Here's Why Mitsubishi Heavy Industries (TSE:7011) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Mitsubishi Heavy Industries (TSE:7011), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Mitsubishi Heavy Industries Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Mitsubishi Heavy Industries' EPS has grown 19% each year, compound, over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

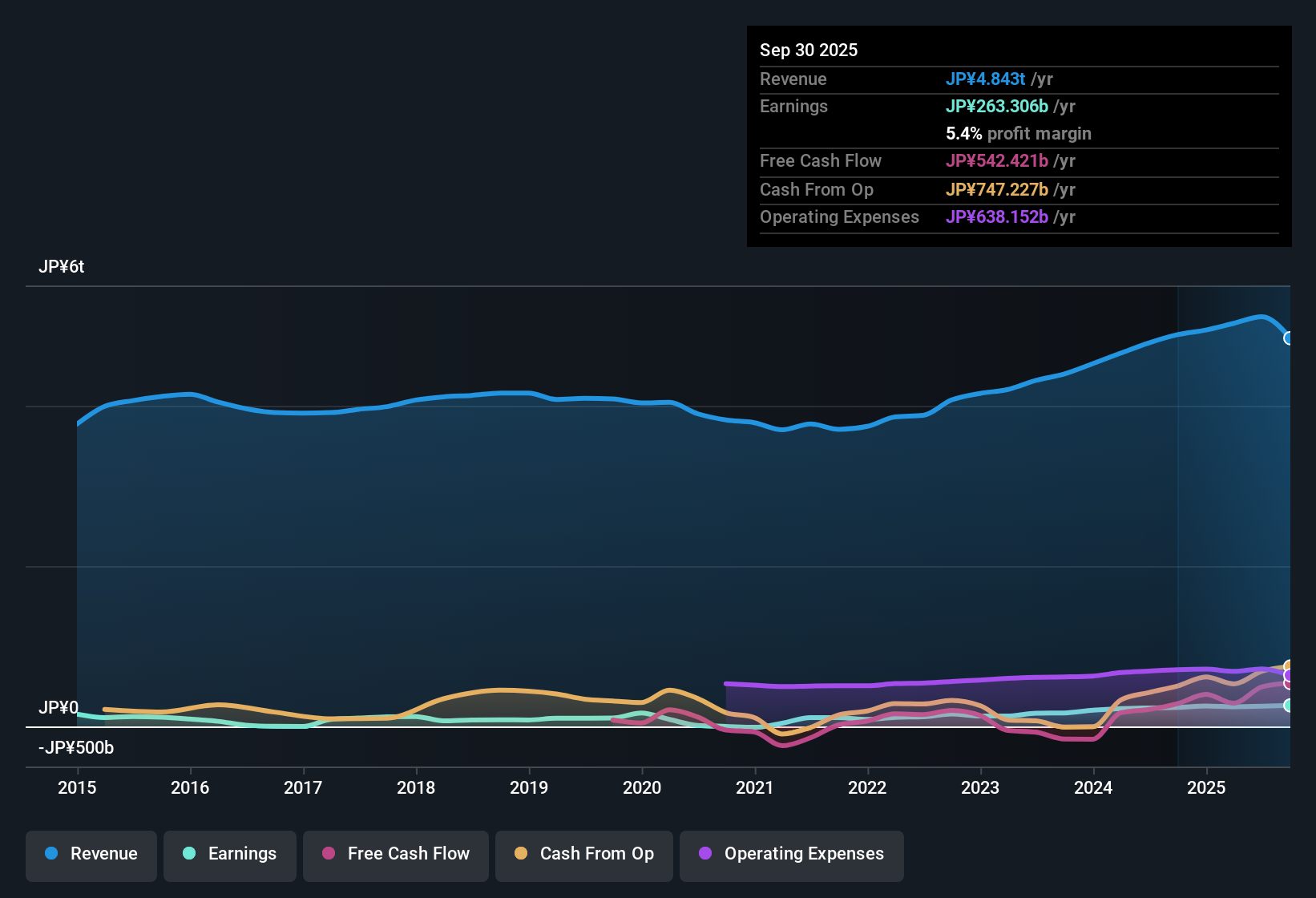

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Mitsubishi Heavy Industries as both revenue and EBIT margins remained have been flat over the past year. That's not bad, but it doesn't point to ongoing future growth, either.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

See our latest analysis for Mitsubishi Heavy Industries

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Mitsubishi Heavy Industries.

Are Mitsubishi Heavy Industries Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a JP¥14t company like Mitsubishi Heavy Industries. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth JP¥35b. While that is a lot of skin in the game, we note this holding only totals to 0.3% of the business, which is a result of the company being so large. This should still be a great incentive for management to maximise shareholder value.

Is Mitsubishi Heavy Industries Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Mitsubishi Heavy Industries' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Mitsubishi Heavy Industries' continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Mitsubishi Heavy Industries , and understanding this should be part of your investment process.

Although Mitsubishi Heavy Industries certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7011

Mitsubishi Heavy Industries

Manufactures and sells heavy machinery worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026