- Japan

- /

- Electrical

- /

- TSE:6504

Where Does Fuji Electric Stand After 27% Gain and AI Infrastructure Expansion in 2025?

Reviewed by Simply Wall St

If you have been eyeing Fuji Electric stock and wondering whether now is the right time to make a move, you are not alone. With so much chatter around electrification, energy solutions, and the changing landscape of global infrastructure, Fuji Electric’s performance is drawing renewed interest among investors. In the last year alone, the stock has gained 27.2%. For those thinking longer-term, it has delivered a 215.7% return over the last five years. That kind of track record can make anyone pause and ask if there is still room for the stock to run, or if most of the value has already been captured.

Interestingly, recent momentum—up 2% in just the last week, 6.9% over the past month, and 17.1% year to date—suggests that the market’s appetite for Fuji Electric remains strong. Some of this continued strength may reflect broader optimism around electrification and the company’s positioning in markets benefiting from energy transition themes. At the same time, investors may be reassessing the company’s risk profile as it adapts to industry changes and new growth opportunities come into focus.

Of course, momentum alone does not tell the whole story. When we put Fuji Electric through our valuation checklist, it scores a 2 out of 6. This means the company appears undervalued by two major measures. This score sets up an interesting discussion: we will take a closer look at these different valuation approaches, revealing where Fuji Electric stands now and hinting at a potentially even more insightful way to think about valuation that we will bring in at the end of the article.

Fuji Electric scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Fuji Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core valuation approach that calculates a company's intrinsic value by projecting its future cash flows and then discounting them back to their present value. In essence, this method answers the question: how much are all those future cash flows worth in today’s money?

For Fuji Electric, the latest twelve-month Free Cash Flow (FCF) came in at ¥18.6 Billion. Over the coming years, analysts forecast this figure to jump, reaching a projected ¥76.2 Billion by 2030. It is important to note that analyst estimates are typically available for the next five years. Projections extending further are constructed by Simply Wall St using extrapolation methods. These projections suggest consistent growth in FCF across the decade.

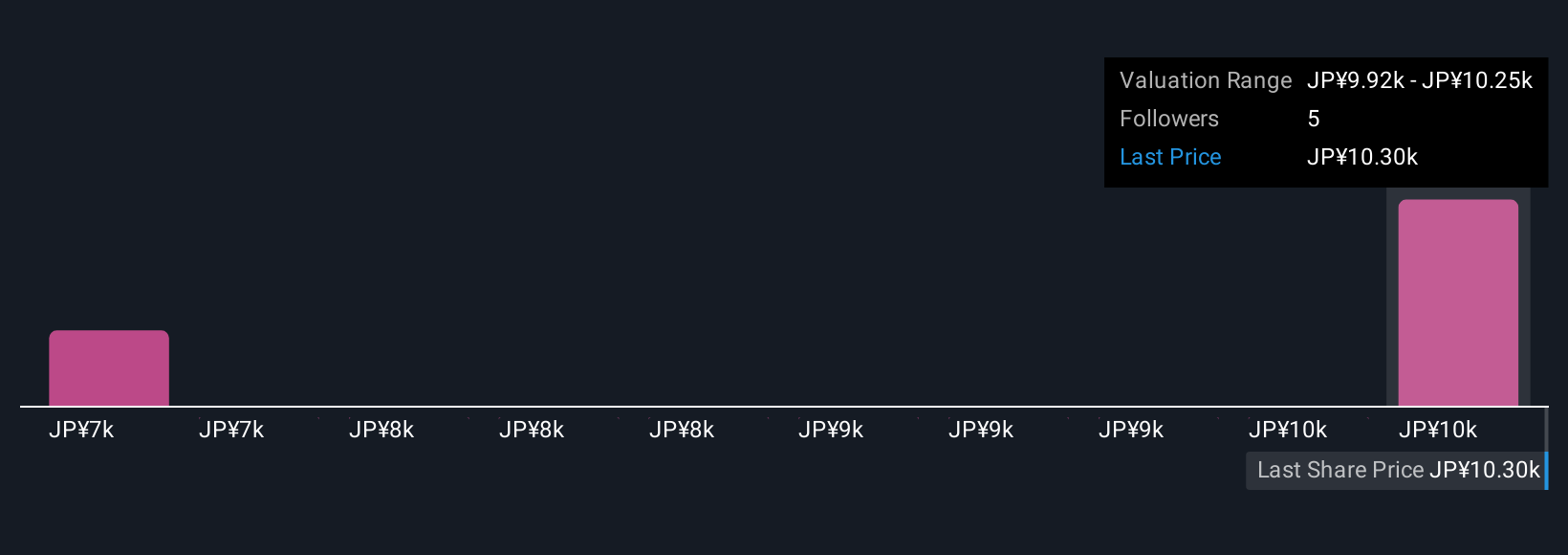

With this outlook, the DCF approach estimates Fuji Electric’s fair value at ¥7,744.83 per share. However, when comparing this number to the market price, the DCF result implies that the stock is trading at a 27.7% premium to its intrinsic value, signaling an overvalued situation at today’s prices.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Fuji Electric.

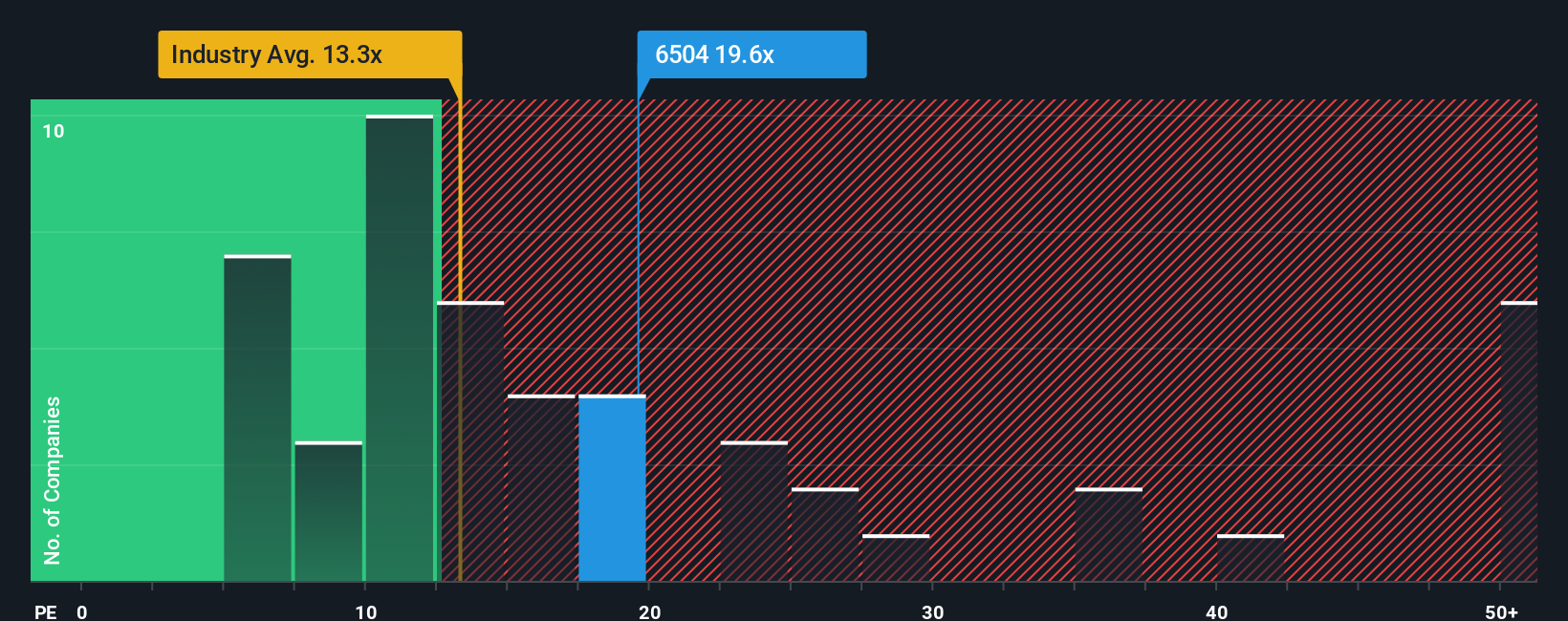

Approach 2: Fuji Electric Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing established, profitable companies like Fuji Electric because it quickly relates a company’s share price to its actual earnings power. For companies that are generating steady profits, the PE ratio helps investors judge whether the market is pricing in too much optimism, or if there is still value left to unlock.

It is important to remember that what counts as a "normal" PE ratio can vary, depending on expectations for future growth and the risk associated with a business. Fast-growing, less risky companies tend to justify higher PE ratios, while slower-growing or riskier firms usually deserve lower ones. For Fuji Electric, the current PE ratio stands at 15.89x, which sits above the Electrical industry average of 12.99x but below the peer group average of 27.38x. This suggests the stock is valued more optimistically than the typical industry player but is still trading at a discount to similar companies.

To provide an even more tailored benchmark, Simply Wall St’s proprietary “Fair Ratio” looks beyond surface-level comparisons. This metric incorporates factors such as Fuji Electric’s earnings growth, profit margins, industry dynamics, market cap, and company-specific risks. Unlike a simple peer or industry comparison, the Fair Ratio aims to represent what a reasonable investor would pay for this specific business today. Fuji Electric’s Fair Ratio is calculated at 20.89x. Compared with the actual PE of 15.89x, the stock appears undervalued on this basis, indicating a potential opportunity for investors when considering its growth prospects, risk, and profitability profile.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Fuji Electric Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, connected directly to your case for its fair value and financial future. With Narratives, you tie your unique expectations, such as future revenues, profit margins, and risks, to a financial forecast that leads straight to what you think the company is truly worth.

Narratives make complex investing accessible by helping you document your reasoning, compare your fair value to the current price, and decide whether to buy or sell. On Simply Wall St’s Community page, millions of investors build and share their Narratives. These are updated in real time as news and earnings come in, so your story can change as the facts do.

For example, looking at Fuji Electric, some investors see robust international demand and grid upgrades, forecasting fair values as high as ¥12,000. Others may worry about margin pressure and overseas risks, setting their fair value closer to ¥7,000. With Narratives, you can create and refine your own investment thesis, making decisions with confidence instead of following the crowd.

Do you think there's more to the story for Fuji Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives