- Japan

- /

- Capital Markets

- /

- TSE:165A

SBI Rheos Hifumi (TSE:165A) Margin Miss Raises Fresh Dividend Sustainability Concerns

Reviewed by Simply Wall St

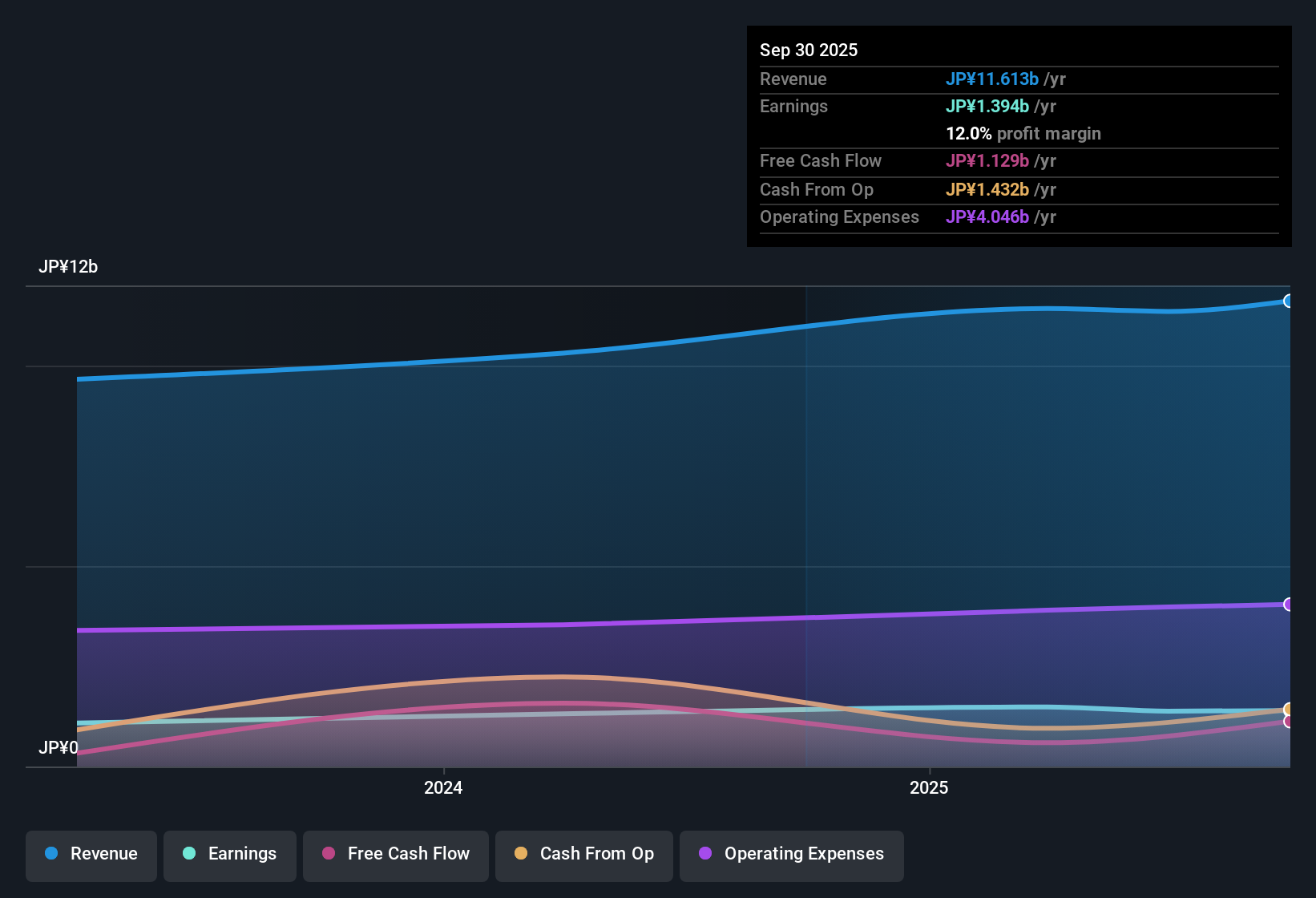

SBI Rheos Hifumi (TSE:165A) reported profit margins of 12%, slipping from last year’s 12.9% and pointing to a decline in net profitability year over year. Looking ahead, revenue is forecast to grow 5.9% per year, and earnings are expected to rise at 8.4% annually, both stronger than the broader Japanese market’s growth rates. Investors are weighing these growth prospects against weaker recent margins and ongoing concerns around dividend sustainability.

See our full analysis for SBI Rheos Hifumi.Next, we will see how this latest set of earnings measures up against the most widely-followed narratives about the company, identifying where the results confirm market expectations and where they might spark new debates.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Earnings Premium Signals Investor Willingness

- SBI Rheos Hifumi’s price-to-earnings (P/E) ratio stands at 14.5x, which is higher than the peer fund average of 13.4x but below the broader JP Capital Markets industry average of 16.1x.

- Recent figures highlight that brand reputation and steady historical performance allow the fund to attract investors even at a mild premium to peers.

- The 14.5x P/E signals that investors are comfortable paying a slight premium, which aligns with the market view that transparent reporting and long-term performance still command a valuation edge.

- At the same time, pricing below the industry average of 16.1x suggests caution. This implies that investors expect the fund to deliver on performance amidst heightened scrutiny on active management results.

Margin Slippage Raises Dividend Questions

- Net profit margin slipped from 12.9% last year to 12%, pointing to shrinking profitability even as revenue outlook is positive.

- Despite strong historical results, the drop in margins underlines ongoing debate over dividend sustainability, a key risk noted by many investors.

- A lower margin makes dividend payments less secure in the future and challenges optimism about the fund’s ability to maintain or grow distributions.

- Investors may continue watching for evidence that management can reverse margin declines while managing any payout pressures.

DCF Fair Value Shows Limited Discount

- Shares are trading at ¥208, about 26% above the DCF fair value estimate of ¥164.87, meaning the stock commands little discount and is valued higher than basic cash flow analysis would suggest.

- This valuation gap is notable because it sits between the modest peer premium and industry average, reinforcing the recent view that investors are cautious but unwilling to sell off completely as long as revenue growth forecasts remain solid.

- The share price above fair value means there is little room for disappointment. Any setback in growth or profitability could cause sentiment to shift quickly.

- However, sales and earnings growth rates that exceed the wider Japanese market help justify some of the premium at present, according to prevailing analysis.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SBI Rheos Hifumi's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

SBI Rheos Hifumi’s shrinking profit margins and high valuation raise concerns about its ability to maintain reliable dividends for investors.

If dependable income matters to you, consider these 2007 dividend stocks with yields > 3% to discover companies offering stronger yields and a better track record of sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:165A

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives