- Japan

- /

- Electrical

- /

- TSE:6503

Should Mitsubishi Electric’s Buyback and Strong Outlook Prompt New Thinking From TSE:6503 Investors?

Reviewed by Sasha Jovanovic

- In October 2025, Mitsubishi Electric Corporation completed a buyback of 29,893,600 shares for ¥99.99 billion, increased its interim dividend by ¥5 to ¥25 per share, and raised its full-year revenue forecast by ¥270 billion following its Q2 2026 earnings call.

- This series of updates highlights the company's focus on shareholder returns and operational momentum, particularly as increased infrastructure sales and favorable foreign exchange effects support higher revenue expectations.

- We'll explore how the upward revision in revenue guidance may shape the investment narrative for Mitsubishi Electric going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsubishi Electric Investment Narrative Recap

To be a shareholder in Mitsubishi Electric, you likely need to believe in its ability to capitalize on rising global demand for automation, infrastructure, and energy solutions while managing margin pressures from competition and shifting industry trends. The recent completion of a substantial share buyback and an upward revenue revision may reinforce confidence in the company's operational momentum, but they do not fundamentally alter the short-term catalyst: ongoing growth in Infrastructure and Factory Automation. Core risks tied to digital transformation and global competition remain unchanged by this news.

Among recent announcements, the raised revenue guidance for the full fiscal year stands out as most relevant to forward-looking investors. While supported by strong infrastructure sales and favorable currency movement, the update leaves operating profit guidance unchanged, highlighting that foreign exchange gains and sales increases currently offset, but do not eliminate, margin pressures from competitive pricing and tariff costs. The interplay of these forces will likely shape how investors view the company’s ability to convert resource advantages into sustainable profit growth.

Yet, despite this optimism, it’s critical for investors to weigh the persistent risk that accelerating digital adoption could...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's outlook anticipates ¥6,044.2 billion in revenue and ¥423.4 billion in earnings by 2028. This is based on a 2.9% annual revenue growth rate and a ¥57.5 billion increase in earnings from the current ¥365.9 billion.

Uncover how Mitsubishi Electric's forecasts yield a ¥3668 fair value, a 15% downside to its current price.

Exploring Other Perspectives

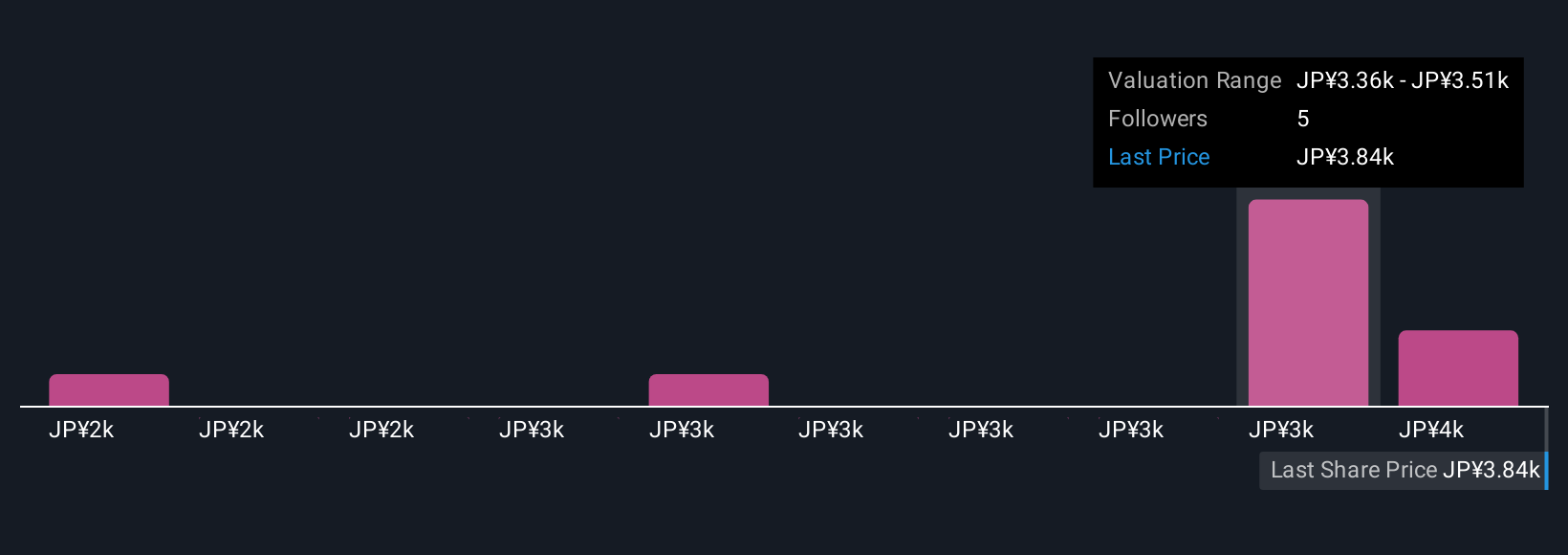

Four distinct fair value estimates from the Simply Wall St Community put Mitsubishi Electric's worth between ¥2,114.29 and ¥3,668.38 per share. As you assess these opinions, remember that ongoing digital transformation challenges could have lasting consequences for future profitability and market position.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives