- Japan

- /

- Professional Services

- /

- TSE:6028

Should TechnoPro Holdings' (TSE:6028) Index Exclusions Prompt a Portfolio Review by Investors?

Reviewed by Sasha Jovanovic

- In November 2025, TechnoPro Holdings, Inc. (TSE:6028) was removed from both the S&P Global BMI Index and the S&P Japan 500, reflecting its exclusion from two prominent benchmarks.

- This dual removal is significant, as index changes like these typically lead passive funds and institutional investors to adjust their portfolios, affecting demand for the company's shares.

- With this context, we’ll examine how TechnoPro Holdings’ recent index exclusions could influence its analyst-driven investment outlook and market perception.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

TechnoPro Holdings Investment Narrative Recap

To be a shareholder in TechnoPro Holdings, investors generally need to believe in the long-term demand for skilled engineering staffing, the company’s ability to increase contract values, and ongoing margin recovery despite recent labor cost pressures. The recent exclusions from the S&P Global BMI Index and S&P Japan 500 are substantial news, but do not materially alter the key short-term catalyst, contract renewals aimed at higher unit prices, nor do they fundamentally change the most prominent risks related to profit margins and turnover.

Among recent corporate developments, the acquisition by Blackstone is the most relevant to the company’s current circumstances, especially following the index removals. Blackstone’s majority stake and plans for delisting could reshape shareholder expectations, potentially shifting the balance between market-driven risks and the internal strategies to boost revenue through contract negotiations and business expansion.

Yet, investors should also be aware that, unlike the headline event of index removal, escalating wage pressures could quietly erode profits over time…

Read the full narrative on TechnoPro Holdings (it's free!)

TechnoPro Holdings is projected to achieve ¥297.6 billion in revenue and ¥26.6 billion in earnings by 2028. This outlook is based on analysts forecasting a 9.0% annual revenue growth rate and a ¥10.0 billion increase in earnings from the current ¥16.6 billion.

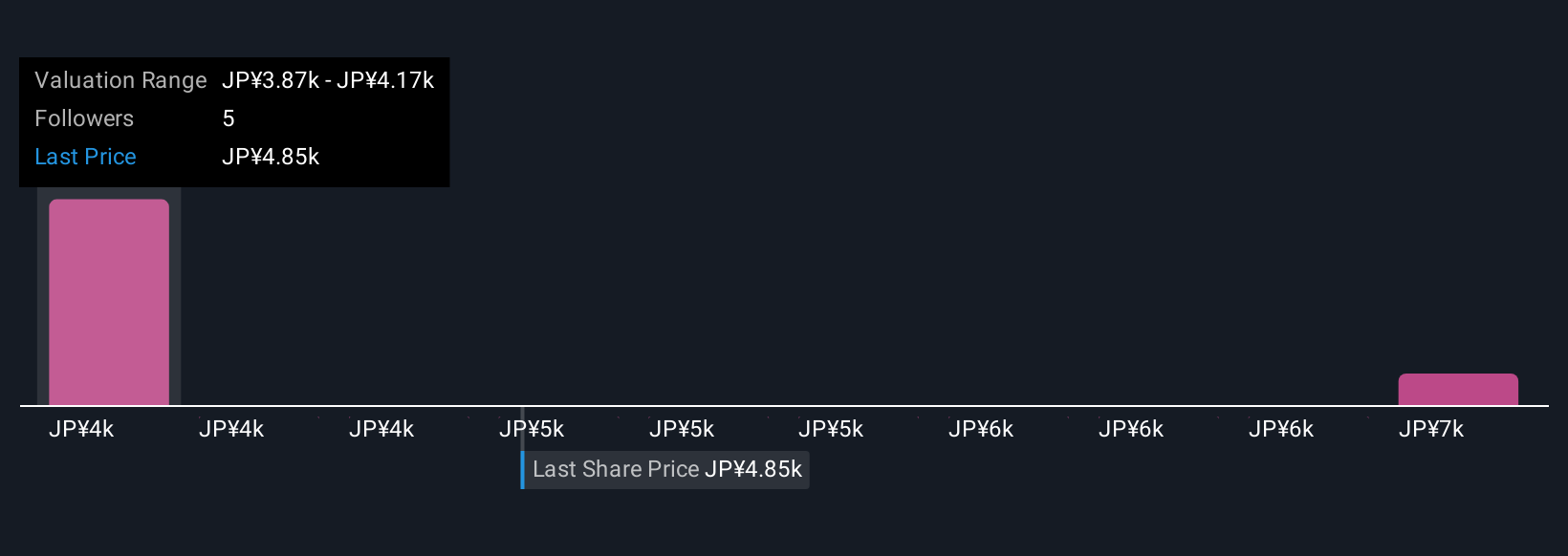

Uncover how TechnoPro Holdings' forecasts yield a ¥3868 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors offer two distinct fair value estimates for TechnoPro Holdings, ranging from ¥3,868 to ¥6,862 per share. While some see substantial value potential, others are cautious, especially as rising wage pressures may weigh on future earnings and influence broader confidence in the company’s performance.

Explore 2 other fair value estimates on TechnoPro Holdings - why the stock might be worth 20% less than the current price!

Build Your Own TechnoPro Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnoPro Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TechnoPro Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnoPro Holdings' overall financial health at a glance.

No Opportunity In TechnoPro Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnoPro Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6028

TechnoPro Holdings

Through its subsidiaries, operates as a temporary staffing and contract work company in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026