- Japan

- /

- Electrical

- /

- TSE:6622

A Look at Daihen (TSE:6622) Valuation Following Secondary Stock Offering and New Selling Price

Reviewed by Simply Wall St

Daihen (TSE:6622) has set the selling price for a secondary offering of its common stock at 8,380 yen per share, following a recent Board resolution. This move aims to raise new capital and improve liquidity.

See our latest analysis for DAIHEN.

After a red-hot run that delivered a 26.85% total shareholder return over the past year, DAIHEN has kept up its positive momentum. Fresh capital from the new offering comes as the stock sits at ¥8,720, having climbed over 10% in the last 90 days. Recent performance signals investors are seeing renewed growth potential and reacting positively to strategic moves.

With market sentiment shifting, this could be a smart moment to scan for other manufacturers on the move. Why not see what’s possible with the See the full list for free.?

With shares still trading below analyst price targets and strong growth in both revenue and net income, investors might wonder if Daihen remains undervalued, or if the market has already factored in all of the company’s future potential.

Price-to-Earnings of 16.1x: Is it justified?

DAIHEN is trading at a price-to-earnings (P/E) ratio of 16.1x, which looks attractive compared to the estimated fair P/E of 20.8x. At the last close of ¥8,720, the market appears to be pricing in less growth than suggested by the fair value multiple.

The price-to-earnings ratio gauges how much investors are willing to pay for each yen of earnings, so it is closely watched in sectors like industrials and manufacturing. A lower P/E may imply that investors see limited future profit growth, or it could signal a market inefficiency.

Compared to the peer group’s average P/E of 16.6x, DAIHEN stands at a slight discount. However, it is priced above the broader JP Electrical industry average of 13.9x, making valuation look less compelling relative to sector benchmarks. The fair P/E ratio of 20.8x indicates a level the market could move towards if optimism around DAIHEN’s earnings outlook continues to build.

Explore the SWS fair ratio for DAIHEN

Result: Price-to-Earnings of 16.1x (UNDERVALUED)

However, weaker-than-expected revenue growth or a reversal in recent net income gains could reduce investor enthusiasm for DAIHEN’s ongoing momentum.

Find out about the key risks to this DAIHEN narrative.

Another View: What Does the DCF Say?

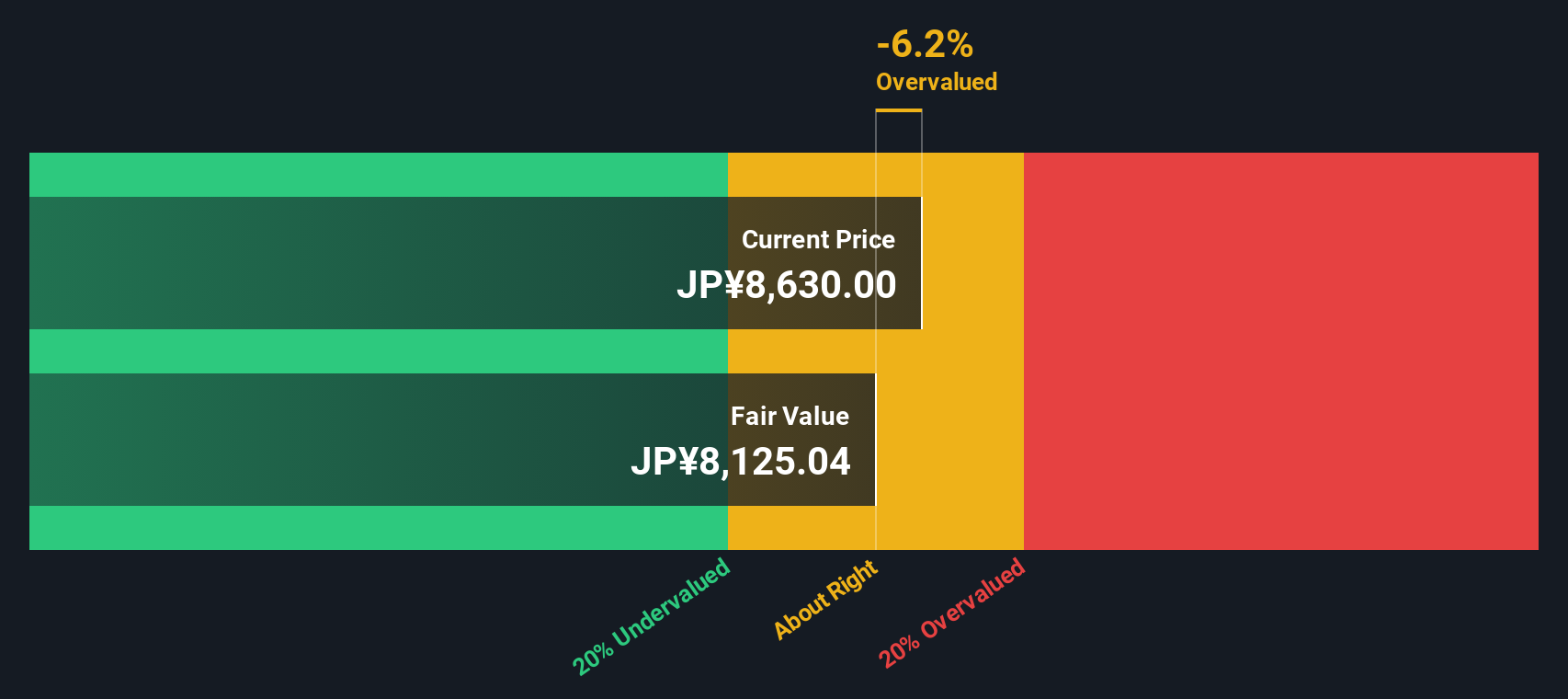

While the earnings multiple hints at potential undervaluation, our DCF model paints a different picture. According to its results, DAIHEN’s shares are currently trading above fair value, suggesting investors may already be pricing in more growth than fundamentals support. Could optimism be running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DAIHEN for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DAIHEN Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own view in just a few minutes. Do it your way.

A great starting point for your DAIHEN research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let other promising trends pass you by. Simply Wall Street’s tailored screeners uncover fast movers in the market and help you stay ahead of the curve. Grab a head start on the next big opportunities with these picks:

- Target consistent income potential by checking out these 15 dividend stocks with yields > 3% with attractive yields that can boost your portfolio’s stability.

- Get an edge in the AI race by evaluating these 25 AI penny stocks driving growth with real world artificial intelligence breakthroughs.

- Tap into hidden value by reviewing these 920 undervalued stocks based on cash flows that analysts believe are priced well below their future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6622

DAIHEN

Manufactures, sells, and repairs transformers, welding machines, industrial robots, and power sources.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.