- Japan

- /

- Trade Distributors

- /

- TSE:8001

Itochu (TSE:8001) Margin Gains Challenge Narrative on Profit Sustainability

Reviewed by Simply Wall St

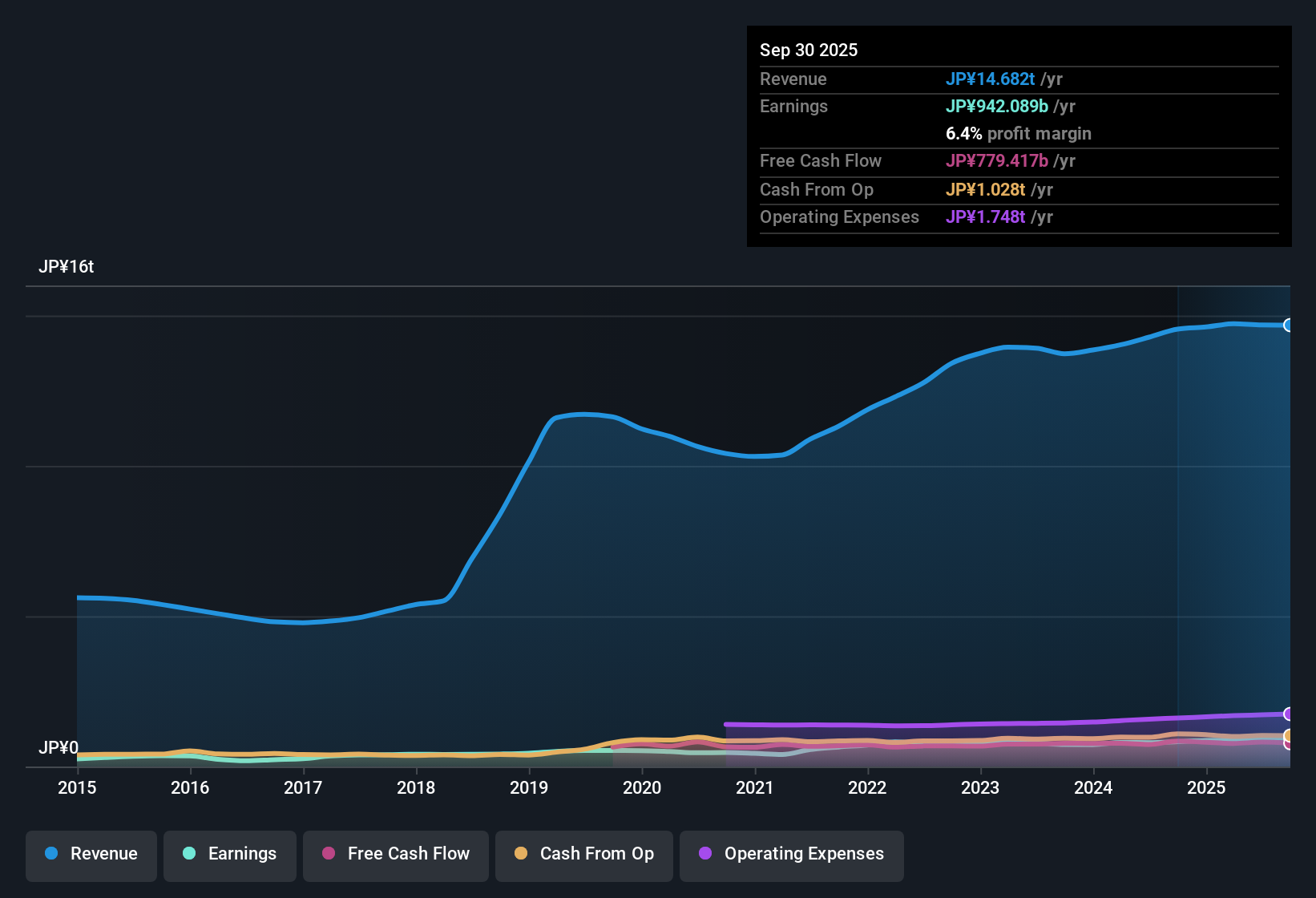

Itochu (TSE:8001) delivered annual earnings growth of 20.4% in its most recent report, outpacing its five-year average of 11.8% per year. Net profit margins rose to 6.5%, compared to 5.6% the year before, marking a solid improvement in profitability. Looking ahead, earnings and revenue growth are forecast to trail the broader Japanese market. However, the latest results stand out for consistently high-quality earnings and an attractive dividend profile.

See our full analysis for ITOCHU.Next up, we are putting these numbers side by side with the most widely held narratives about Itochu to see what holds up and what surprises might be in store for investors.

See what the community is saying about ITOCHU

Margins Expand to 6.5% as Profit Mix Shifts

- Net profit margins reached 6.5% this period, up from last year's 5.6%. This highlights stronger profitability as a factor driving results beyond headline earnings growth.

- Consensus narrative notes that Itochu’s transition toward stable, high-margin consumer sectors and sustainability projects is helping reduce dependence on more volatile commodities.

- Portfolio optimization and moves into new business areas are cited as improving operational efficiency and boosting shareholder returns.

- Despite the margin gains, consensus expectations indicate a gradual margin decrease to 6.0% in three years, rather than a sustained climb.

- Confidence in these margin trends is closely linked to the consensus view. Steady performance and diversified growth are seen as important elements of Itochu's outlook. Stay on top of this evolving story and see how the market narrative compares with the numbers by checking out the full consensus perspective. 📊 Read the full ITOCHU Consensus Narrative.

Trading Above DCF Fair Value, but Cheaper Than Peers

- At a share price of ¥9,590, Itochu trades about 32% above its DCF fair value of ¥7,239.20. Its price-to-earnings ratio (14.1x) is just below peers (14.4x) and well above the broader industry average (10.1x).

- Consensus narrative acknowledges the stock’s premium to DCF fair value, but stresses that Itochu's active capital management, such as buybacks and expansion into new business lines, may justify a higher multiple.

- Analyst price targets average ¥9,696.36, only slightly ahead of the current share price, suggesting the stock is fairly valued by consensus but offers limited near-term upside.

- Despite strong recent results, bullish price targets remain conservative due to ongoing concerns about profit sustainability and sector-specific risks.

Dividend Profile Draws Attention Amid Sustainability Questions

- Itochu’s dividend continues to be described as “attractive,” but market feedback on the ¥200/share minimum payout reflects some skepticism about its long-term reliability.

- Consensus narrative highlights the tension between strong ongoing returns and concerns over future free cash flow, noting that dividend sustainability is not certain if operational growth weakens.

- Bulls highlight recent active portfolio management and buybacks as supportive, while bears point to possible over-reliance on asset sales and cyclical gains.

- Close monitoring of the dividend’s foundation is recommended, especially with analyst forecasts of moderate revenue growth and ongoing industry headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ITOCHU on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the results? Shape your perspective and contribute a new narrative in just a few minutes. Do it your way

A great starting point for your ITOCHU research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Itochu’s premium valuation and sustainability questions, especially around its ongoing dividend reliability and margin stability, could mean limited upside for cautious investors.

If you want to focus on companies delivering robust and reliable income streams, check out these 1970 dividend stocks with yields > 3% which may offer steadier, more dependable payouts for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8001

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives