Can Bandai Namco's (TSE:7832) Strong IP Strategy Sustain Momentum Beyond Dividend Hikes?

Reviewed by Sasha Jovanovic

- Bandai Namco Holdings recently raised its full-year earnings guidance for fiscal 2026 and more than doubled its interim dividend, highlighting improved business momentum in its core segments such as Toys and Hobby and Amusement.

- This move follows a 5.3% net sales increase in the second quarter, underpinned by notable growth in the Gundam series and the company’s effective IP strategy.

- We’ll explore how Bandai Namco’s focus on leveraging its popular intellectual properties could shape its broader investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is BANDAI NAMCO Holdings' Investment Narrative?

For investors considering Bandai Namco Holdings, the core story has centered around unlocking value from powerful franchises and expanding global reach through a scaleable IP strategy. The recent upward revision to full-year earnings guidance and a sharp interim dividend increase signal management’s confidence in current momentum, particularly in toys, hobby, and amusement where properties like the Gundam series continue to perform. These moves could act as short-term catalysts by re-energizing sentiment and potentially tightening the gap between the current share price and consensus targets. At the same time, this positive shift prompts a reweighting of risks; while tax liabilities from a recent reassessment and integration of Sony’s minority stake still linger, the bigger questions now revolve around the sustainability of recent gains given some softness in operating profit growth. Whether this inflection point leads to a rerating will depend on how well Bandai Namco continues to execute on these core strengths, even as industry competition remains intense. Still, short-term profitability trends may be masking deeper operational hurdles investors should watch closely.

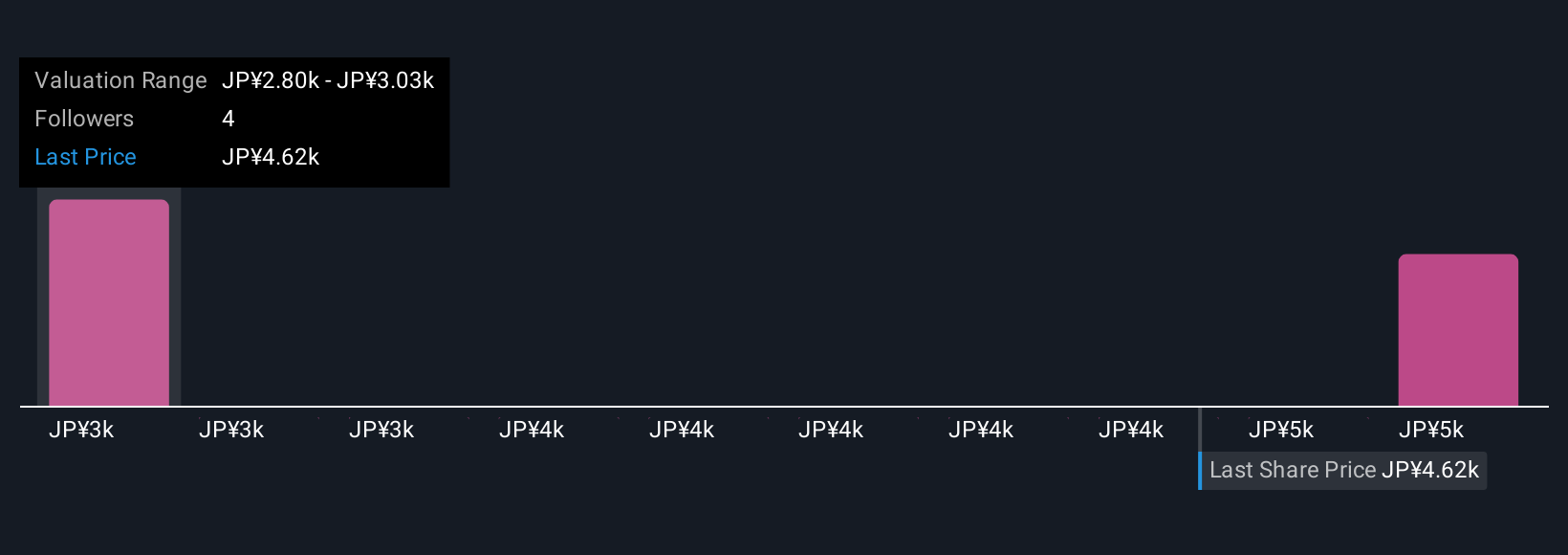

Despite retreating, BANDAI NAMCO Holdings' shares might still be trading 12% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on BANDAI NAMCO Holdings - why the stock might be worth as much as 13% more than the current price!

Build Your Own BANDAI NAMCO Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BANDAI NAMCO Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free BANDAI NAMCO Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BANDAI NAMCO Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BANDAI NAMCO Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7832

BANDAI NAMCO Holdings

Develops entertainment-related products and services worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives