- Japan

- /

- Commercial Services

- /

- TSE:9686

Toyo Tec Ltd. (TSE:9686) Profit Margins Surge, Challenging Steady-Performer Narrative

Reviewed by Simply Wall St

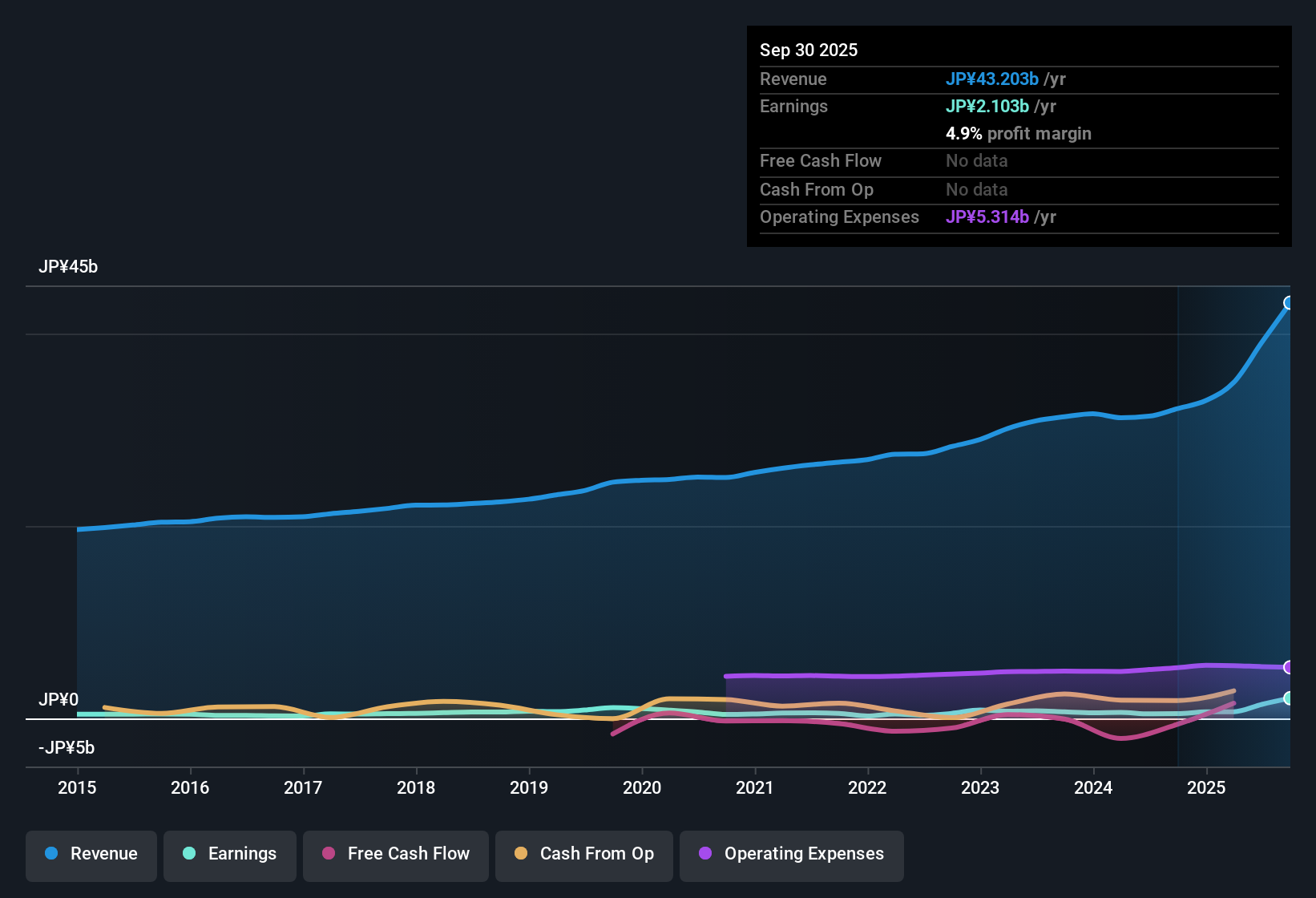

Toyo Tec Ltd. (TSE:9686) reported a sharp leap in profitability this year, with net profit margins reaching 4.9%, up from just 1.5% a year ago. Earnings soared an astonishing 328.3% year over year, and the company has maintained a strong 23.1% annualized earnings growth rate over the past five years. With a Price-to-Earnings ratio at only 7.6x, well below both peer and industry averages, and a share price trading almost exactly at fair value (¥1544 vs. ¥1545), investors are likely to take notice of the attractive combination of high-quality, rapidly accelerating earnings and compelling valuation.

See our full analysis for Toyo TecLtd.Next, we will see how these standout results compare to the prevailing market narratives. Sometimes the numbers follow the story, but often they set a new one entirely.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hit 4.9%, Highest in Recent Memory

- The company’s net profit margin reached 4.9% this year, up from 1.5% last year. This notable expansion demonstrates improved efficiency and cost management over a short period.

- According to the prevailing market view, this margin expansion positions Toyo Tec Ltd. as a stable option among peers.

- The business’s high-quality earnings growth stands out in a sector generally considered reliable but not always high performing, as net profit margins climb decisively higher year over year.

- Investors looking for companies with visible improvements in operational results may consider this profit margin trajectory as a strength in a marketplace dominated by steady but unremarkable performers.

Earnings Growth Outpaces Five-Year Trend

- The most recent annual earnings growth soared 328.3%, dramatically exceeding the already impressive five-year annualized growth rate of 23.1%.

- This explosive performance, while still fitting the sector’s reputation for steady growth, signals that Toyo Tec Ltd. is temporarily outperforming expectations.

- Such a leap is rare for a business typically discussed as defensively stable, introducing the possibility that medium-term growth prospects are stronger than the sector average.

- The ongoing track record of five-year growth gives further credibility to the latest surge as more than a one-off. If this pace is maintained, its fundamental momentum supports a more optimistic take than the market’s usual cautious tone.

Valuation Well Below Industry and Peer Averages

- Toyo Tec Ltd. trades at a 7.6x Price-to-Earnings ratio, compared with industry and peer averages of 13.3x and 23.9x. The share price sits just below DCF fair value (¥1544 share price vs. ¥1545 DCF fair value).

- Investors focused on value are likely to notice this discount.

- The share price’s close alignment with calculated DCF fair value and steep discount to comparable companies makes Toyo Tec Ltd. an attractive target for those seeking quality at a compelling price.

- The prevailing perspective suggests sentiment is positive on this basis. Investors view the valuation as both an opportunity and a backstop against downside, especially in a sector where perceived safety is already high.

See our latest analysis for Toyo TecLtd.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toyo TecLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive profit and earnings growth, Toyo Tec Ltd.'s performance has recently been strong but lacks the proven consistency that some investors prefer across full cycles.

If you value reliable results through ups and downs, uncover steadier performers with stable growth stocks screener (2103 results) built to deliver consistent growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo TecLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9686

6 star dividend payer with solid track record.

Market Insights

Community Narratives