The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Kawasaki Heavy Industries, Ltd. (TSE:7012) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Kawasaki Heavy Industries

What Is Kawasaki Heavy Industries's Net Debt?

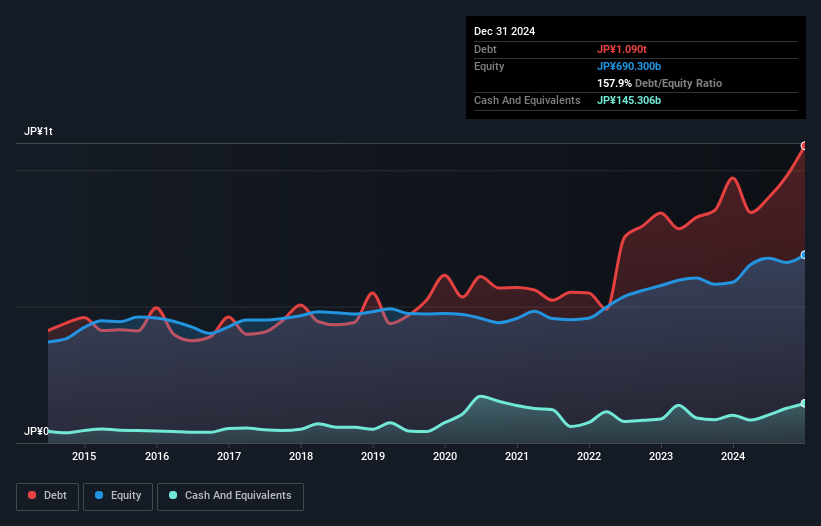

You can click the graphic below for the historical numbers, but it shows that as of December 2024 Kawasaki Heavy Industries had JP¥1.09t of debt, an increase on JP¥971.4b, over one year. However, because it has a cash reserve of JP¥145.3b, its net debt is less, at about JP¥944.7b.

How Healthy Is Kawasaki Heavy Industries' Balance Sheet?

According to the last reported balance sheet, Kawasaki Heavy Industries had liabilities of JP¥1.92t due within 12 months, and liabilities of JP¥439.2b due beyond 12 months. Offsetting this, it had JP¥145.3b in cash and JP¥883.1b in receivables that were due within 12 months. So it has liabilities totalling JP¥1.33t more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's JP¥1.30t market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kawasaki Heavy Industries's net debt is 4.9 times its EBITDA, which is a significant but still reasonable amount of leverage. But its EBIT was about 79.3 times its interest expense, implying the company isn't really paying a high cost to maintain that level of debt. Even were the low cost to prove unsustainable, that is a good sign. We also note that Kawasaki Heavy Industries improved its EBIT from a last year's loss to a positive JP¥108b. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Kawasaki Heavy Industries's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. During the last year, Kawasaki Heavy Industries burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mulling over Kawasaki Heavy Industries's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, we think it's fair to say that Kawasaki Heavy Industries has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Kawasaki Heavy Industries you should be aware of, and 1 of them is a bit unpleasant.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Heavy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7012

Kawasaki Heavy Industries

Engages in aerospace systems, energy solution and marine engineering, precision machinery and robot, rolling stock, and motorcycle and engine businesses in Japan and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives