- Japan

- /

- Commercial Services

- /

- TSE:2353

Nippon Parking Development (TSE:2353) Margin Compression Reinforces Cautious Valuation Narratives

Reviewed by Simply Wall St

NIPPON PARKING DEVELOPMENT Ltd (TSE:2353) opened fiscal 2026 with Q1 revenue of ¥9.2 billion and basic EPS of ¥4.34, setting the tone for how investors will judge its latest parking and urban services performance. The company has seen quarterly revenue move from ¥8.8 billion in Q1 2025 to ¥9.2 billion in Q1 2026, while EPS has held in a similar band at around ¥4.34 per share over the same stretch as markets watch how those headline figures filter through to profits. With margins in focus after a year of softer profitability, this print gives investors fresh data on whether the business is stabilizing or if pressure on returns is still building.

See our full analysis for NIPPON PARKING DEVELOPMENTLtd.With the latest numbers on the table, the next step is to weigh them against the prevailing narratives about NIPPON PARKING DEVELOPMENT Ltd, highlighting where expectations are confirmed and where the story may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

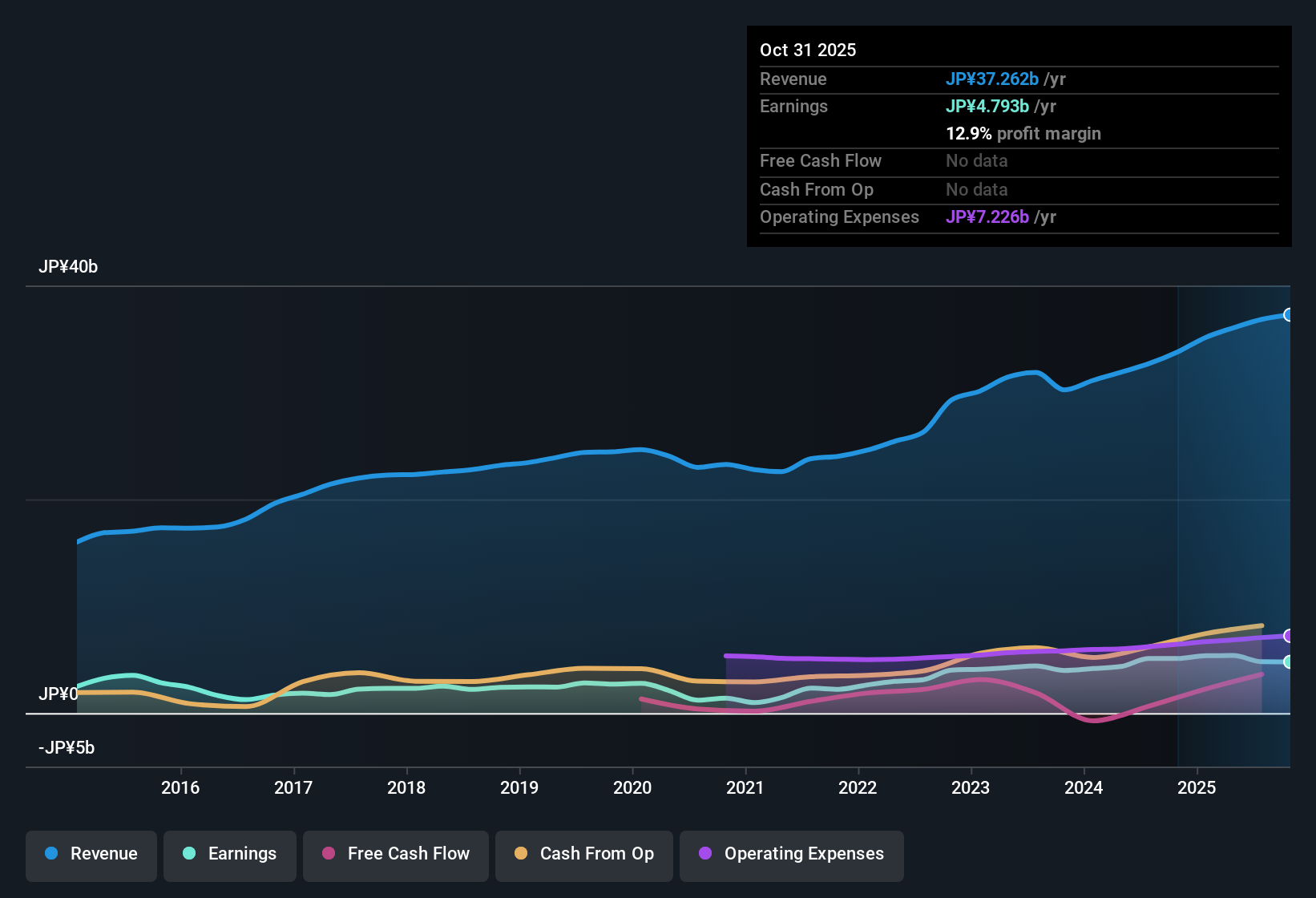

Margins Slip From 15.1% To 12.9%

- Over the last 12 months, net profit margin was 12.9%, lower than the 15.1% margin recorded the year before, even though trailing twelve month net income was ¥4,793 million on revenue of ¥37,262 million.

- Bears argue that weaker profitability justifies caution, and the recent margin step down aligns with that view. However, the five year earnings growth rate of 22.6% per year and Q1 2026 net income of ¥1,378 million

- Highlight that the business has still generated meaningful absolute profits despite the lower margin.

- Suggest that any bearish focus on margin compression needs to be weighed against this multi year growth track record.

Five Year Growth Meets Recent Slowdown

- Trailing twelve month basic EPS for Q1 2026 came in at ¥15.03, close to ¥15.04 a year earlier, while management has delivered 22.6% average annual earnings growth over five years alongside quarterly EPS in a band of roughly ¥3.22 to ¥5.07 since 2024.

- Supporters often point to that 22.6% five year growth rate as a key bullish pillar, but the flat trailing EPS profile and reference to negative earnings growth in the most recent year

- Show that the bullish story rests more on the longer history than on the latest 12 month trend.

- Indicate that investors who lean bullish need to watch whether quarters like Q1 2026, with EPS of ¥4.34, re accelerate that longer term pattern.

Premium Valuation Above DCF Fair Value

- The stock trades at about 17.8 times trailing earnings versus peers at 11 times and the broader JP Commercial Services group at 13.8 times, and it also sits above a DCF fair value of ¥219.14 with the current share price at ¥269.

- Critics highlight this valuation gap as a bearish data point, and the combination of compressed margins and a price above both peer multiples and DCF fair value

- Reinforces the view that the market is already paying up relative to fundamentals that include a 12.9% net margin and flat trailing EPS year on year.

- Raises the bar for future execution, because any further pressure on earnings could make the 17.8 times multiple and premium to the ¥219.14 DCF look harder to defend.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NIPPON PARKING DEVELOPMENTLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NIPPON PARKING DEVELOPMENT Ltd pairs a premium valuation with flat trailing EPS and thinner margins, leaving less room for disappointment if performance weakens further.

If that trade off feels uncomfortable, use our these 906 undervalued stocks based on cash flows to quickly shift your focus toward companies where valuations better reflect earnings quality and provide more downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIPPON PARKING DEVELOPMENTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2353

NIPPON PARKING DEVELOPMENTLtd

Provides consulting services for parking lot in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026