- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6644

Undiscovered Gems in Japan to Explore This October 2024

Reviewed by Simply Wall St

As Japan's stock markets navigate political shifts and economic policy continuity under new leadership, the Nikkei 225 and TOPIX indices have recently experienced declines. Despite these fluctuations, opportunities may arise within the small-cap sector as investors look for stocks that can capitalize on domestic economic policies aimed at overcoming deflation. In this context, identifying stocks with strong fundamentals and potential for growth amidst broader market uncertainties can be crucial in uncovering undiscovered gems in Japan.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| KurimotoLtd | 20.73% | 3.34% | 18.64% | ★★★★★★ |

| Central Forest Group | NA | 7.05% | 14.29% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| Icom | NA | 4.68% | 14.92% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Techno Ryowa | 1.77% | 2.06% | 5.32% | ★★★★★☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

SAN-ALTD (TSE:2659)

Simply Wall St Value Rating: ★★★★★★

Overview: SAN-A CO., LTD. operates a chain of supermarkets in Okinawa with a market cap of ¥179.10 billion.

Operations: The company generates its revenue primarily from operating supermarkets in Okinawa. It has a market capitalization of ¥179.10 billion.

SAN-A, a promising player in Japan's retail landscape, is debt-free and trades at 41% below its estimated fair value. Over the past five years, earnings have grown by 8.7% annually, though recent growth of 17.6% lags behind the industry average of 22.2%. The company forecasts operating revenue of ¥236 billion and profit attributable to owners at ¥11 billion for fiscal year ending February 2025, despite halving its dividend to ¥55 per share from last year's ¥110.

- Unlock comprehensive insights into our analysis of SAN-ALTD stock in this health report.

Explore historical data to track SAN-ALTD's performance over time in our Past section.

Osaki Electric (TSE:6644)

Simply Wall St Value Rating: ★★★★★★

Overview: Osaki Electric Co., Ltd. is engaged in the development, manufacturing, sales, and installation of meters across Japan and various international markets including Asia, Oceania, and Europe with a market capitalization of ¥37.92 billion.

Operations: Osaki Electric generates revenue primarily from its Domestic Measurement Control Business at ¥55.74 billion and Overseas Measurement Control Business at ¥40.14 billion, with a smaller contribution from its Real Estate Business.

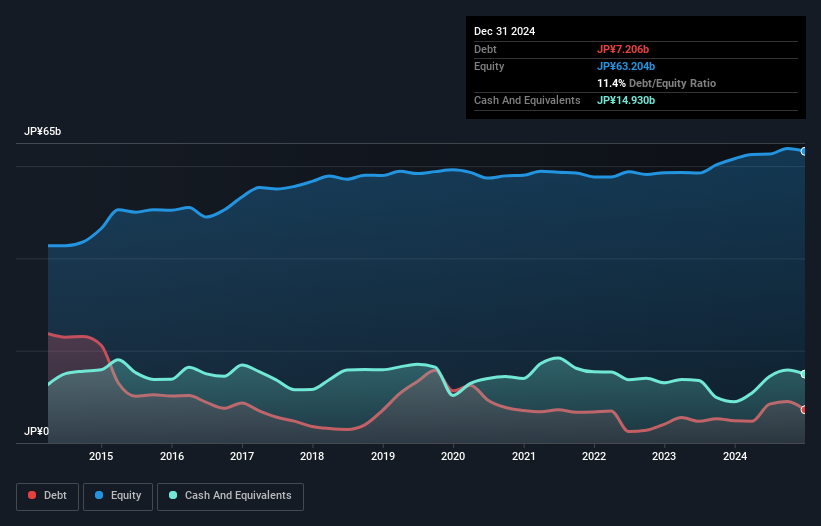

Osaki Electric, a compact player in the electronics sector, has turned profitable recently and trades at 37.6% below its estimated fair value. The company is on solid ground with high-quality earnings and free cash flow positivity. A recent buyback of 373,900 shares for ¥251.9 million underscores its commitment to shareholder returns. Debt management appears prudent as the debt-to-equity ratio dropped from 22.8% to 13.4% over five years, indicating financial health and strategic foresight.

- Click to explore a detailed breakdown of our findings in Osaki Electric's health report.

Evaluate Osaki Electric's historical performance by accessing our past performance report.

Aeon Delight (TSE:9787)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aeon Delight Co., Ltd. is a facility management services company operating in Japan, China, and the ASEAN region with a market cap of ¥206.08 billion.

Operations: Revenue is primarily derived from facility management services across Japan, China, and the ASEAN region. The company reported a market cap of ¥206.08 billion.

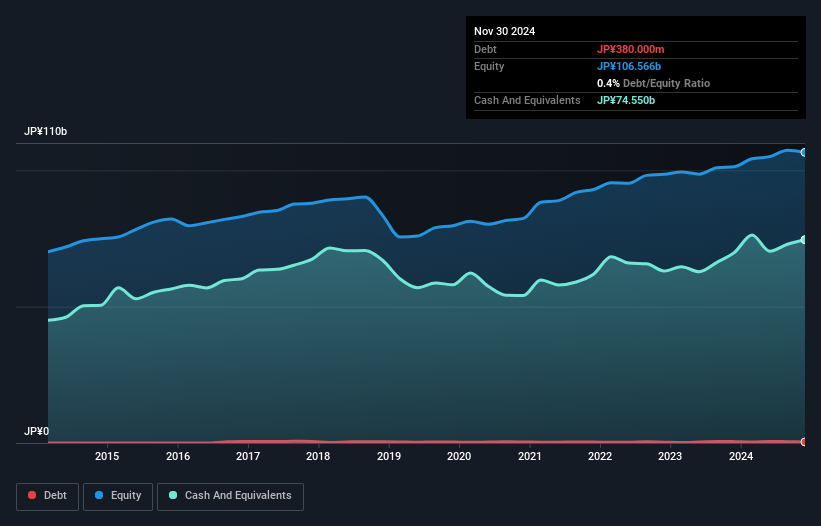

A well-positioned player in the commercial services sector, Aeon Delight has demonstrated a notable earnings growth of 7.8% over the past year, outpacing the industry average of 5.3%. The company repurchased 442,400 shares for ¥1.69 billion recently, reflecting confidence in its valuation, which trades at 17.9% below estimated fair value. Despite an increase in its debt-to-equity ratio from 0.4 to 0.6 over five years, it remains financially robust with more cash than total debt and high-quality earnings ensuring interest coverage is not a concern.

- Delve into the full analysis health report here for a deeper understanding of Aeon Delight.

Examine Aeon Delight's past performance report to understand how it has performed in the past.

Key Takeaways

- Investigate our full lineup of 730 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6644

Osaki Electric

Develops, manufactures, sells, and installs meters in Japan, rest of Asia, Oceania, Europe, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives