Should ASICS’ (TSE:7936) Buyback Talks Signal Renewed Faith in Its Core Business Strategy?

Reviewed by Sasha Jovanovic

- On November 12, 2025, ASICS Corporation held a board meeting to discuss the potential repurchase of treasury shares in accordance with the Companies Act of Japan.

- This agenda item is significant as share buyback considerations often reflect management’s confidence in ongoing business fundamentals and capital allocation priorities.

- We'll explore how ASICS’s focus on possible share repurchases could influence its investment narrative and shareholder value outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is ASICS' Investment Narrative?

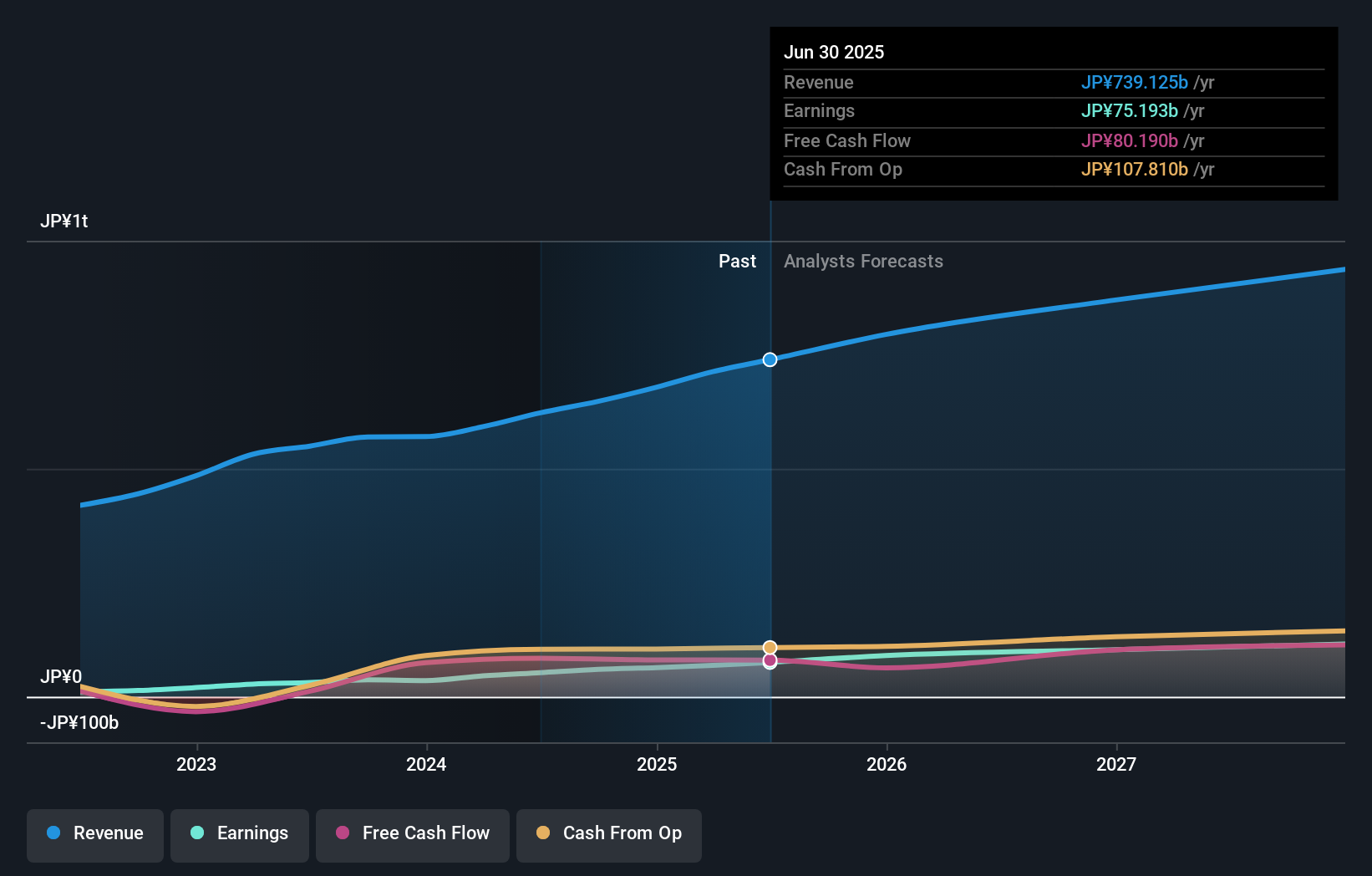

To invest in ASICS, you’ll want to believe in the long-term strength of its athletic brand and management’s ability to balance disciplined growth, consistent earnings momentum, and meaningful shareholder returns. The board’s latest move to discuss another round of share buybacks signals continued confidence in business performance, reaffirming management’s commitment to capital efficiency just as strong earnings guidance and an upgraded profit outlook are in play for 2025. With price volatility seen in recent months, buyback news could offer a modest short-term support, but the impact may not significantly alter the biggest near-term catalysts and risks, analyst consensus already points out elevated valuations versus peers and a price premium to fair value. Any major change to this risk-reward equation would likely depend on further corporate actions or an unexpected shift in growth or profitability, neither of which seem immediately triggered by this latest buyback consideration. On the other hand, risks from ASICS’ higher-than-average valuations deserve closer attention.

ASICS' share price has been on the slide but might be up to 14% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on ASICS - why the stock might be worth 12% less than the current price!

Build Your Own ASICS Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASICS research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASICS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASICS' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7936

ASICS

Manufactures and sells sporting goods in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives