A Look at Sankyo (TSE:6417) Valuation Following Major Share Buyback Progress

Reviewed by Simply Wall St

Sankyo (TSE:6417) confirmed it repurchased 2,700,600 shares in November 2025 as part of its ongoing buyback plan to acquire up to 30 million shares by March 2026. This highlights efforts to strengthen shareholder value.

See our latest analysis for Sankyo.

Sankyo’s latest share buyback comes as its momentum holds up nicely, with a 28.5% year-to-date share price return and an impressive 34.7% total shareholder return over the past year. The five-year total return of 543.8% also highlights how transformative recent strategies have been for long-term investors. Shorter-term price swings remain part of the story.

If you’re interested in finding standout opportunities beyond today’s headlines, now's an opportune moment to discover fast growing stocks with high insider ownership

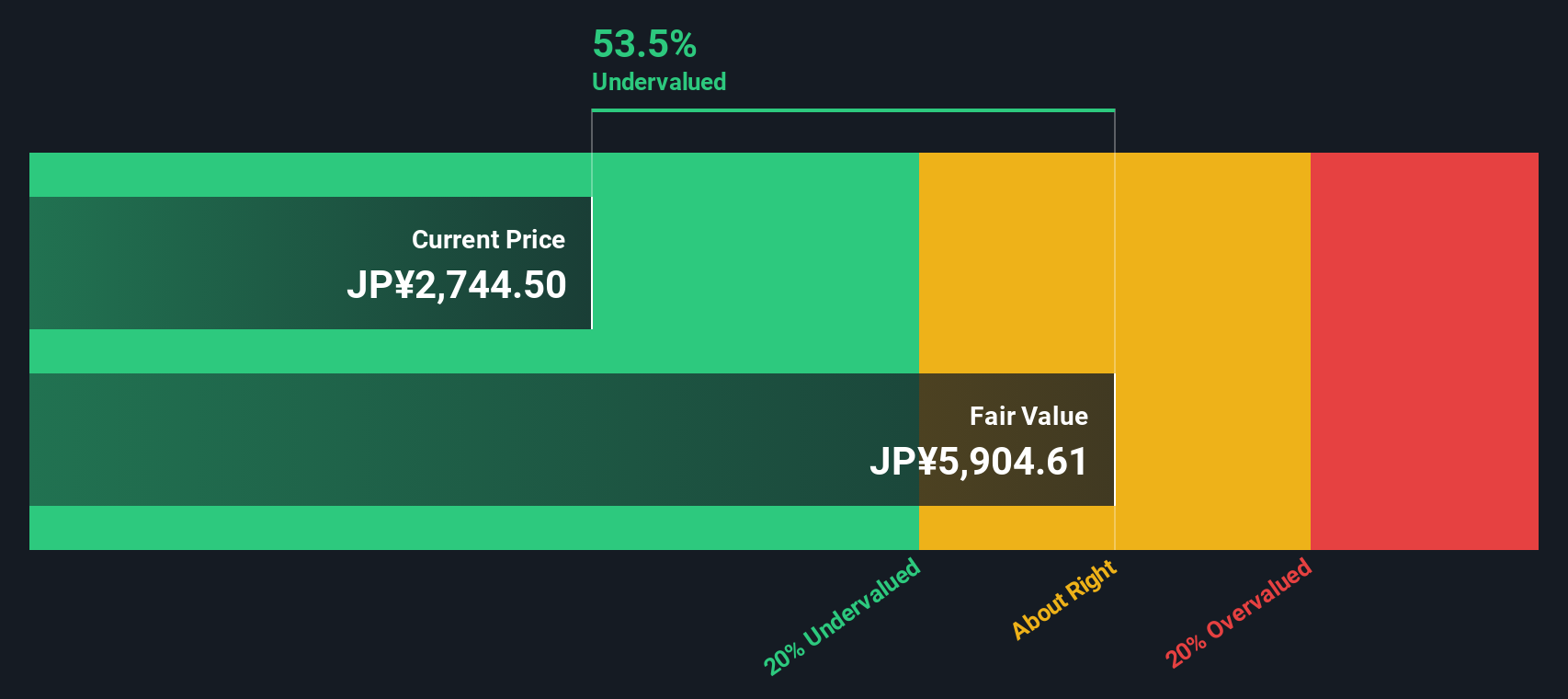

Yet with years of strong returns and a recent buyback in motion, the central question remains: is Sankyo currently undervalued and offering fresh upside, or has the market already factored in the company’s future growth potential?

Price-to-Earnings of 9.7x: Is it justified?

With Sankyo trading at a price-to-earnings (P/E) ratio of 9.7x, the stock stands out as undervalued compared to both industry and peer benchmarks, as well as its historical positioning, given its recent close of ¥2,744.5 per share.

The P/E ratio measures how much investors are paying for each yen of earnings and is widely used to assess whether a stock is expensive or cheap relative to its profits. For a leisure sector company like Sankyo, which has delivered robust profit growth, this metric gives clear insight into the market’s expectations.

At 9.7x earnings, Sankyo trades noticeably below the Japanese Leisure industry’s average P/E of 13.4x as well as the peer average of 24.9x. Our data-driven Fair P/E for Sankyo stands even higher at 13.8x, a level the market could move toward under the right conditions. This amplifies the current value proposition.

Explore the SWS fair ratio for Sankyo

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, slowing annual revenue and net income growth could weigh on Sankyo’s future performance and raise questions about the sustainability of its strong returns.

Find out about the key risks to this Sankyo narrative.

Another View: DCF Analysis Raises Further Questions

For a different perspective, our DCF model suggests Sankyo may be trading more than 50% below its estimated fair value, at ¥2,744.5 compared to a fair value of ¥5,904.61. This model, which focuses on projected future cash flows, presents a more optimistic picture than market multiples alone. Why is there such a wide gap in outlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sankyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sankyo Narrative

For those who prefer a hands-on approach or see a different angle in the data, you have the tools to analyze these numbers and develop your own perspective in just a few minutes. Do it your way

A great starting point for your Sankyo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to tap into new market trends and sharpen your edge. Take action today and see where the latest investment opportunities are emerging.

- Maximize your portfolio’s earning potential by reviewing these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% and stand out for their cash returns.

- Future-proof your strategy by targeting innovation and rapid growth through these 25 AI penny stocks at the forefront of artificial intelligence advancements.

- Amplify your value hunt by checking these 919 undervalued stocks based on cash flows with strong cash flows, offering entry points that savvy investors will not overlook for long.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6417

Sankyo

Manufactures and sells game machines and ball bearing supply systems in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026