- Japan

- /

- Diversified Financial

- /

- TSE:8421

Shinkin Central Bank (TSE:8421) Profit Margin Jumps to 22.5%, Challenging Value Narratives

Reviewed by Simply Wall St

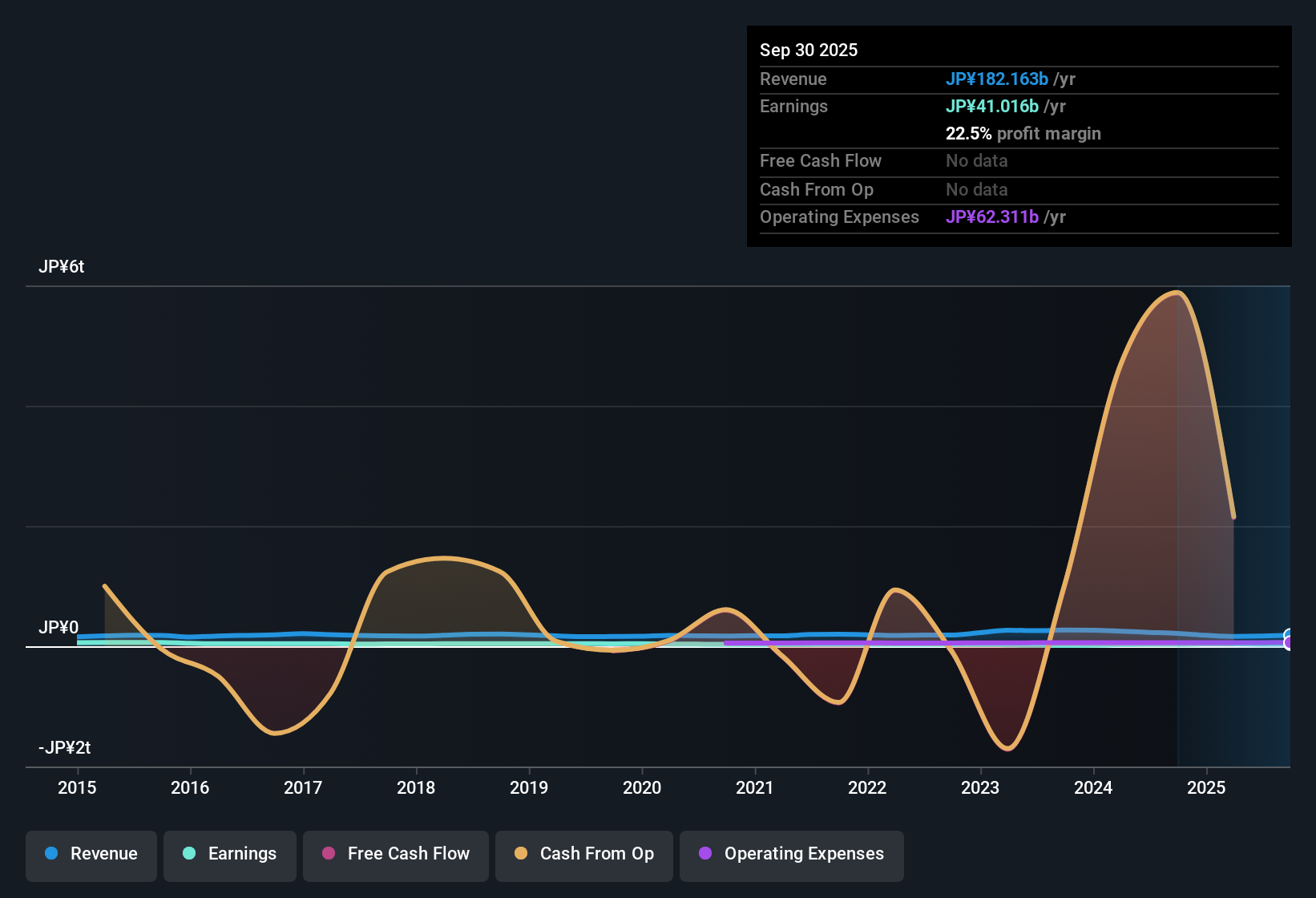

Shinkin Central Bank (TSE:8421) posted a net profit margin of 22.5%, rising from 16.1% over the past year, with annual earnings growth soaring to 19.3%. This performance is well above its 5-year average growth of just 3.2% per year, and the company continues to report high quality earnings. As investors weigh the impressive profit acceleration, attention is turning to its premium valuation, with shares trading at ¥189,500, far above the estimated fair value, and price-to-earnings multiples well ahead of both peers and the industry.

See our full analysis for Shinkin Central Bank.The next section compares these headline numbers with the most widely followed investment narratives, setting the stage to see which stories stand up and where the data disrupts expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Five-Year Trend

- Net profit margin has risen sharply to 22.5% this year, a significant step-up from the 5-year average earnings growth of 3.2% per year. This highlights operational improvement beyond the normal trend.

- What stands out is that the latest margin expansion strengthens the case for Shinkin Central Bank’s reputation for quality earnings, as recent coverage and prevailing outlooks emphasize its reliability and stable sector role.

- The current profit margin far exceeds previous years, supporting ongoing discussions about the bank’s consistent mandate and its position as a defensive choice.

- With sector focus moving toward resilience, the rate of margin growth becomes a surprising bright spot set against a typically steady industry context.

P/E Multiple at 40.2x Signals Premium

- The stock’s price-to-earnings ratio is 40.2x, nearly four times the Japanese financials industry average of 12.3x and well above peers at 10.6x. This indicates an aggressive market premium.

- Analysts note that this valuation premium puts the onus on the bank to sustain elevated growth and justify investor optimism, especially as most central financial institutions are recognized more for defensive characteristics than for high earnings multiples.

- The significant gap between Shinkin Central Bank’s P/E and its industry average challenges the view that financials should be priced chiefly as stable sector bellwethers.

- While steady sentiment prevails, some investors may hesitate to pay such a strong premium without signs that earnings momentum is durable in a low-rate, competitive environment.

Dividend Sustainability Flags Caution

- The latest filing identifies a minor risk concerning dividend sustainability, even as profit and revenue growth have been standouts this year.

- Prevailing commentary observes that, while operational strength is undeniable, any doubts about future dividend stability could temper enthusiasm and force investors to weigh high recent growth against potential yield risks.

- Unlike headline profit gains, a shift in dividend outlook may matter more for those holding the stock as a safety play rather than for breakout upside.

- Attention may turn quickly from strong earnings to payout sustainability if sector conditions become more challenging.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shinkin Central Bank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shinkin Central Bank’s lofty valuation and questions over dividend sustainability may leave investors wary about paying a premium for uncertain future returns.

If you’re searching for more compelling value, check out these 829 undervalued stocks based on cash flows that are trading at attractive prices with upside potential and less valuation risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8421

Shinkin Central Bank

Operates as a central bank for Shinkin banks in Japan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives