Can Goldwin’s (TSE:8111) Share Buyback Strategy Strengthen Capital Efficiency and Investor Appeal?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Goldwin Inc. announced a share repurchase program to buy back up to 1,200,000 shares for ¥2,500 million, reflecting 0.87% of its share capital and running through January 30, 2026.

- The company also issued a correction regarding its Stock Benefit Trust plan, clarifying its equity management approach without changing the reported figures.

- To understand how this share buyback could reshape Goldwin’s investment narrative, let’s examine its potential to improve capital efficiency.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Goldwin's Investment Narrative?

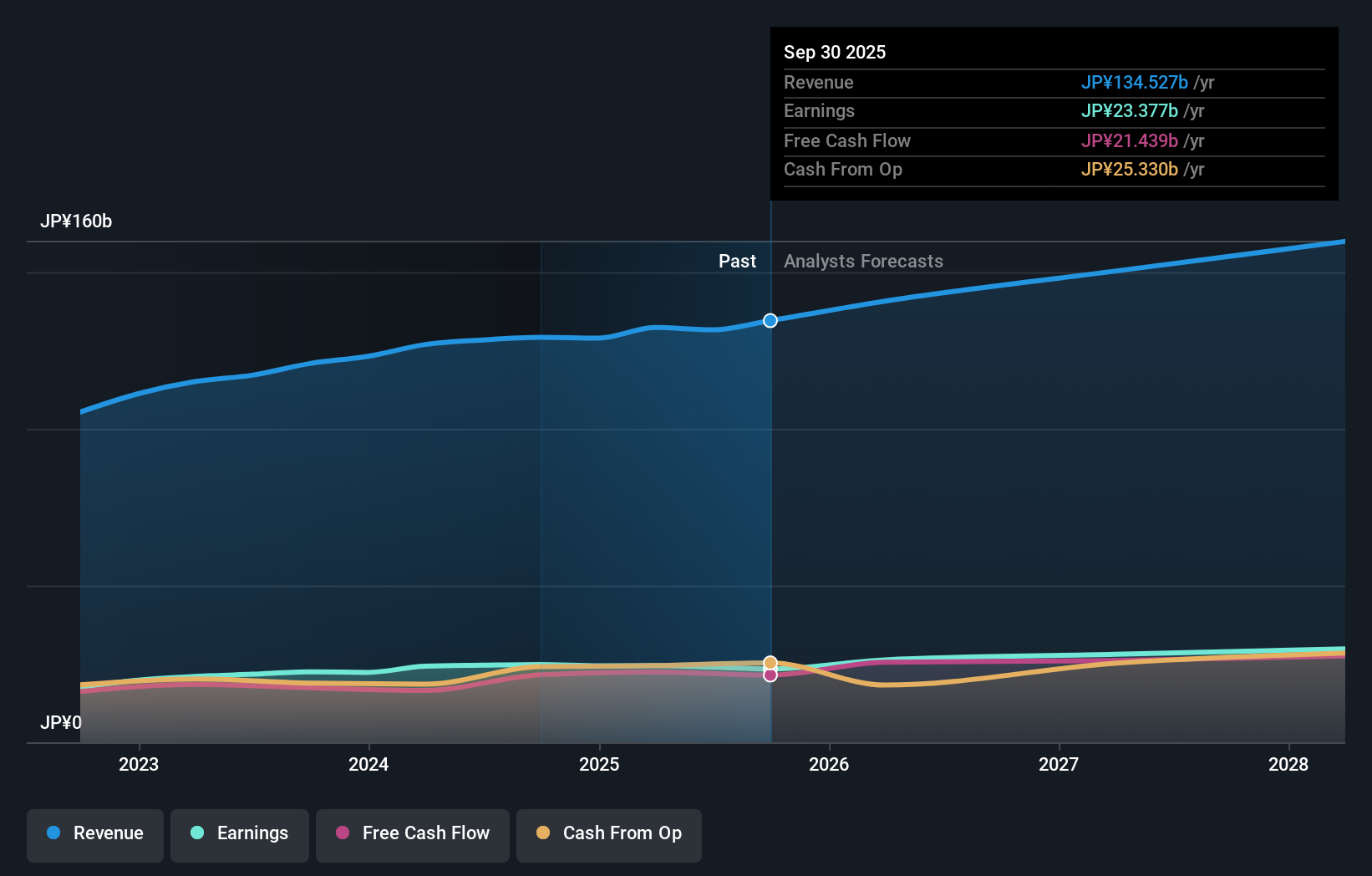

Goldwin’s recent buyback program signals a strong emphasis on returning value to shareholders and enhancing capital efficiency at a time when growth and margin trends face heightened scrutiny. While previous catalysts included solid revenue growth forecasts, high return on equity, and a healthy balance of experienced leadership, some short-term uncertainties remain around the sustainability of profit growth and dividend reductions, as well as a correction on its Stock Benefit Trust plan. The new repurchase, covering nearly 1% of share capital, aligns with ongoing efforts to boost returns, but on its own, probably won’t move the needle for Goldwin’s immediate risks and opportunities. This is reinforced by recent price action and consensus that sees only moderate undervaluation, plus concerns over slower earnings growth compared to market averages and a decline in net profit margin year-on-year.

But mounting questions about future dividend stability warrant particular attention from investors.

Exploring Other Perspectives

Explore another fair value estimate on Goldwin - why the stock might be worth as much as 15% more than the current price!

Build Your Own Goldwin Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldwin research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Goldwin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldwin's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8111

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives