How Seiko Group’s (TSE:8050) Profits Surge and Dividend Boost May Shape Investor Expectations

Reviewed by Sasha Jovanovic

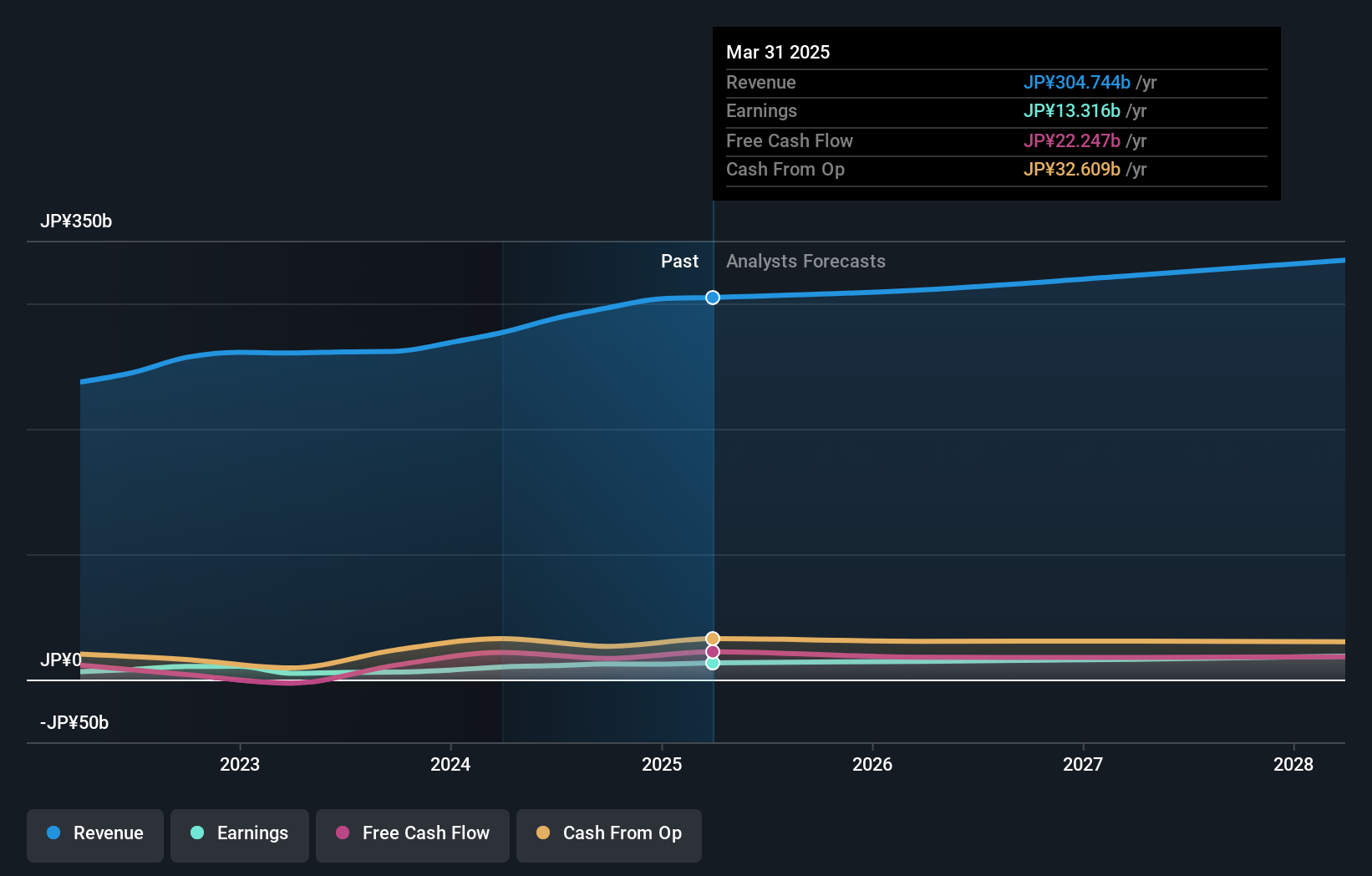

- Seiko Group Corporation recently reported its consolidated financial results for the six months ended September 30, 2025, posting a 6.3% rise in net sales and a 44.2% increase in profit attributable to owners of the parent over the previous year.

- The company’s upward revision of its dividend forecast reflects management’s confidence in both its current financial stability and future outlook.

- We’ll explore how Seiko Group’s improved dividend forecast and strong operational results add new dimensions to its investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Seiko Group's Investment Narrative?

For investors considering Seiko Group, the big picture often centers on whether its renowned brand, operational momentum, and disciplined management can offset risks from slow revenue forecasts and high debt levels. The recent surge in net sales and profit stands out as a concrete short-term catalyst, particularly when paired with an improved dividend outlook that signals management’s confidence. This update could prompt a re-evaluation of previous concerns, especially regarding growth rates versus the broader Japanese market and the company’s premium price-to-earnings ratio. While faster-than-expected profit expansion may temporarily ease worries about valuation or leverage, fundamentally, underlying risks like modest revenue growth and substantial debt persist. The market’s strong price return this year suggests this news has already generated real enthusiasm, but it remains to be seen if these gains can be sustained as competitive and macroeconomic factors evolve. In contrast, Seiko's high level of debt is a risk investors should be aware of.

Despite retreating, Seiko Group's shares might still be trading 10% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Seiko Group - why the stock might be worth as much as 31% more than the current price!

Build Your Own Seiko Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seiko Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seiko Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seiko Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8050

Seiko Group

Engages in watches, devices solutions, systems solutions, apparels, clocks, fashion accessories, system clocks and other businesses in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives