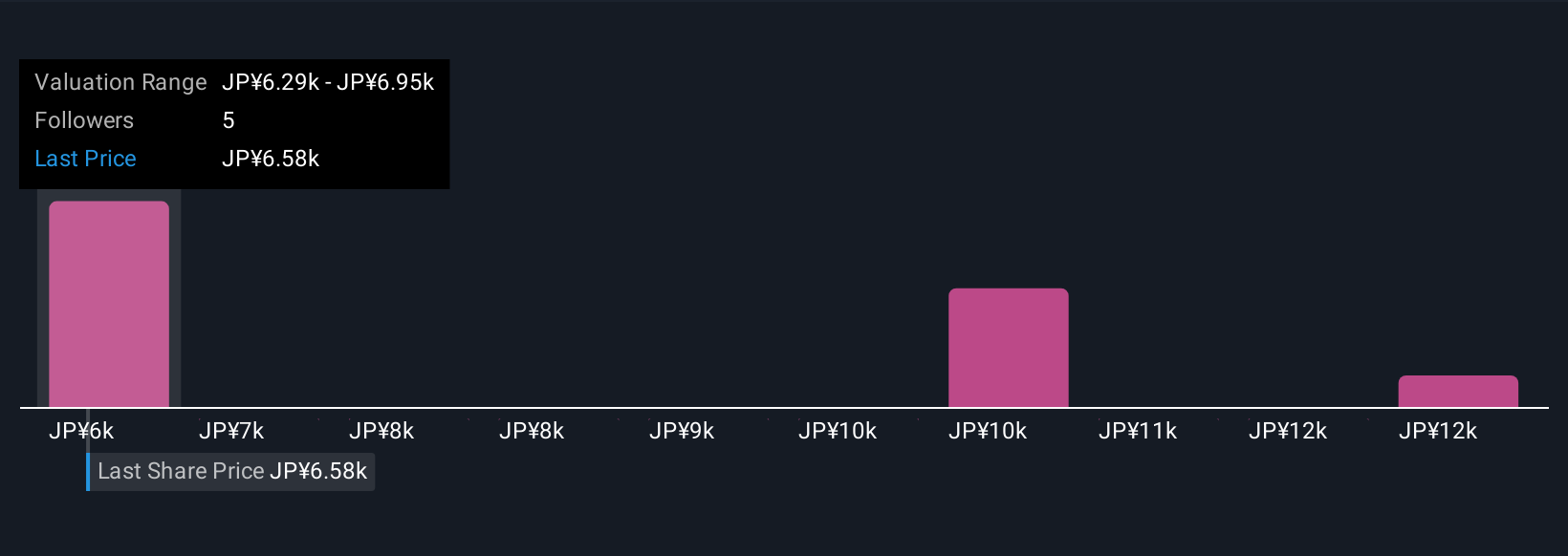

Four independent fair value estimates from the Simply Wall St Community range widely from ¥5,950 to ¥12,832 per share. As you compare these diverging outlooks, keep in mind that broader adoption of digital assets remains an earnings catalyst but comes with operational and security risks that could impact long-term performance.

Explore 4 other fair value estimates on SBI Holdings - why the stock might be worth 6% less than the current price!

Build Your Own SBI Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SBI Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SBI Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives