Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that ROXX,inc. (TSE:241A) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is ROXXinc's Debt?

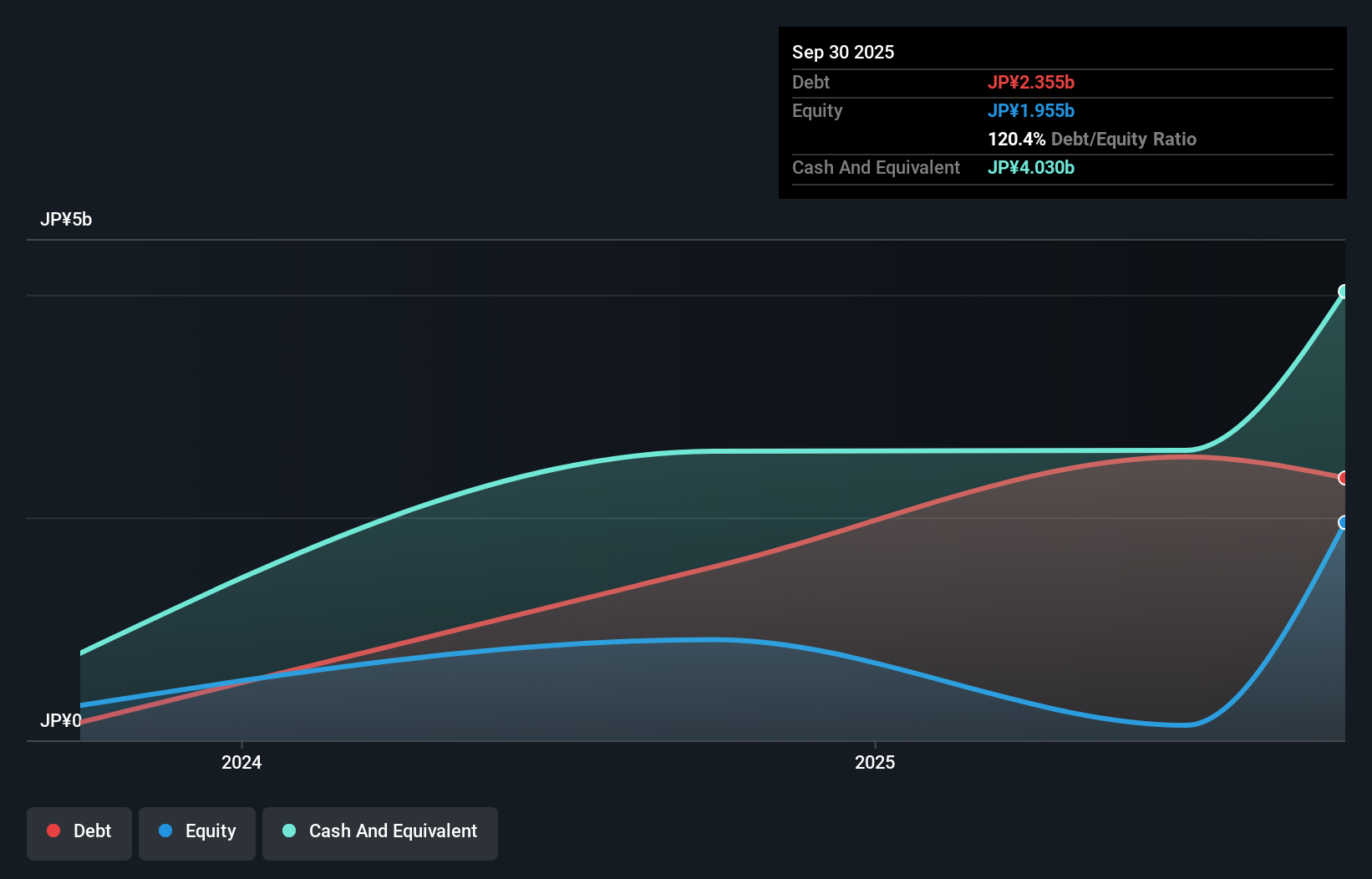

As you can see below, at the end of September 2025, ROXXinc had JP¥2.35b of debt, up from JP¥1.56b a year ago. Click the image for more detail. But on the other hand it also has JP¥4.03b in cash, leading to a JP¥1.68b net cash position.

How Strong Is ROXXinc's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that ROXXinc had liabilities of JP¥2.69b due within 12 months and liabilities of JP¥981.0m due beyond that. Offsetting this, it had JP¥4.03b in cash and JP¥1.03b in receivables that were due within 12 months. So it actually has JP¥1.39b more liquid assets than total liabilities.

This surplus liquidity suggests that ROXXinc's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that ROXXinc has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since ROXXinc will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

See our latest analysis for ROXXinc

Over 12 months, ROXXinc reported revenue of JP¥4.5b, which is a gain of 30%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is ROXXinc?

Although ROXXinc had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of JP¥1.1b. So taking that on face value, and considering the cash, we don't think its very risky in the near term. We think its revenue growth of 30% is a good sign. We'd see further strong growth as an optimistic indication. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - ROXXinc has 3 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:241A

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026