- Japan

- /

- Capital Markets

- /

- TSE:8473

SBI Holdings (TSE:8473): Assessing Valuation After Boosted Dividend and Stock Split Announcement

Reviewed by Simply Wall St

SBI Holdings (TSE:8473) just announced both a higher interim dividend and a stock split, along with related changes to its Articles of Incorporation. These moves are catching the market’s attention for good reason.

See our latest analysis for SBI Holdings.

SBI Holdings’ recent pop in share price, with a year-to-date share price return of nearly 79%, follows the company’s move to boost its interim dividend and approve a stock split. These shareholder-friendly steps have amplified momentum and capped a year when the total shareholder return soared over 112%, serving as a testament to both short-term excitement and strong long-term performance.

If these bold moves have you rethinking your portfolio, now is a perfect time to broaden your search and see what’s happening among fast growing stocks with high insider ownership.

With shares already up nearly 80% this year and a strong record of total returns, investors may wonder if further upside remains. They may question whether SBI Holdings’ recent moves are fully accounted for in the current price, if there could be untapped value, or if the market is already factoring in future growth.

Most Popular Narrative: 9.3% Overvalued

SBI Holdings’ last close of ¥7,145 currently stands above the most widely followed narrative fair value of ¥6,538. This suggests that analyst optimism may be outpacing calculated expectations. The difference highlights a growing gap between market price and the projected worth built on consensus assumptions.

The company's reliance on positive revaluations and realized gains from PE and crypto-related investments for outsized quarterly profits may not be repeatable in the future. As earnings normalize and asset volatility persists, future profitability and return on equity could fall short of present expectations, impacting long-term earnings stability.

Curious what’s driving this punchy fair value? The narrative banks on a steady profit engine, but also leans heavily on bold forecasts for margins and long-term growth. Want to see which financial bets are behind that price? Find out what could shift the outcome by diving in.

Result: Fair Value of ¥6,538 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, record profits and strong growth in key business segments could drive continued momentum and quickly overturn the case for a pullback.

Find out about the key risks to this SBI Holdings narrative.

Another View: What Does the SWS DCF Model Say?

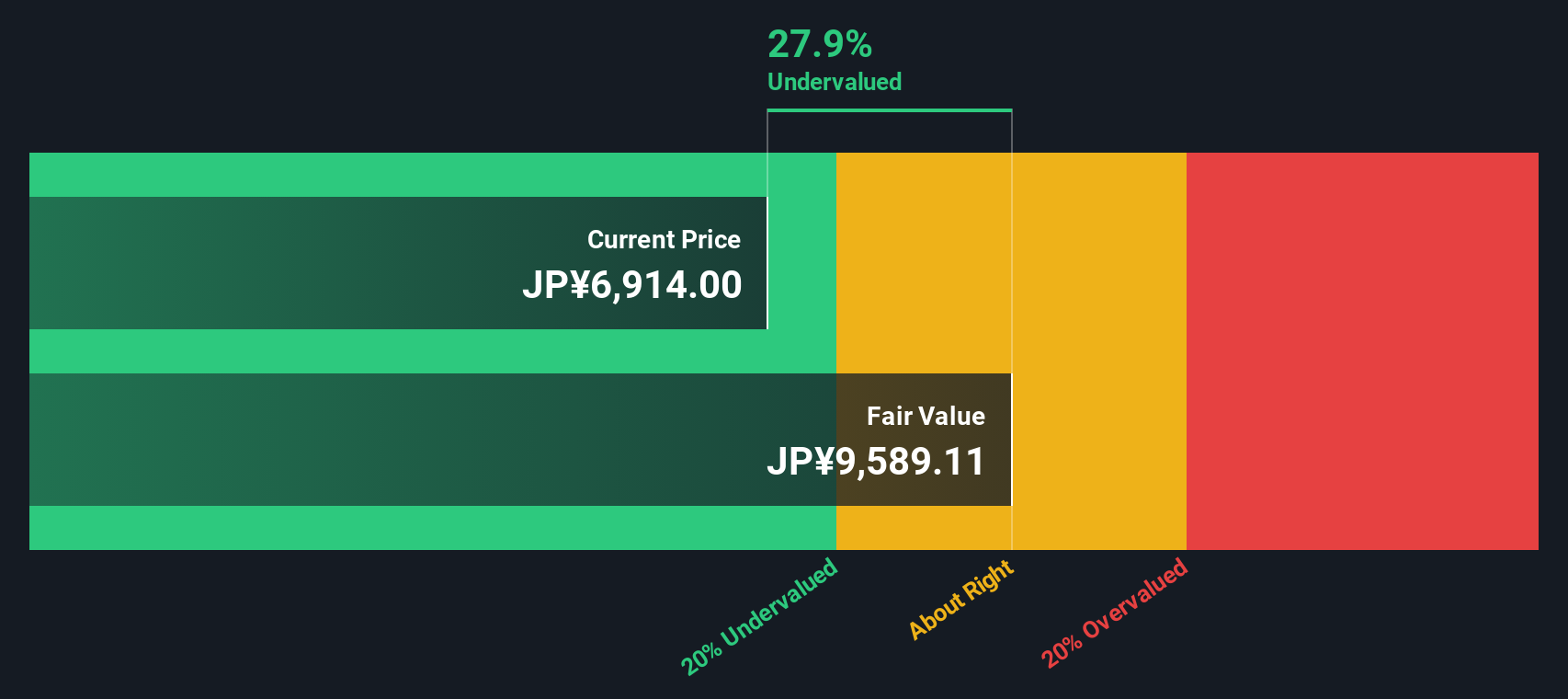

Switching perspectives, our DCF model takes a different approach by estimating SBI Holdings’ fair value based on projected future cash flows. With this method, SBI shares appear significantly undervalued and are trading well below what the cash flow outlook suggests. Could the market be missing future potential, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SBI Holdings Narrative

If you see the story differently or want to dig into the numbers your own way, it only takes a few minutes to build a personal viewpoint. So why not Do it your way.

A great starting point for your SBI Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your search stop here. Take charge of your investing journey by finding tomorrow’s opportunities before everyone else. Use these hand-picked screens to energize your portfolio:

- Unlock new growth by targeting these 885 undervalued stocks based on cash flows that are priced below their true potential. This gives you a head start on market movers.

- Tap into the AI boom and accelerate your returns by tracking these 27 AI penny stocks making waves with real-world innovation and future-ready business models.

- Boost your income stream by focusing on these 15 dividend stocks with yields > 3% delivering reliable yields and outpacing traditional fixed-income alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japan and Saudi Arabia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives