- Japan

- /

- Industrials

- /

- TSE:9435

Could Hikari Tsushin (TSE:9435) Be Signaling a New Approach to Debt Management?

Reviewed by Sasha Jovanovic

- Hikari Tsushin recently announced the issuance of its 54th unsecured corporate bond, raising ¥15 billion to fund upcoming bond redemption.

- This move highlights the company's intent to maintain financial flexibility and may reinforce its ability to manage debt obligations effectively.

- We'll explore how this large-scale bond issuance shapes Hikari Tsushin's investment narrative through its focus on financial stability.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Hikari Tsushin's Investment Narrative?

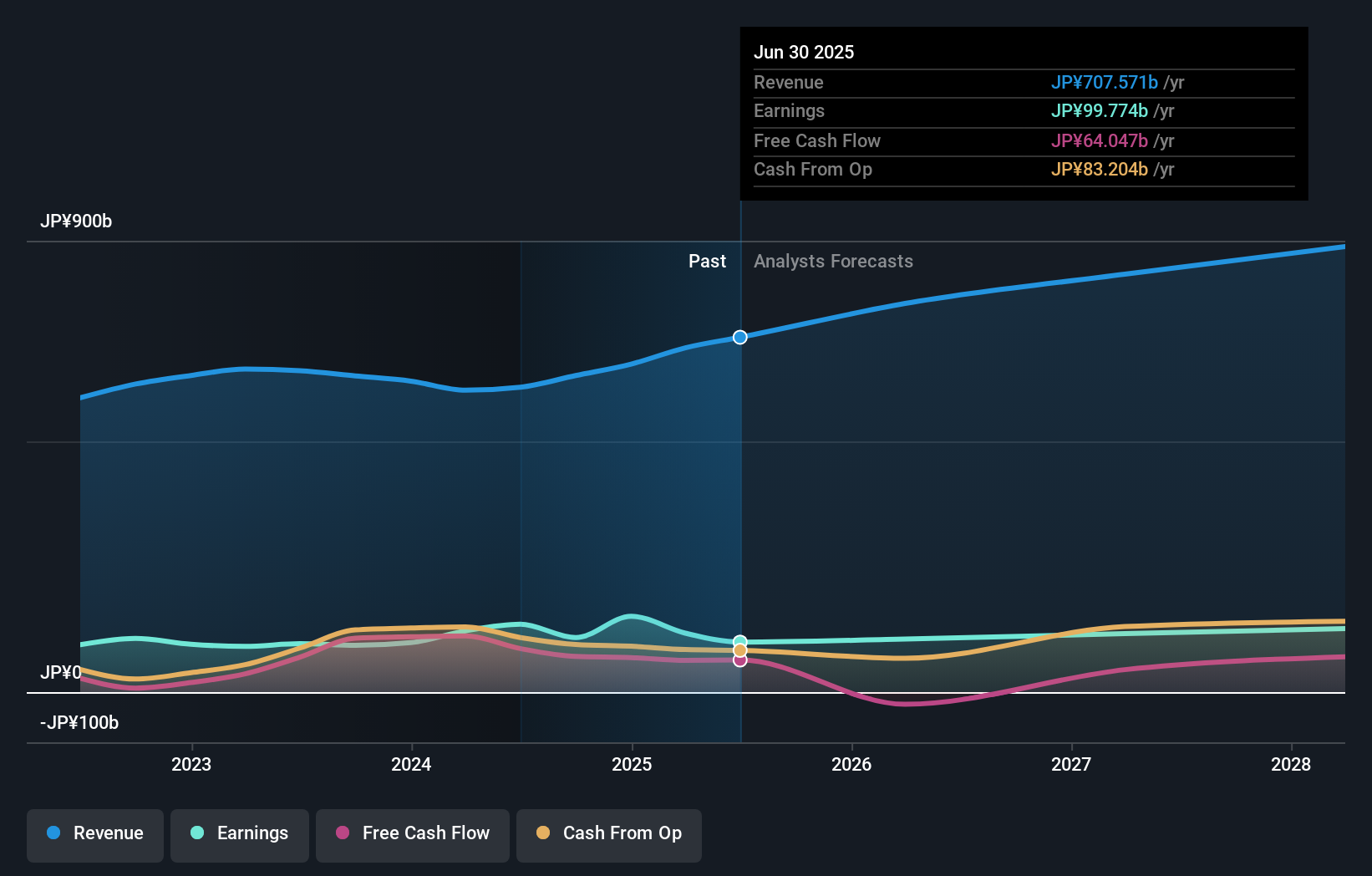

For anyone considering Hikari Tsushin as a holding, the essential story revolves around its capacity to balance growth and capital returns, while managing financial discipline amid shifting profit margins. With its recent ¥15 billion unsecured bond issuance, Hikari Tsushin has put a spotlight on its commitment to flexible debt management, directly addressing one of the company’s major near-term risks: relatively low operating cash flow coverage for existing debt. This move comes just ahead of key earnings releases and follows a series of consistent dividend increases and shareholder buybacks, all of which investors have seen as near-term catalysts. While this sizeable bond issue does provide some added reassurance regarding liquidity and future bond redemption, it doesn’t fundamentally shift the biggest concerns around earnings volatility or the pace of recovery after last year’s margin compression. Recent share price moves have remained relatively muted, suggesting that the market sees this as a prudent, but not game-changing, financial step.

But despite this proactive move, low cash flow coverage still stands out as a risk investors should track. Hikari Tsushin's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Hikari Tsushin - why the stock might be worth as much as ¥40390!

Build Your Own Hikari Tsushin Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hikari Tsushin research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Hikari Tsushin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hikari Tsushin's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hikari Tsushin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9435

Hikari Tsushin

Engages in the provision and sale of gas and electricity in Japan and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives